Unlocking Savings: Your Guide to New Jersey’s Rent Rebate Program

If you’re a resident of New Jersey, you may have heard about the state’s Rent Rebate Program, a financial aid initiative designed to assist eligible renters. This program is essential for many residents who are struggling to keep up with the ever-increasing living costs. In this guide, we’ll delve into the nitty-gritty of the program, highlighting its benefits, eligibility requirements, and how to apply.

What is the Rent Rebate Program?

The Rent Rebate Program, officially known as the “Senior Citizens and Disabled Persons’ Property Tax Reimbursement Act,” provides rebates to qualified renters based on the amount of rent paid, enabling them to retain more of their hard-earned income. This program is especially useful for seniors and disabled individuals, ensuring that they live with dignity and financial stability.

Who is Eligible?

To qualify for the Rent Rebate Program, you must meet specific criteria:

- Be a resident of New Jersey.

- Be at least 65 years of age or a disabled individual.

- Meet the income limits set by the state. As of the latest guidelines, single applicants must have gross incomes not exceeding $10,000, while married couples must have an income not exceeding $15,000.

- Must have paid rent on a dwelling in New Jersey during the applicable tax year.

- Be in a situation where property taxes were your responsibility during the year for which you are applying.

How to Apply

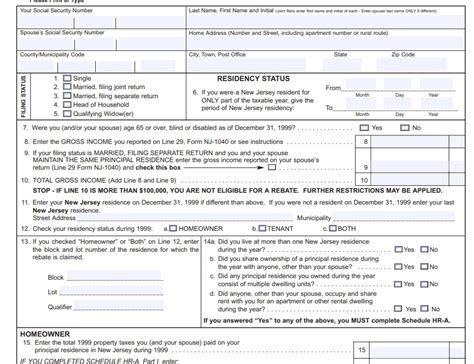

The application process for the Rent Rebate Program is straightforward:

- Gather your documents: You’ll need your proof of income, such as tax returns, and documentation showing the rent paid.

- Complete the application form: You can obtain this form from the New Jersey Division of Taxation’s website or visit your local tax office.

- Submit your application: Applications can usually be submitted online, by mail, or in person at designated locations.

Important Deadlines

To receive your rebate timely, you must be aware of the application deadlines. Typically, applications must be submitted by the deadline set by the state, which is often in late spring. Check the New Jersey Division of Taxation website for the exact dates specific to the tax year you are applying for.

How Much Can You Save?

The rebate amount you may receive varies, depending on your income and the amount of rent you paid. Generally, the maximum refund can go up to several hundred dollars. This can significantly alleviate the burden of rental costs, particularly for those on a fixed income.

Why is the Rent Rebate Program Important?

The Rent Rebate Program serves multiple purposes:

- Financial Relief: It helps alleviate the financial burden on low-income renters, enabling them to allocate funds more effectively towards other essential needs.

- Stability for Vulnerable Populations: By supporting seniors and disabled residents, the program helps foster stability and comfort in their living situations.

- Stimulating Economic Activity: When residents save money from the rebates, they are likely to spend it in their communities, thus stimulating economic growth.

Common Challenges Faced

While the Rent Rebate Program is beneficial, applicants often encounter various challenges:

- Understanding Eligibility: Many potential applicants are unaware of the eligibility criteria and miss out on potential savings.

- Application Process: The process can be daunting for some, especially those who are not tech-savvy or may struggle with paperwork.

- Document Requirements: Gathering the necessary documentation can be a hurdle, particularly for those lacking organizational skills.

Resources for Assistance

If you need help with the Rent Rebate Program, several resources can assist you:

- Local Senior Centers: Many senior centers offer workshops and one-on-one assistance for residents applying for financial assistance programs.

- Non-Profit Organizations: Various statewide non-profits focus on assisting low-income residents access available financial programs.

- State Website: The New Jersey Division of Taxation website has comprehensive information detailing the application process, important forms, and contact information for further assistance.

Conclusion

New Jersey’s Rent Rebate Program is a valuable resource for qualifying individuals seeking to alleviate the financial burden of housing costs. By understanding the program’s benefits, eligibility criteria, and application process, you can take advantage of this financial aid and help make your life a little more manageable. Don’t hesitate to reach out to the available resources for assistance with the application. Your savings may lie just a step away!

Frequently Asked Questions (FAQs)

1. How long does it take to receive the rebate after applying?

The processing time can vary, but applicants typically receive their rebates within a few months after submission, provided their application is complete and correctly filled out.

2. Can I apply for the Rent Rebate Program if I live with someone else?

Yes, you can still apply as long as you meet the eligibility criteria regarding age, disability, and income limitations.

3. Is the Rent Rebate taxable income?

No, the rebate is considered a reimbursement and is not subject to state or federal taxation.

4. Can I apply for the Rent Rebate Program every year?

Yes, you can apply annually as long as you continue to meet the program’s eligibility requirements.

5. Where can I find more information about the program?

For the most current information, visit the New Jersey Division of Taxation website or consult your local tax office.

Download New Jersey Rent Rebate