Introduction

The automotive landscape is rapidly evolving, with electric vehicles (EVs) at the forefront of this transformation. As more individuals and families seek environmentally friendly transportation options, the increasing availability of rebates and incentives has made the dream of owning an EV more attainable than ever. This article explores how rebates work and their significant role in reducing the overall cost of electric vehicles.

Understanding Electric Vehicle Rebates

Rebates for electric vehicles come from various sources, including federal, state, and local governments, as well as private organizations. These financial incentives encourage consumers to embrace EV technology by alleviating some of the initial costs associated with purchasing an electric vehicle.

Generally, these rebates can take several forms:

- Federal Tax Credit: In the United States, a federal tax credit can be applied directly to the buyer’s tax return, potentially providing significant savings. As of the latest regulations, consumers can receive up to $7,500 off their tax liability when purchasing an EV.

- State Incentives: Many states offer additional rebates, grants, or tax incentives, which can substantially enhance the overall savings. These vary widely depending on the state and can reach several thousand dollars.

- Utility Company Programs: Some electric utility companies provide rebates for EV purchases or discounts on electricity rates for EV charging during off-peak hours, thereby incentivizing consumers to opt for electric vehicles.

- Local Incentives: Cities and counties sometimes create their own programs to promote the use of electric vehicles. These could include rebates, tax breaks, or even perks like free parking or access to carpool lanes.

The Financial Impact of Rebates

The financial savings achieved through rebates can significantly lower the effective price of an electric vehicle. For example, a new electric vehicle listed at $35,000 could see its price drop to $27,500 after applying a federal tax credit and a state rebate. This lower upfront cost makes electric vehicles a more appealing option for consumers who may have been hesitant due to the historically higher price point of EVs compared to traditional gasoline-powered cars.

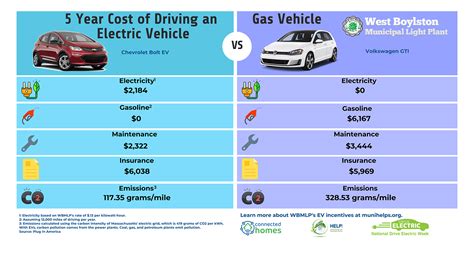

Additionally, the long-term savings should also be considered. EVs typically require less maintenance than their gas counterparts, and electricity is often less expensive than gasoline. When combined with rebates, the total cost of ownership for electric vehicles becomes more attractive over time.

Case Studies of Successful Incentive Programs

Several regions have successfully implemented rebate programs that promote electric vehicle adoption. Let’s look at a couple of noteworthy examples:

California

California offers one of the most comprehensive rebate programs for electric vehicles, known as the Clean Vehicle Rebate Project (CVRP). Under this initiative, eligible buyers can receive rebates of up to $7,000. In combination with the federal tax credit, this has led to a significant increase in EV sales within the state.

Norway

Norway stands out internationally for its electric vehicle strategy. The Norwegian government provides substantial incentives, including exemptions from sales tax, no import taxes, and free tolls. These policies have resulted in electric vehicles comprising a majority of new car sales in the country.

Challenges and Considerations

While rebates and incentives significantly enhance the affordability of electric vehicles, challenges remain. Availability can vary considerably, leaving some potential buyers without sufficient support. Furthermore, as more individuals transition to electric vehicles, there is a concern regarding the sustainability and funding of these programs in the long term.

Another consideration is the potential for program limitations, such as income eligibility or vehicle type restrictions that can exclude some buyers from benefiting from rebates. It’s crucial for potential EV buyers to research available programs in their area and understand the eligibility requirements before making a purchase.

Conclusion

In summary, rebates and incentives play a pivotal role in making electric vehicles more accessible and affordable for consumers. As government initiatives and private organizations continue to push for cleaner transportation, the financial benefits associated with owning an electric vehicle can significantly impact decisions for many buyers. By leveraging these programs, consumers can participate in the transition to sustainable transport while also enjoying substantial savings in the process. The future of mobility is electric, and with ongoing support from rebates, we can unlock the door to a greener tomorrow.

FAQs

1. What are the eligibility requirements for electric vehicle rebates?

Eligibility can vary depending on the specific rebate program. Generally, it may include factors such as income, residency, and the type of vehicle being purchased. It’s best to consult local program details for accurate information.

2. How do federal tax credits for electric vehicles work?

The federal tax credit allows buyers to deduct a certain amount (up to $7,500) from their federal tax liability when they purchase a new electric vehicle. The exact amount may depend on the vehicle’s battery capacity and manufacturer sales.

3. Are there any tax credits for used electric vehicles?

As of now, the federal tax credits primarily apply to new electric vehicles. However, some states may offer incentives for used electric vehicle purchases, so it’s essential to check specific state policies.

4. Can you combine multiple rebates and incentives?

In many cases, yes. Buyers can often stack federal, state, and sometimes local incentives to maximize their savings on an electric vehicle. However, it is crucial to read the specific terms and conditions of each program.

5. Do rebates have an expiration date?

Yes, many rebate programs have specific timeframes or funding limits. It’s important to verify the current status of any rebates you may be interested in before proceeding with a purchase.

Download Rebates For Electric Vehicles