Owning a home is a dream for many, but the associated costs can often be overwhelming. In New Jersey, homeowners have a unique opportunity to mitigate some of these financial burdens through the New Jersey Homestead Rebate program. This initiative aims to provide financial relief to taxpayers, making homeownership more affordable and sustainable. In this article, we’ll explore how the Homestead Rebate works, its eligibility criteria, application process, and the potential benefits it can offer to New Jersey residents.

What is the New Jersey Homestead Rebate?

The New Jersey Homestead Rebate is designed to provide property tax relief to eligible homeowners. The program offers rebates based on the amount of property taxes paid, thus reducing the overall financial burden. This rebate can be crucial for families looking to manage their housing expenses in one of the most expensive states in the nation.

Eligibility Criteria

To qualify for the Homestead Rebate, homeowners must meet specific criteria:

- You must be a resident of New Jersey.

- You must own the property for which you are claiming the rebate.

- You must have paid property taxes on that home.

- Your income must fall below the established threshold, which is subject to change each year.

It’s essential to check the current year’s income limits and to ensure that your application is submitted on time to take advantage of this beneficial program.

How to Apply for the Homestead Rebate

The application process for the Homestead Rebate is straightforward:

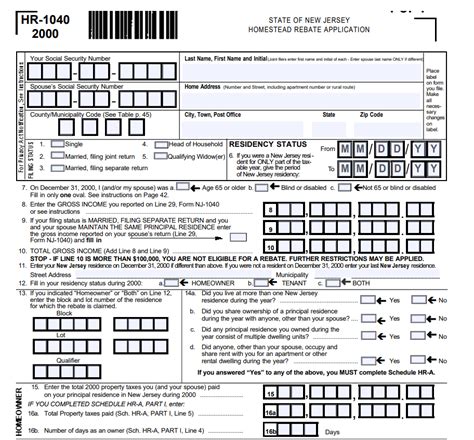

- Gather Documents: Collect all relevant documents, including proof of ownership and tax payments.

- Check Eligibility: Ensure you meet all criteria, especially the income limit for the year.

- Complete Application: You can apply online through the New Jersey Division of Taxation website or by mailing a hard copy of your application form.

- Submit the Application: Ensure the application is sent before the deadline, which is typically set by the state each year.

It’s advisable to consult with a tax professional or local government office if you have any questions during the application process.

Benefits of the New Jersey Homestead Rebate

Participating in the New Jersey Homestead Rebate program comes with various benefits:

- Financial Relief: The most direct benefit is the cash rebate that helps ease the burden of property taxes.

- Increased Affordability: With a rebate, homeowners can allocate funds to other essential expenses, like education, healthcare, or savings.

- Stability in Property Ownership: By alleviating some of the financial pressures, the Homestead Rebate encourages homeowners to stay in their properties longer, promoting community stability.

- Promotion of Homeownership: The initiative supports the state’s aim to foster homeownership, contributing to the overall economic growth of New Jersey.

Calculating Your Rebate

Understanding how your rebate is calculated is essential for maximizing your benefits. The Homestead Rebate amount is typically based on a percentage of the property taxes paid. However, the specific calculation can vary based on your income and the total amount of property tax assessed. Utilizing online calculators available through the New Jersey Division of Taxation site can provide a preliminary estimate to help you plan your finances accordingly.

Moreover, be aware that the Homestead Rebate can be combined with other state and local programs designed to assist homeowners, offering even more considerable savings. Always stay informed about the latest initiatives and programs available in your area.

Common Misconceptions

As with many government programs, a few misconceptions about the Homestead Rebate persist. Here are some clarifications:

- It’s only for low-income homeowners: While there’s an income threshold, many middle-income families may still qualify.

- You must pay property taxes upfront: The rebate targets homeowners who have already paid their taxes; it does not require upfront payment to qualify.

- It’s complicated to apply: Many find the application process straightforward, especially with online resources available to guide you.

Conclusion

The New Jersey Homestead Rebate program represents a valuable opportunity for homeowners looking to ease the financial strain of property ownership. By understanding the eligibility requirements, application process, and potential benefits, residents can take significant steps toward unlocking savings that contribute to a more affordable living experience in New Jersey. Homeownership is a privilege that should remain accessible, and programs like the Homestead Rebate are vital in making this a reality for many families across the state.

FAQs

1. How do I know if I qualify for the Homestead Rebate?

To qualify, ensure you are a New Jersey resident, own your property, have paid property taxes, and meet the income eligibility requirements as outlined by the state.

2. When can I apply for the Homestead Rebate?

The application period usually opens in early spring, with specific deadlines varying year to year. It’s essential to check the New Jersey Division of Taxation website for the latest updates.

3. How is my rebate amount determined?

Your rebate is calculated based on a percentage of the property taxes you have paid, as well as your income level compared to the state’s established thresholds for the year.

4. Can I receive the Homestead Rebate if I have a mortgage?

Yes, many homeowners with mortgages can still qualify for the Homestead Rebate as long as they meet the eligibility requirements.

5. If my income changes, will it affect my rebate?

Yes, changes in income can impact your eligibility for future rebates. It’s essential to stay informed about the income thresholds each year.

Download N J Homestead Rebate