Unlocking Savings: Everything You Need to Know About New Jersey’s Homestead Rebate

If you are a homeowner in New Jersey, you may be familiar with the financial pressures that come with property ownership, particularly rising property taxes. Fortunately, New Jersey offers a program known as the Homestead Rebate, which provides significant relief to eligible homeowners. This article aims to detail everything you need to know about the Homestead Rebate, including how to qualify, how to apply, and how you can benefit from it.

What is the Homestead Rebate?

The Homestead Rebate is a property tax relief program aimed at reducing the burden of property taxes for New Jersey homeowners. Funded by the state, this initiative provides cash rebates based on income, property taxes paid, and other criteria. The primary objective is to make housing more affordable while keeping property taxes manageable for residents.

Who is Eligible?

Eligibility for the Homestead Rebate has specific criteria. Homeowners must meet the following requirements:

- Be a resident of New Jersey and own your home as of October 1 of the tax year.

- Have a total annual income that does not exceed the specified limits set forth for the current tax year. As of the last update, income thresholds vary depending on your filing status.

- Have paid property taxes on your principal residence in New Jersey for the applicable tax year.

It’s essential to check the specific income limits each year, as these can change based on government guidelines.

How to Apply?

The application process for the Homestead Rebate can seem daunting at first, but it is fairly straightforward. Here’s a step-by-step guide:

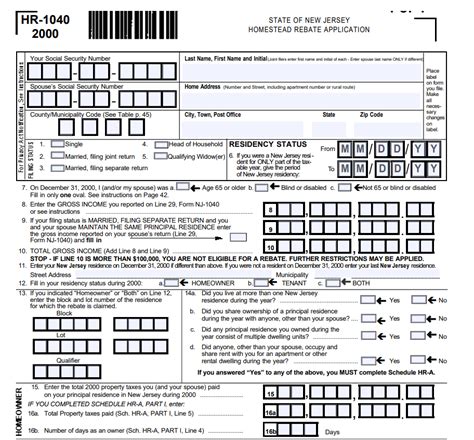

- Obtain the Application Form: You can download the Homestead Rebate application from the New Jersey Division of Taxation website or your local tax assessor’s office.

- Fill Out the Application: Carefully complete all sections of the form, ensuring that you provide accurate information regarding your income and property taxes paid.

- Submit the Application: Mail your completed application to the appropriate address listed on the form. Make sure to keep a copy of your application for your records.

- Await Confirmation: After submission, you will receive a confirmation from the state regarding your application status. The processing time can vary, so patience is crucial.

Key Deadlines

Being aware of application deadlines is crucial for receiving your rebate. Traditionally, applications must be submitted by the end of the tax year, typically set for June 30th. It’s paramount to check the New Jersey Division of Taxation website for the exact deadlines each year, as they may vary.

How Much Can You Receive?

The amount of your rebate can vary significantly based on income and property taxes paid. Typically, homeowners can receive substantial rebates, with amounts reaching up to several thousand dollars for low- to moderate-income earners. Moreover, additional credits or adjustments can be available for seniors, disabled persons, or qualifying veterans. Always check the specific rebate schedules for the current year to know the exact figures.

Rebate Distribution

Once your application is approved, the state of New Jersey will issue the rebate either as a direct deposit or as a check via mail, depending on the preference indicated during the application process. Ensure your banking details, if provided, are correct to avoid delays.

Additional Resources

If you have questions about the Homestead Rebate or need additional assistance, consider reaching out to the New Jersey Division of Taxation, your local tax assessor’s office, or statewide organizations dedicated to assisting homeowners. Community outreach programs often provide free workshops and assistance for individuals looking to maximize their benefits.

Conclusion

The New Jersey Homestead Rebate program is an essential resource for homeowners looking to alleviate their property tax burdens. By understanding eligibility requirements, navigating the application process, and maximizing potential rebates, residents can unlock considerable savings that directly impact their financial health. Informing ourselves about available programs not only empowers homeowners but also strengthens communities as a whole.

FAQs

1. Can renters apply for the Homestead Rebate?

No, the Homestead Rebate is specifically designed for homeowners who pay property taxes on their primary residence in New Jersey.

2. Is there a deadline to apply for the Homestead Rebate?

Yes, applications typically must be submitted by June 30th of the tax year. However, it is advisable to check the New Jersey Division of Taxation’s website for specific yearly deadlines.

3. How often can I apply for the Homestead Rebate?

You can apply for the Homestead Rebate every tax year, provided you meet the eligibility requirements.

4. Will the rebate affect my income tax?

The Homestead Rebate is not considered taxable income. However, it’s essential to consult with a tax professional for personalized advice regarding your tax situation.

5. What should I do if my application is denied?

If your application is denied, you will receive a notice explaining the reasons. You may appeal the decision, and it’s advisable to contact the New Jersey Division of Taxation for guidance on the appeals process.

This HTML format contains proper headings, lists, and sections that you can directly use in a WordPress article to provide clear and organized information about New Jersey’s Homestead Rebate program.

Download Homestead Rebate In Nj