Unlocking Savings: What You Need to Know About the NYS Property Tax Rebate for 2025

As homeowners in New York navigate the complexities of property taxes, understanding the available relief options is essential for financial planning. One such opportunity is the New York State (NYS) Property Tax Rebate, which aims to provide financial relief to eligible homeowners. As we approach 2025, it’s vital to be informed about the specifics of this program, including eligibility criteria, application processes, and potential savings. This article will delve into everything you need to know about the 2025 NYS Property Tax Rebate.

What is the NYS Property Tax Rebate?

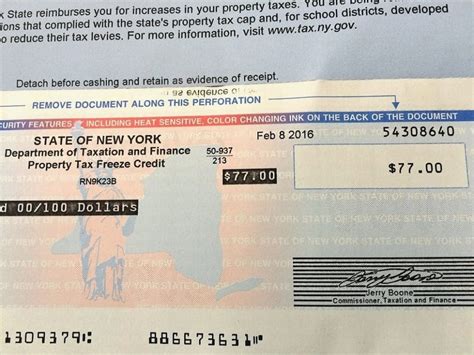

The NYS Property Tax Rebate program is designed to offer financial relief to eligible homeowners by providing a rebate check based on the amount of property taxes they pay. This initiative is particularly beneficial for those facing financial strain due to rising property taxes. The rebates are issued annually, contingent on funding allocations by the state legislature.

Eligibility Requirements

To qualify for the NYS Property Tax Rebate in 2025, homeowners must meet several criteria:

- Residency: The property must be a primary residence in New York State.

- Income Limits: Homeowners must meet specific income thresholds which are determined annually. For the 2025 rebate, the income limit is projected to remain similar to previous years.

- Property Tax Amount: Homeowners must have paid a minimum amount in property taxes during the previous year.

How to Apply

Applying for the NYS Property Tax Rebate is a straightforward process:

- Gather Documents: Collect necessary documentation, such as your current property tax bill and proof of income.

- Complete Application: Fill out the application form, which can be accessed through the New York State Department of Taxation and Finance website.

- Submit Application: Applications can often be submitted online or via mail. Ensure that they are sent before the deadline, which typically falls in the spring.

- Receive Rebate: Once processed, the rebate check will be mailed to eligible applicants.

Understanding the Rebate Amount

The amount homeowners can expect to receive as a rebate can vary based on several factors, including:

- The total amount of property taxes paid.

- Income level of the household.

- Whether the property is located in a municipality that participates in this program.

- Changes in legislation that may adjust rebate amounts.

In 2025, it’s expected that there will be a reassessment of the rebate amounts, so homeowners should stay updated on the latest legislative changes.

How to Maximize Your Rebate

While every homeowner’s situation is unique, there are several ways to potentially maximize the rebate amount:

- Stay Informed: Follow updates from the New York State Department of Taxation and Finance regarding any changes to eligibility or rebate amounts.

- Review Your Property Taxes: Ensure that your property tax assessment is accurate. If you believe your property is over-assessed, consider appealing the assessment.

- Utilize Other Tax Relief Programs: Explore other tax relief programs in New York State, such as the School Tax Relief (STAR) program, which can complement the property tax rebate.

Conclusion

The NYS Property Tax Rebate program is a crucial financial relief measure for homeowners facing the persistent challenge of rising property taxes. As the new year approaches, understanding the details about eligibility, application processes, and how to maximize your rebate can lead to significant savings. By staying informed and proactive, homeowners can unlock valuable savings and navigate their tax responsibilities more effectively. Make sure you keep an eye on official state announcements so you can take full advantage of this beneficial program.

FAQs

1. When can I apply for the NYS Property Tax Rebate?

Applications typically open in the spring of each year. It’s crucial to check the New York State Department of Taxation and Finance website for specific dates.

2. How will I receive my rebate?

If your application is approved, you will receive a rebate check in the mail. Be sure to provide the correct mailing address on your application.

3. What if I miss the application deadline?

Missed deadlines typically mean you will have to wait until the next rebate cycle. It’s essential to keep track of dates and apply on time.

4. Can I appeal my property tax assessment?

Yes, homeowners can appeal their property tax assessment if they believe it is inaccurate. The process usually involves filing a grievance with your local assessment office.

5. Are there other tax relief programs I can qualify for?

Yes, in addition to the Property Tax Rebate, homeowners may qualify for programs like the STAR exemption or senior citizen property tax exemptions, depending on their circumstances.

Download Nys Property Tax Rebate 2025