Unlocking Savings: Understanding the New Jersey Renters Rebate Program

The New Jersey Renters Rebate Program is designed to provide financial assistance to eligible residents who pay rent for their homes. The program aims to alleviate the financial burden on low- and moderate-income renters, particularly seniors and individuals with disabilities. In this article, we will explore the intricacies of the program, eligibility requirements, application process, and key benefits. Understanding the Renters Rebate Program can help you unlock significant savings and maintain your financial stability.

What is the Renters Rebate Program?

Established by New Jersey law, the Renters Rebate Program offers eligible participants a rebate on a portion of the rent they pay. The program is administered by the New Jersey Division of Taxation, and it serves as an essential resource for thousands of residents across the state. Through this initiative, eligible renters can receive financial assistance intended to support their living expenses and enhance their overall quality of life.

Eligibility Requirements

To qualify for the Renters Rebate Program, applicants must meet specific criteria:

- Age and Disability: Applicants must be at least 65 years old or be at least 18 years old with a permanent disability.

- Income Limits: The program has a cap on income, which varies slightly from year to year. Generally, applicants should have a total annual income below $60,000 for individuals or $70,000 for couples.

- Residency: Applicants must be residents of New Jersey and have lived in the state for at least one year.

- Rental Payments: You must have paid rent on your primary residence for the entire year.

How is the Rebate Calculated?

The amount of the rebate varies based on the applicant’s income, age, and rental payment. Generally, the maximum rebate can go up to $1,500. The precise calculation takes into account the following:

- Your total rent paid during the year.

- Your income level.

- The proportion of rental costs relative to your income.

It’s essential to note that the program also adjusts the rebate based on how long you have been a resident and the size of your household.

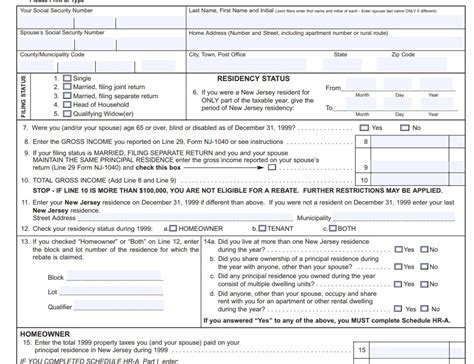

Application Process

Applying for the Renters Rebate Program is straightforward. Here are the steps to follow:

- Gather Required Documents: Before you start the application, compile necessary documents, including proof of income, rental payments (like a lease or rent receipts), and personal identification.

- Complete the Application Form: The application can be obtained online from the New Jersey Division of Taxation’s website or through local agencies.

- Submit Your Application: Applications can be submitted via mail, and it’s important to ensure that it is sent before the deadline, usually set for September 30 each year.

- Track Your Status: After submission, applicants can follow up to check the status of their application through the Division of Taxation’s online portal or by contacting their office directly.

Key Benefits of the Renters Rebate Program

Participating in the Renters Rebate Program offers numerous benefits:

- Financial Relief: The rebate can significantly reduce your financial burden, freeing up funds for other essential expenditures.

- Supports Low-Income Residents: The program targets low- and moderate-income individuals, providing necessary assistance to those who need it most.

- Encourages Stability: By offering financial support, the program helps residents maintain their housing stability, reducing the risk of eviction and homelessness.

- Easy Application Process: The relatively straightforward application process allows most eligible residents to apply without hassle.

Conclusion

The New Jersey Renters Rebate Program is a vital resource for eligible renters seeking financial assistance. By understanding the eligibility requirements and application process, you can position yourself to benefit from this program. Whether you are a senior citizen or a disabled individual, don’t overlook this opportunity to unlock potential savings. As housing costs continue to rise, programs like the Renters Rebate are essential for fostering financial stability and ensuring that all New Jersey residents have access to affordable housing.

FAQs

1. What is the maximum rebate amount I can receive?

The maximum rebate amount can be up to $1,500, depending on your income and rental expenses.

2. How often can I apply for the renters rebate?

You can apply for the Renters Rebate Program annually, provided you continue to meet the eligibility requirements.

3. When is the application deadline?

The application deadline for the Renters Rebate Program is generally September 30 each year, but it’s always good to check for specific dates.

4. Can I apply online?

Yes, you can download the application form from the New Jersey Division of Taxation’s website, complete it, and submit it via mail.

5. What documents do I need to apply?

You will need proof of income, rental payments, and identification. Check the official website for a complete list of required documents.

Download New Jersey Renters Rebate