In the state of Missouri, understanding the current rent rebate rules is essential for residents, especially those who are facing financial difficulties. Rent rebates, often referred to as property tax credits, are designed to assist lower-income individuals and families in alleviating the burden of housing costs. This article will explore the eligibility criteria, application process, and important changes in the rules governing rent rebates in Missouri.

Eligibility Criteria

To qualify for a rent rebate in Missouri, residents must meet specific criteria:

- Age: Applicants must be at least 65 years old, or at least 18 years old and disabled.

- Income: The total household income must not exceed a certain threshold, which is subject to change annually. As of the latest updates, the income limit is $30,000 for individuals and $34,000 for couples.

- Residency: Applicants must have lived in Missouri for at least one year prior to applying.

- Housing Costs: Eligible housing costs include rent payments that contribute to a liveable space.

Rental Property Requirements

Additionally, there are specific requirements concerning the rental properties:

- The property must be the applicant’s primary residence.

- Rent must be paid for the entire year to qualify.

- Residents who receive Section 8 or other housing assistance may still be eligible under certain circumstances.

Application Process

The application process for the Missouri rent rebate can be done in several ways:

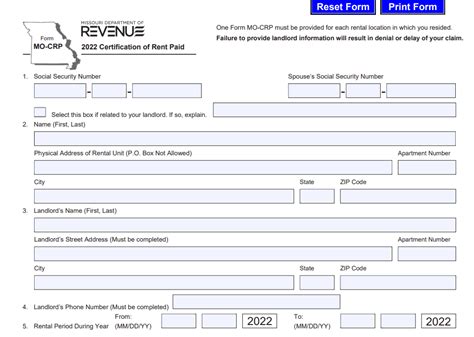

- Obtain the Application: Residents can download the application form from the Missouri Department of Revenue website or obtain it from local county offices.

- Complete the Form: Carefully fill out the application, ensuring that all necessary documentation, such as proof of income and residency, is included.

- Submit the Application: Applications can be mailed or submitted in person at local county offices. It is crucial to keep a copy of the application for personal records.

- Follow Up: After submitting, applicants should follow up with the local county office to ensure their application is being processed.

Changes to Rent Rebate Rules

Residents should be aware of recent changes to the rules governing rent rebates in Missouri. These changes may affect eligibility and application processes:

- Increased Income Limits: In response to rising living costs, the income limits for eligibility have been adjusted. It’s advisable for applicants to check the Missouri Department of Revenue’s website regularly for updates.

- Online Applications: The introduction of online application forms has streamlined the process, making it more accessible for residents.

- Extended Deadlines: Deadlines for application submissions have been extended to help residents, especially during emergencies or economic downturns.

Benefits of Rent Rebate Programs

The benefits of participating in the rent rebate program are significant. Lower-income residents, especially seniors and disabled individuals, can gain much-needed financial relief. Here are some key benefits:

- Financial Relief: Rent rebates can provide critical assistance to residents struggling to meet their housing costs.

- Improved Quality of Life: With extra funds, residents can allocate resources towards other essential needs, such as food or healthcare.

- Support for Vulnerable Populations: These programs specifically target at-risk individuals and families who may otherwise face housing instability.

Conclusion

Understanding the current rent rebate rules in Missouri is essential for those who may benefit from the program. By being informed about the eligibility criteria, application process, and recent changes, residents can take full advantage of available resources. With the rising cost of living, these rent rebates offer crucial support to help ensure that everyone can maintain stable housing.

FAQs

- Q: How often do I need to apply for the rent rebate?

- A: Rent rebates are typically reviewed annually, so residents should apply each year to continue receiving benefits.

- Q: What documents will I need to submit with my application?

- A: Necessary documents include proof of income, rental agreements, and identification to verify residency.

- Q: Can I receive a rent rebate if I live with family?

- A: Yes, as long as you are responsible for paying rent and meet other eligibility criteria.

- Q: What if my income exceeds the limit?

- A: If your income exceeds the established limit, you will not qualify for the rent rebate program for that particular year.

- Q: Where can I find additional information?

- A: For more information, residents should visit the Missouri Department of Revenue website or contact their local county office.

This code provides a structured HTML format suitable for WordPress, detailing what Missouri residents need to know about current rent rebate rules, including eligibility, benefits, and frequently asked questions.

Download Missouri Rent Rebate Status