In the picturesque state of Minnesota, residents can take advantage of a lucrative opportunity to save money on their property taxes. The Minnesota Property Tax Rebate Program is specifically designed to assist qualifying homeowners with their tax burdens, thereby easing financial pressures and helping families maintain their homes. This guide aims to provide a comprehensive overview of the program, its benefits, eligibility criteria, and how to apply, ensuring you can unlock these savings effectively.

What is the Minnesota Property Tax Rebate Program?

The Minnesota Property Tax Rebate Program is an initiative implemented by the state government aimed at helping homeowners reduce their property tax liabilities. This program is part of a larger effort to make housing more affordable for residents and to support economic stability within the state. Eligible applicants can receive a refund on a portion of the property taxes they have paid, making homeownership more accessible and financially manageable.

Eligibility Criteria

To qualify for the Minnesota Property Tax Rebate Program, homeowners must meet specific criteria:

- Residency: Applicants must be legal residents of Minnesota.

- Ownership: The property must be owned and occupied by the applicant as their principal residence.

- Income Limit: The household income must fall below a certain threshold, which can vary by year. For the 2022 tax year, for example, the limit was set at $115,000 for married couples filing jointly.

- Property Tax Paid: Applicants must have paid property taxes on their principal residence in the year for which they are applying for a rebate.

Benefits of the Rebate Program

The benefits of participating in the Property Tax Rebate Program are numerous:

- Financial Relief: Homeowners can receive a significant rebate that helps to offset their property taxes, leading to substantial savings.

- Encourages Home Ownership: By reducing property tax burdens, the program makes it easier for individuals and families to purchase and maintain homes.

- Community Support: The funds returned from this program circulate within local economies, promoting community growth and stability.

- Simplicity of Application: The application process is straightforward, and resources are available to help homeowners navigate it.

How to Apply

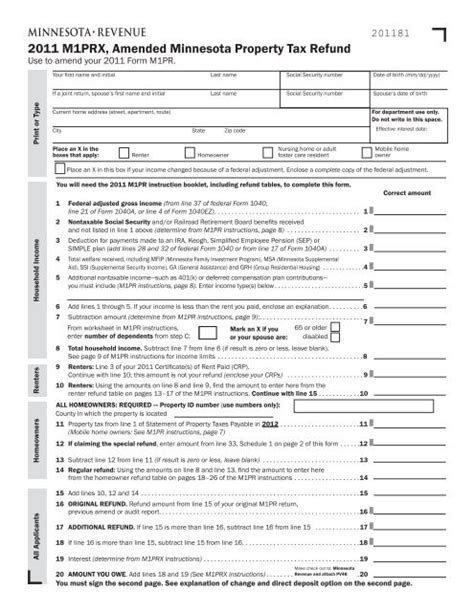

Applying for the Minnesota Property Tax Rebate Program is a simple process:

- Gather Necessary Documents: Homeowners should collect all relevant documents, including proof of income, property tax statements, and any other required paperwork.

- Complete the Application Form: The state provides an online application form. This form will require details about your income, property, and the taxes paid.

- Submit the Application: Once completed, the application can be submitted either online or through the mail, depending on your preference.

- Track Your Application Status: After submitting, applicants can check the status of their application via the state’s website.

Important Dates

Key dates to remember when applying for the rebate include:

- Application Period: The application period generally opens on January 1st and closes on August 15th following the year for which you are applying.

- Rebate Issuance: Rebate checks are typically issued within a few months after the application deadline, providing timely financial relief.

Conclusion

The Minnesota Property Tax Rebate Program stands as a beacon of hope for homeowners seeking to alleviate their financial burdens. By understanding the eligibility requirements, benefits, and the straightforward application process, you can take crucial steps towards unlocking significant savings on your property taxes. This program not only provides financial relief but also promotes homeownership and stability within communities throughout Minnesota. Don’t miss your chance to take advantage of this fantastic opportunity; start your application process today!

FAQs

1. Who is eligible to apply for the Minnesota Property Tax Rebate?

Eligibility requirements include being a legal resident of Minnesota, owning and occupying the property as your principal residence, having a household income below the designated threshold, and having paid property taxes in the previous year.

2. What documents do I need to apply?

You will need proof of income, property tax statements, and any additional paperwork relevant to your application. It is wise to refer to the application guidelines for a complete list of required documents.

3. How much can I expect to receive in rebates?

The rebate amount varies based on several factors, including your income, the amount of property taxes you paid, and changes to the program from year to year. You can find specific calculations on the state’s website.

4. Can I apply online?

Yes, Minnesota provides an online application form that makes it easy for residents to apply for the Property Tax Rebate Program. You can also choose to submit a paper application via mail if you prefer.

5. When will I receive my rebate check?

Rebate checks are generally issued a few months after the application period closes on August 15th. You can track the status of your rebate on the state’s website.

This HTML format article covers the essential information about Minnesota’s Property Tax Rebate Program, including its benefits, eligibility criteria, application process, and frequently asked questions, providing readers with a clear path to understanding and utilizing the program.

Download Property Tax Rebate Mn