Unlocking Savings: A Guide to Pennsylvania’s Senior Property Tax Rebate Program

As the cost of living continues to rise, many senior citizens in Pennsylvania find it increasingly challenging to manage their finances, particularly when it comes to property taxes. Fortunately, Pennsylvania’s Senior Property Tax Rebate Program offers financial relief to eligible senior homeowners, helping them to stay in their homes and maintain their quality of life. This guide will delve into the details of the program, eligibility requirements, application process, and tips for maximizing your benefits.

Understanding the Senior Property Tax Rebate Program

The Senior Property Tax Rebate Program is designed to provide financial assistance to homeowners aged 65 and older, who meet certain income and residency criteria. The program is intended to help alleviate the burden of property taxes, allowing seniors to keep their homes while enjoying their retirement years.

Eligibility Requirements

To qualify for the Senior Property Tax Rebate Program, applicants must meet the following criteria:

- Age: Applicants must be 65 years or older by December 31 of the application year.

- Residency: The applicant must be a permanent resident of Pennsylvania for at least the last year.

- Income: The household income must not exceed $35,000 per year. For applicants who are homeowners and receive a rent rebate, the income limit is slightly lower.

- Property Type: The property must be the applicant’s primary residence.

How the Rebate Works

The rebate amount varies based on the applicant’s income and the amount of property taxes paid. Generally, applicants with lower incomes and higher property tax payments will receive larger rebates. The maximum rebate amount is currently set at $650, although additional adjustments and specifics may vary by year.

Application Process

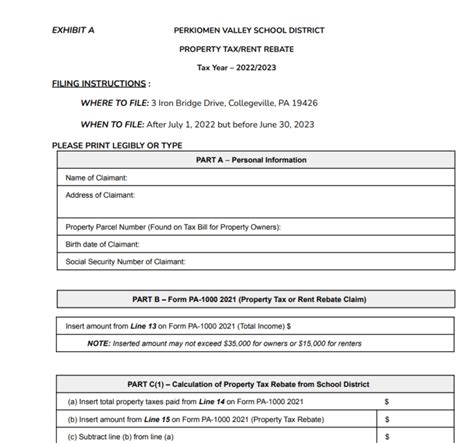

Applying for the Senior Property Tax Rebate is a straightforward process, but it requires gathering specific documents and information. Here’s a step-by-step guide:

- Gather Required Documents: You’ll need your property tax bill, proof of age, and documentation of income.

- Complete the Application: You can obtain the application form from the Pennsylvania Department of Revenue’s website or local government offices. Fill it out carefully to ensure all information is accurate.

- Submit Your Application: Mail your completed application along with the necessary documents to the appropriate office designated in the application guidelines. Make sure to keep copies for your records.

- Await Response: Once your application is processed, you’ll receive notification regarding your rebate status.

Maximizing Your Benefits

To make sure you get the most out of the Senior Property Tax Rebate Program, consider the following tips:

- Keep Track of Changes: Stay informed about any changes in income limits or rebate amounts each year that may affect your eligibility.

- Consult Local Resources: Many local organizations offer assistance in filling out tax forms and understanding your rights as a homeowner.

- Apply Every Year: The program requires annual reapplication, so keep a schedule and ensure that you apply promptly each year.

- Consider Other Benefits: Explore additional programs available to seniors, such as local property tax assistance initiatives and federal programs.

Conclusion

The Pennsylvania Senior Property Tax Rebate Program is an essential resource for seniors striving to maintain financial stability and live comfortably in their homes. By understanding the eligibility requirements, application process, and ways to maximize your benefits, you can take full advantage of this program. The savings from the rebates can make a significant difference in your overall financial well-being, allowing you to focus more on enjoying this precious stage of life.

FAQs

1. How much can I expect to receive from the Senior Property Tax Rebate Program?

The amount you can receive varies based on your income and property taxes. The maximum rebate is up to $650, with larger amounts potentially available for low-income seniors paying higher property taxes.

2. When should I submit my application?

You should submit your application as soon as possible after you receive your property tax bill. Applications are generally accepted from January 1 to June 30 for the previous tax year’s payments.

3. Can I apply if I am living in a care facility?

If you own a home that you are not currently living in due to health or moving into a care facility, you may still qualify, as long as you meet the eligibility criteria outlined above.

4. Are there any other programs similar to the Senior Property Tax Rebate Program?

Yes, Pennsylvania offers various assistance programs for seniors, including rent rebates, property tax deferral programs, and local initiatives. Be sure to research what’s available in your area.

5. How do I contact someone for help with my application?

You can contact your local Department of Revenue office or visit their website for resources and assistance. Additionally, many local nonprofits offer support services for seniors with tax-related questions.

This HTML format consists of well-structured content, ensuring all details are organized and easily readable for users on a WordPress website. If you have any specific themes or styles in mind, further customization may be needed.

Download Pa Senior Property Tax Rebate