Unlocking Savings: Your Guide to the Ambetter Premium Rebate Program Check!

The Ambetter Premium Rebate Program is a valuable initiative aimed at providing financial relief to eligible members enrolled in Ambetter health plans. Navigating the nuances of health insurance can often be overwhelming, especially when it comes to understanding available benefits. This guide will walk you through the essential aspects of the Ambetter Premium Rebate Program, helping you unlock potential savings that can ease the burden of healthcare expenses.

What is the Ambetter Premium Rebate Program?

The Ambetter Premium Rebate Program is designed to reward members by returning a portion of their premium costs when specific criteria are met during a designated period. This program is beneficial for individuals and families seeking affordable healthcare solutions, as it offers a chance to recoup some of the money spent on monthly health insurance premiums.

Eligibility Criteria

To qualify for the Ambetter Premium Rebate, members need to meet several eligibility requirements. Here are some key factors to consider:

- Enrollment: You must be an active Ambetter member enrolled in a qualifying health plan for the specified rebate period.

- Premium Payments: You must have made premium payments on time throughout the eligibility period without gaps in coverage.

- Program Specifics: Each state may have different criteria and rules regarding who qualifies for rebates; hence, it’s crucial to review your state’s specific guidelines.

How to Apply for the Rebate

Applying for the Ambetter Premium Rebate is a straightforward process. Here’s a step-by-step guide you can follow:

- Gather Information: Collect all necessary documents, including proof of premium payments and your membership ID.

- Visit the Ambetter Website: Go to the official Ambetter website and navigate to the Premium Rebate Program section.

- Complete the Application: Fill out the online application form with accurate information. Make sure all details match your enrollment information.

- Submit Your Application: Once you have filled out the application, submit it electronically. You may also have the option to print and send it via mail depending on your state’s requirements.

- Await Confirmation: After submission, you will receive a confirmation email. Keep this for your records!

Rebate Calculation

The amount you may receive from the Ambetter Premium Rebate Program can vary based on several factors, including the length of enrollment, the amount you paid in premiums, and the terms outlined for that particular rebate period. Generally, the rebate amount is calculated as a percentage of the total premiums paid during the specified timeframe.

Common Uses for Your Rebate

A premium rebate can offer significant financial assistance and may be utilized in various ways:

- Reduce Healthcare Costs: Use the rebate to cover outstanding medical bills or co-pays.

- Increase Savings: Save the amount for future healthcare needs or expenses.

- Family Needs: Invest in other family priorities, such as education or groceries, alleviating the financial strain of healthcare costs.

Understanding the Tax Implications

While receiving a rebate can provide immediate financial relief, it’s important to understand that it may have tax implications. It’s advisable to consult with a tax professional to determine if you need to report the rebate on your income tax return. Generally, health insurance rebates aren’t taxable income, but this can vary based on individual circumstances.

Staying Informed

To maximize the benefits of the Ambetter Premium Rebate Program, stay informed about any updates or changes to the program by regularly checking the Ambetter website and your member portal. There could be additional resources available, including community support or consultations that can help you better navigate your health plan.

Conclusion

The Ambetter Premium Rebate Program represents an avenue for members to recoup some costs associated with their health insurance premiums. With the right information and eligibility, you can easily navigate the application process and potentially unlock significant savings. Taking the time to understand the program, its requirements, and how to apply can help you take full advantage of this beneficial offering from Ambetter, ensuring that your healthcare experience is as financially manageable as possible.

FAQs

1. Who is eligible for the Ambetter Premium Rebate?

Eligibility is typically based on being an active member of an Ambetter health plan, timely payment of premiums, and meeting specific state criteria.

2. How do I apply for the rebate?

Members can apply through the Ambetter website by completing and submitting the required application form online or via mail, depending on state guidelines.

3. When can I expect to receive my rebate?

Rebate processing times may vary; however, you should receive confirmation about your application and a timeline for when to expect payment.

4. Will the rebate money be taxed?

Generally, health insurance rebates are not considered taxable income, but it is wise to consult with a tax professional for personal situations.

5. Can I use the rebate for anything I want?

Yes, once you receive the rebate, you can use the funds to cover health-related expenses, save for future needs, or meet other financial priorities.

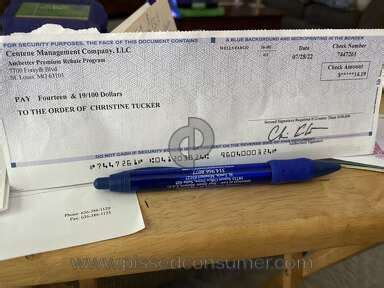

Download Ambetter Premium Rebate Program Check