Unlocking Savings: Everything You Need to Know About Federal Electric Car Rebates

As the world shifts towards clean energy, electric vehicles (EVs) are gaining momentum. The U.S. government recognizes the environmental and economic benefits of EVs, prompting the introduction of federal rebates and incentives. This article dives deep into everything you need to know about federal electric car rebates, guiding you through eligibility, application processes, and the long-term benefits of going electric.

What are Federal Electric Car Rebates?

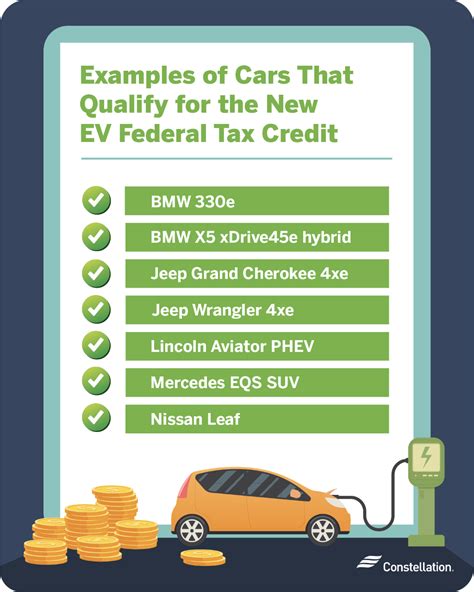

Federal electric car rebates are financial incentives provided to encourage the purchase of electric vehicles. These rebates can significantly reduce the out-of-pocket cost of an EV, making it a more accessible option for consumers. The most prominent federal incentive is the Plug-In Electric Vehicle Tax Credit, which offers a credit of up to $7,500 depending on the vehicle’s battery capacity.

Eligibility Criteria

To qualify for these federal rebates, several criteria must be met:

- Vehicle Type: The vehicle must be a new, qualified electric vehicle, meeting the specifications set by the IRS.

- Battery Capacity: The vehicle must have a battery capacity of at least 4 kilowatt-hours.

- Manufacturer Sales Cap: The tax credit begins to phase out once a manufacturer sells 200,000 qualifying vehicles. This means that some manufacturers may no longer qualify for the full tax credit.

- Income Limit: There are no federal income limits for consumers purchasing electric vehicles under the current tax credit structure, although some states may impose their own caps.

How to Apply for the Rebate

Applying for the federal electric car rebate is a straightforward process:

- Purchase an Eligible Vehicle: Ensure that the electric vehicle you want to buy qualifies for the federal rebate.

- Gather Documentation: Collect necessary documents, such as the Vehicle Identification Number (VIN) and proof of purchase.

- File Tax Form 8834: When filing your federal tax return, complete IRS Form 8834, which is used to claim the qualified Plug-in Electric Drive Motor Vehicle Credit.

- Consult a Tax Professional: If you’re uncertain about the process, consulting a tax professional can ensure that you submit all necessary information correctly.

State Incentives

In addition to federal rebates, many states offer their own incentives for electric vehicle purchases. These can include additional tax credits, rebates, and grants, as well as benefits like HOV lane access and reduced registration fees. Always check your state’s regulations and incentives as these can significantly enhance your overall savings.

Long-Term Benefits of Electric Vehicles

Investing in an electric vehicle goes beyond immediate savings from federal rebates. Some long-term benefits include:

- Lower Operating Costs: Electricity is generally less expensive than gasoline, and EVs typically require less maintenance due to fewer moving parts.

- Environmental Impact: Driving an electric vehicle contributes to reduced greenhouse gas emissions, fostering a healthier planet.

- Increased Resale Value: As EVs become more popular, their resale values are also rising, giving owners a better return on their investment.

- Technological Advancements: Continued innovation in EV technology promises even better efficiency and performance in the years to come.

Challenges and Considerations

While the benefits of electric vehicles are compelling, potential buyers should also be aware of some challenges:

- Charging Infrastructure: Depending on where you live, access to charging stations may vary. However, the network is rapidly expanding.

- Upfront Cost: Although rebates help, EVs can still be more expensive upfront compared to traditional vehicles. It’s important to consider the entire cost of ownership over time.

- Battery Lifespan: Over time, battery performance can degrade. Researching battery warranties and options for replacements is crucial.

Conclusion

Federal electric car rebates are a fantastic way to save money while contributing to a sustainable future. As more people recognize the benefits of electric vehicles, the financial incentives will only enhance their appeal. By understanding eligibility criteria, the application process, as well as state-specific incentives, potential buyers can make informed decisions. With a blend of immediate financial benefits and long-term gains, electric vehicles represent a smart investment in both personal finance and the environment.

FAQs

1. How much is the federal tax credit for electric vehicles?

The federal tax credit for electric vehicles can be up to $7,500, depending on the vehicle’s battery capacity.

2. Is there a limit to the number of vehicles I can purchase to receive the rebate?

No, there is no limit on the number of vehicles for which you can claim the rebate, as long as each vehicle qualifies for the tax credit.

3. Where can I find state-level incentives for electric vehicles?

State-specific incentives can typically be found on your state’s Department of Energy website or other local government resources.

4. What happens if I buy a vehicle after the tax credit has phased out?

If the tax credit has phased out for a particular manufacturer, you will not be eligible for the federal rebate on that vehicle.

5. Can I claim the rebate if I lease an electric vehicle?

If you lease an electric car, the leasing company usually claims the tax credit. However, many companies pass some of those savings onto the leaseholder.

Download Federal Rebate For Electric Car