Unlocking Savings: How the Solar Power Tax Rebate Benefits Homeowners

For homeowners considering sustainable energy solutions, solar power has emerged as an advantageous and increasingly popular option. Not only does solar energy significantly reduce electricity bills, but it also contributes to a cleaner environment. A vital aspect of making solar energy more accessible to homeowners is the solar power tax rebate. In this article, we explore how this incentive benefits homeowners and enhances the transition to renewable energy.

Understanding the Solar Power Tax Rebate

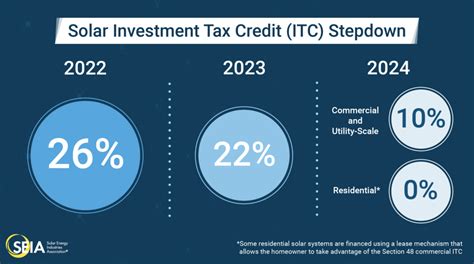

The solar power tax rebate is a financial incentive provided by the government to encourage homeowners to adopt solar energy systems. Depending on the country or state, this incentive can come in various forms, such as direct tax credits, rebates, or grants. For example, in the United States, the federal government has implemented the Investment Tax Credit (ITC), which allows homeowners to deduct a significant percentage of their solar system costs from their federal taxes.

Financial Benefits of Solar Power Tax Rebate

One of the most attractive aspects of the solar power tax rebate is the financial benefits it offers:

- Lower Initial Investment: The tax rebate reduces the amount homeowners need to spend upfront on a solar energy system. By taking advantage of this incentive, homeowners can alleviate the initial costs associated with solar panel installation.

- Long-Term Savings: Solar power can significantly lower electricity bills. The energy generated by solar panels allows homeowners to rely less on traditional utility companies, leading to substantial long-term savings.

- Increased Property Value: Investing in solar energy can enhance the overall value of a home. Studies have shown that homes with solar power systems tend to sell for more than those without them. The solar tax rebate thus not only makes installation more affordable but also increases a property’s market appeal.

How Solar Power Tax Rebate Works

To better understand how the tax rebate works, let’s break down its essential components:

- Eligibility: Homeowners must ensure their solar energy system meets specific criteria to qualify for the tax rebate. This typically includes using approved solar technology and having the system installed correctly.

- Application Process: After installation, homeowners can file for the rebate through their tax return. This usually involves filling out IRS Form 5695 for the federal tax credits in the U.S.

- Claiming the Rebate: The tax rebate amount is typically calculated as a percentage of the installation costs. Homeowners must ensure they keep all relevant receipts and documentation for tax purposes.

Environmental Impact

Beyond the financial incentives, solar power also provides significant environmental benefits. Transitioning to solar energy helps reduce reliance on fossil fuels, lowers greenhouse gas emissions, and contributes to a cleaner, more sustainable future. Homeowners who adopt solar energy not only save money but also play a crucial role in the fight against climate change.

Common Misconceptions

While the benefits of solar energy and tax rebates are compelling, several misconceptions may deter homeowners from considering solar power:

- High Initial Costs: Many homeowners believe that solar installations are prohibitively expensive. However, with the availability of tax rebates and financing options, the upfront costs have become significantly more manageable.

- Complexity of Installation: Some may think that installing solar systems is an overly complicated process. In reality, numerous certified professionals are available to assist with installation, making the process seamless.

- Solar Isn’t Effective Everywhere: While some regions may receive more sunlight than others, advances in solar technology have increased efficiency, allowing homeowners in various climates to benefit from solar energy.

Conclusion

The solar power tax rebate serves as an essential driver for homeowners looking to invest in renewable energy. This financial incentive not only decreases the initial costs associated with solar installation but also leads to substantial long-term savings on electricity bills. Moreover, adopting solar energy contributes positively to the environment by reducing carbon footprints and promoting sustainability. As more homeowners take advantage of these rebates, the future of our energy landscape could become significantly cleaner and more sustainable.

FAQs

- What is the current percentage of the solar tax rebate?

- The percentage can vary by year and location. As of the last update, the federal ITC offers a 26% tax credit for solar installations.

- Are there state-specific solar rebates available?

- Yes, many states offer additional rebates and incentives, so it’s essential to check local programs in addition to federal incentives.

- Can I claim the rebate if I finance my solar installation?

- Yes, you can still claim the solar tax rebate even if you finance the installation through loans or leasing arrangements.

- Are there any eligibility criteria for the solar tax rebate?

- Yes, eligibility criteria typically include the type of solar technology used, installation compliance with state and local requirements, and usage for primary residences.

- How long will the solar tax rebate last?

- The solar tax rebate is set to decrease over time, so it’s advisable to take advantage of it as soon as possible to maximize benefits.

This code outputs a structured and informative WordPress HTML article discussing the benefits of the solar power tax rebate for homeowners, along with a conclusion and FAQs section.

Download Solar Power Tax Rebate