Unlocking Your Economic Recovery Rebate: What Your IRS Transcript Reveals

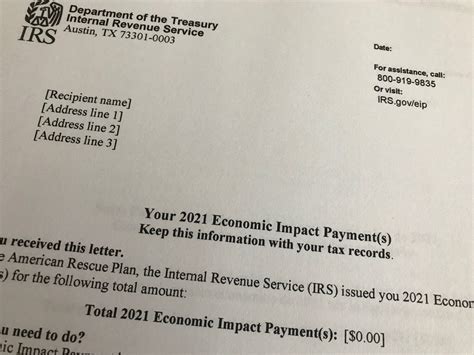

The Economic Recovery Rebate, a part of the government’s efforts to alleviate the financial burden caused by the COVID-19 pandemic, provides eligible individuals with direct payments. Understanding your eligibility and payment details is paramount for effective financial planning. One essential tool that can help unlock this information is your IRS transcript.

What is an IRS Transcript?

An IRS transcript is a record of your tax return data as maintained by the Internal Revenue Service (IRS). It contains crucial information about your income, tax deductions, and payment history. There are several types of transcripts, with the most relevant ones for understanding your Economic Recovery Rebate being the Tax Return Transcript and the Account Transcript.

Types of IRS Transcripts Relevant to Economic Recovery Rebate

- Tax Return Transcript: This document summarizes your tax return information for a particular year. It includes details on your AGI (Adjusted Gross Income), which is used to determine your eligibility for the Economic Recovery Rebate.

- Account Transcript: This type provides a record of transactions, including payments made and adjustments processed during the year. It can help clarify any discrepancies that may affect your rebate amount.

How to Obtain Your IRS Transcript

Getting your IRS transcript is straightforward. Here’s how:

- Online Request: Visit the IRS website and use the “Get Transcript” tool. You will need to create an account if you don’t have one.

- Mail Request: Alternatively, you can complete Form 4506-T and mail it to the IRS. This method may take longer.

- Phone Request: Call the IRS directly at 1-800-908-9946 to request your transcript over the phone.

Understanding Your Transcript

Once you have obtained your transcript, it’s essential to analyze it effectively:

- Check Your AGI: Your AGI directly influences your rebate eligibility. For instance, individuals earning up to $75,000 and married couples earning up to $150,000 are eligible for the full rebate.

- Review Past Payments: Your account transcript will show any Economic Recovery Rebates that were previously issued, helping you verify that you have received the correct amounts.

- Identify Errors: Look for any discrepancies between your records and the IRS transcript. Errors could delay or impact your rebate eligibility.

Common Issues and How to Resolve Them

While you may find crucial information on your IRS transcript, some common issues could arise:

- Missing Records: If your transcript does not reflect your tax filings, check for submission errors or mailing issues. You may need to file amended returns.

- Incorrect AGI: If your AGI appears incorrect, use your tax return to cross-reference and file necessary amendments.

- Payment Delays: If you believe you are eligible but have not received the rebate, contact the IRS for clarification and follow-up on status.

Updates to Economic Recovery Rebate Criteria

It’s important to stay updated on any changes to rebate eligibility criteria. The IRS regularly updates its guidelines, and several factors could influence your eligibility:

- Changes in Income: Your income level can fluctuate, affecting your eligibility for future rebates.

- Dependent Status: Changes in your dependent status can also impact the rebate amount you are eligible for.

How to Use Your Rebate Effectively

Once you’ve accessed and understood your Economic Recovery Rebate, consider the following ways to use it effectively:

- Emergency Savings: Allocate a portion to build or enhance your emergency fund.

- Debt Repayment: Prioritize paying down high-interest debts to improve your financial standing.

- Invest in Opportunities: If your financial situation is stable, consider investing in stocks, real estate, or educational opportunities.

Conclusion

Unlocking your Economic Recovery Rebate is crucial in today’s economic landscape. By understanding your IRS transcript and its implications, you can ensure that you are making informed financial decisions. Whether it’s confirming your eligibility, resolving any issues, or effectively utilizing your rebate payment, knowledge is your best ally. Stay proactive and informed, ensuring that you are equipped to navigate any economic challenges ahead.

FAQs

1. How do I know if I received the Economic Recovery Rebate?

You can check your IRS account transcript to verify if the rebate has been issued and the amount received.

2. What should I do if my IRS transcript shows an error?

If you notice discrepancies, it’s advisable to gather supporting documents and contact the IRS to amend your records.

3. Can I track my rebate status online?

Yes, you can track your Economic Recovery Rebate status through the IRS website using their “Get My Payment” tool.

4. Will I need to pay taxes on my Economic Recovery Rebate?

No, the Economic Recovery Rebate is not considered taxable income, so you do not need to pay taxes on it.

5. What if I didn’t file taxes in the previous year?

If you did not file taxes, you may still be eligible for the rebate, but you may need to provide additional information to the IRS to determine your eligibility.

This article offers a comprehensive guide on understanding your economic recovery rebate through your IRS transcript, useful for readers seeking clarity on this financial matter.

Download Economic Recovery Rebate Irs Show On Transcript