The rise of electric vehicles (EVs) marks a pivotal shift in the automotive industry, providing a sustainable alternative to traditional gasoline-powered cars. However, the upfront cost of electric cars can be a deterrent for many consumers. Fortunately, government incentives and rebates are available to ease this financial burden, making EVs more accessible and appealing. This article aims to delve into how EV rebates can effectively reduce the overall cost of electric vehicles and contribute to a greener future.

Understanding EV Rebates

Electric Vehicle (EV) rebates are financial incentives offered by federal, state, and local governments aimed at promoting the adoption of electric vehicles. These rebates typically come in the form of tax credits or direct cash rebates and can significantly reduce the purchase price of an electric vehicle.

Types of EV Rebates

EV rebates can vary significantly depending on the region and the specific policies in place. Here are the common types:

- Federal Tax Credit: In the United States, electric vehicle buyers may qualify for a federal tax credit of up to $7,500, depending on the battery capacity of the vehicle. This amount can make a substantial difference in the car’s total cost.

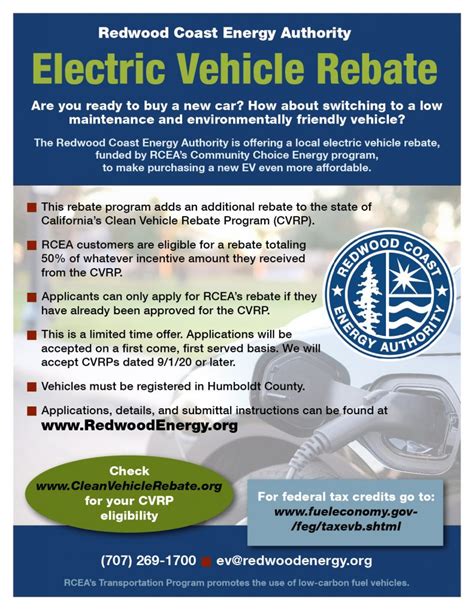

- State Incentives: Many states offer additional rebates or tax credits. For instance, California has a Clean Vehicle Rebate Project that provides up to $2,000 for eligible electric vehicles.

- Local Incentives: Local governments and utility companies may offer additional incentives such as rebates for home charging station installations or reduced electricity rates for EV charging.

How EV Rebates Lower the Cost of Ownership

Beyond the initial purchase price, EV rebates contribute to lowering the overall cost of ownership. This section will discuss several ways in which these incentives make electric vehicles a financially sound investment.

1. Upfront Savings

The most immediate effect of an EV rebate is the reduction in the vehicle’s sticker price. For example, a $7,500 federal tax credit can effectively lower a vehicle priced at $40,000 to $32,500, bringing it closer to the price range of traditional vehicles.

2. Lower Fuel Costs

Electric vehicles generally have much lower fuel costs than gasoline-powered vehicles. The cost of electricity per mile is significantly lower than the cost of gasoline, especially as fuel prices rise. Many states also offer off-peak electricity rates, making it even more economical to charge your EV overnight.

3. Reduced Maintenance Costs

Electric vehicles tend to have fewer moving parts than traditional internal combustion engine vehicles, which can result in lower maintenance costs over time. EVs do not require oil changes, fuel filters, spark plugs, or exhaust systems, which translates into significant savings on vehicle maintenance.

4. Incentives for Home Charging Stations

Many local governments and utility companies offer rebates for the installation of home charging stations. These rebates can significantly reduce the cost associated with setting up a home EV charging infrastructure, making it more convenient and cost-effective for homeowners.

Environmental Impact

Beyond the economic benefits of EV rebates, it’s crucial to consider the positive impact on the environment. By incentivizing the purchase of electric vehicles, governments aim to reduce greenhouse gas emissions and promote cleaner air. Electric vehicles produce zero tailpipe emissions, making them a vital component in the fight against climate change and air pollution.

Challenges and Considerations

While EV rebates offer exciting opportunities, there are also challenges and considerations for consumers. Some of these challenges include:

- Eligibility Criteria: Not all vehicles or buyers qualify for rebates. Consumers must ensure they understand the eligibility requirements, which can vary significantly depending on location and vehicle model.

- Availability and Reductions: As more electric vehicles enter the market, manufacturers may hit thresholds that reduce or eliminate the federal tax credit. Keeping up with legislative changes is essential to maximize potential savings.

Conclusion

Electric vehicles offer numerous benefits, but their upfront costs can be a significant barrier for many consumers. EV rebates play a vital role in bridging this gap, making electric vehicles more affordable and encouraging more people to contribute to a sustainable future. With ongoing advancements in EV technology and increased government support, the transition to electric cars will continue to evolve, providing even greater savings and environmental benefits.

FAQs

1. What is the average rebate amount for electric vehicles?

The average rebate amount can vary widely. In the U.S., federal tax credits can go up to $7,500, while state rebates can range from several hundred to several thousand dollars.

2. Are there income limits for qualifying for EV rebates?

Yes, some states and local programs impose income limits on eligibility for rebates. It is essential to check local regulations in your area.

3. Can I lease an electric vehicle and still receive rebates?

Yes, in many cases, lessees can benefit from the same rebates as buyers, but it will depend on the specific terms of the lease and the regulations in your area.

4. Are there any additional costs associated with owning an electric vehicle?

Yes, potential costs can include home charging station installation, increased electricity bills, and insurance costs. However, these may be offset by savings on fuel and maintenance.

5. How do I find out about local EV rebates in my area?

Local government websites, utility companies, and the Department of Energy’s Alternative Fuels Data Center are great resources to find information on available EV rebates.

This article provides a comprehensive overview of how EV rebates work, their benefits, and potential challenges, while including a conclusion and FAQs for further clarity.

Download Rebate For Electric Vehicle