Unlocking Savings: A Comprehensive Guide to the Minnesota Property Tax Rebate Form

The Minnesota property tax rebate form is designed to help homeowners and renters offset rising property taxes. Understanding the ins and outs of this rebate can feel daunting, but this comprehensive guide aims to simplify the process, allowing you to unlock potential savings and take advantage of this valuable benefit.

What Is the Minnesota Property Tax Rebate Form?

The Minnesota Property Tax Rebate is a program established by the state to assist eligible residents by providing a rebate on property taxes they have paid. This program is beneficial for both homeowners and renters, making it an essential tool for managing housing costs.

Who Qualifies for the Rebate?

Eligibility for the rebate hinges on several factors, including income level, property type, and location. Below are the primary qualifications you need to meet:

- Income Requirements: Your income must fall below a predefined limit set by the state. This limit varies each year, so it’s essential to check the latest guidelines.

- Property Ownership: For homeowners, the property must be your primary residence, and the taxes must have been paid during the relevant tax year.

- Renters: Renters can qualify based on the amount of property tax paid indirectly through their rent.

How to Obtain the Property Tax Rebate Form

Obtaining the Minnesota Property Tax Rebate Form is a simple process:

- Visit the Minnesota Department of Revenue Website: The form can be downloaded directly from the official website.

- Local Government Offices: You can also find the form at local county offices or city halls.

- Tax Assistance Centers: Many community organizations offer assistance in filling out the form.

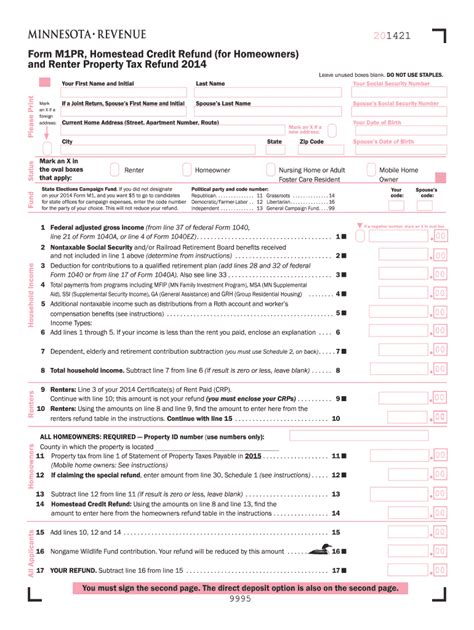

Steps to Fill Out the Rebate Form

Once you have the form, the next step is to fill it out accurately. Here’s a step-by-step guide:

- Personal Information: Enter your name, address, and Social Security number. Make sure this information is accurate to avoid delays.

- Income Information: Report your adjusted gross income for the tax year. This will determine your eligibility and rebate amount.

- Property Information: Enter details about your property, including the tax year for which you’re claiming the rebate and the amount of property tax that was paid.

- Review Form: Double-check all information for accuracy to ensure successful processing.

Where to Submit the Completed Form

After filling out the form, you need to submit it to the Minnesota Department of Revenue. You can do this in one of two ways:

- By Mail: Send the completed form to the address provided on the form.

- Electronically: If you’re comfortable with technology, you can submit the form online through the state’s e-Services portal.

Important Deadlines

To successfully claim your rebate, be aware of the important deadlines:

- The application generally needs to be submitted by August 15 of the year following the tax year in question.

- For instance, if you’re submitting for the 2022 tax year, you need to file by August 15, 2023.

What to Expect After Submission

Once you have submitted the property tax rebate form, here’s what you can expect:

- Processing Time: It may take several weeks to process your application. During this time, the state may contact you for additional information.

- Receiving Your Rebate: If approved, you will receive a check in the mail or a direct deposit, depending on your preference.

- Possible Audits: The state reserves the right to audit applications and may request additional documents to verify your claims.

Conclusion

Understanding the Minnesota Property Tax Rebate Form can unlock significant savings for many people. By following this comprehensive guide, you can navigate your way through the application process with ease. Make sure to stay updated with any changes in income requirements or forms, and don’t hesitate to reach out to local assistance organizations if you need help. The rebate may seem small, but every dollar counts, especially when it comes to managing monthly housing expenses.

FAQs

- 1. How much can I expect to receive from the rebate?

- The amount varies based on your property tax payments and income level, but you can use the state’s calculator to estimate your rebate.

- 2. When will I know if my application was approved?

- You should receive notification of your application status within a few weeks after submission.

- 3. Can I apply for the rebate if I just moved to Minnesota?

- If you own or rent a property that you have paid taxes on in Minnesota, you may be eligible as long as you meet other requirements.

- 4. What if I missed the deadline?

- Unfortunately, missing the deadline for submitting your rebate application will disqualify you for that tax year. You can apply in the next year if eligible.

- 5. Is there assistance available for filling out the form?

- Yes, many local organizations offer assistance in completing the property tax rebate form, so you don’t have to navigate the process alone.

Download Mn Property Tax Rebate Form