Unlocking Savings: What You Need to Know About New York State’s STAR Rebate Checks

If you are a homeowner in New York State, you may be eligible for the School Tax Relief (STAR) program, designed to provide relief from property taxes. The STAR rebate checks can significantly ease your financial burden, enabling you to keep more of your hard-earned money. In this article, we’ll explore what STAR is, how it works, eligibility criteria, and tips for getting the most from your rebate checks.

What is STAR?

The School Tax Relief (STAR) program is a property tax relief program administered by the New York State Department of Taxation and Finance. It was established to assist homeowners in paying property taxes, particularly those who have school-aged children or who live in areas with high property taxes. The STAR program consists of two main components: the Basic STAR and the Enhanced STAR. Understanding these can help you determine what type of rebate you qualify for.

Basic STAR vs. Enhanced STAR

The Basic STAR program is available to all eligible homeowners, while the Enhanced STAR program is designed specifically for senior citizens. Here’s a breakdown of each:

- Basic STAR: This provides a reduction in the school property taxes for homeowners with a school-aged child or for those who qualify based on income.

- Enhanced STAR: This offers a larger rebate for homeowners aged 65 or older, who meet certain income guidelines. Enhanced STAR allows for a greater exemption on school taxes, offering significant savings.

Eligibility Criteria

To qualify for the STAR program, homeowners must meet specific criteria. Here are the key points:

- You must own your home and it must be your primary residence.

- For Basic STAR, there is no age requirement, but income may be considered for some applicants.

- For Enhanced STAR, you must be 65 years old or older and meet certain income limitations.

- You must apply through your local assessor’s office to enroll in the program.

- Note: If you’ve already applied for the STAR exemption, you don’t need to reapply; the exemption will automatically deduct from your school property taxes.

How Much Can You Save?

The amount you save through STAR varies based on your school district and the type of STAR rebate you qualify for. For the Basic STAR exemption, the average reduction is about $1,000 off your school taxes. Enhanced STAR can significantly increase this amount, providing an average exemption of about $1,500 or more, depending on local property taxes. This means considerable savings for eligible homeowners, particularly those with fixed or limited incomes.

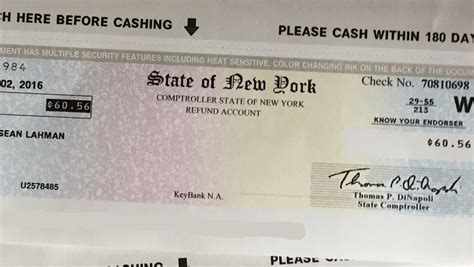

When Will You Receive Your Rebate Check?

STAR rebate checks are typically mailed out in the fall. Homeowners generally receive their checks around October, which can provide a helpful financial boost as the holiday season approaches. However, the timing may vary depending on your district and how quickly applications are processed. It’s crucial to check with your local assessor for the most accurate timing for your area.

How to Maximize Your Benefits

To ensure you are getting the most out of the STAR program, consider the following tips:

- Stay Informed: Keep yourself updated on changes in STAR regulations and eligibility requirements, as they can shift based on budgetary adjustments and policy changes.

- Apply Early: If you believe you are eligible, don’t wait until the deadline. Early applications can help you get in line for benefits quickly.

- Local Resources: Utilize local government websites and offices to gain insights into possible benefits and services available in your area that complement STAR, like local tax exemptions.

- Keep Records: Maintain your documentation meticulously. This ensures that you can provide necessary information in case of any follow-ups or audits.

Conclusion

New York State’s STAR rebate checks provide a vital source of financial relief for many homeowners. Understanding the program, including its eligibility requirements and potential savings, enables you to take full advantage of available benefits. Whether you qualify for Basic or Enhanced STAR, every dollar counts in the ever-increasing costs of home ownership. Stay informed, apply, and watch your savings grow, making your financial future a bit brighter.

FAQs

- 1. How do I apply for the STAR program?

- You can apply by visiting your local assessor’s office or through the New York State Department of Taxation and Finance website.

- 2. Can I receive STAR benefits if I rent my home?

- No, STAR benefits are only available to homeowners who occupy their homes as their primary residence.

- 3. Do I need to apply every year?

- If you qualify for the STAR exemption, you typically do not need to reapply each year. However, you must remain eligible and your local assessor may contact you periodically.

- 4. What happens if my income exceeds the threshold for Enhanced STAR?

- If your income exceeds the set threshold for Enhanced STAR, you may still apply for Basic STAR, which has different eligibility criteria.

- 5. When will I receive my STAR rebate check?

- STAR rebate checks are usually mailed in the fall, typically around October. Check with your local assessor’s office for specific dates.

This article provides a comprehensive overview of New York State’s STAR rebate checks. You can copy and paste the above HTML code to use in a WordPress post editor that supports HTML input.

Download New York State Star Rebate Checks