Unlocking Savings: A Comprehensive Guide to Property Tax Rebates in New Jersey

Property taxes can often feel overwhelming for New Jersey residents, with rates being among the highest in the nation. However, potential savings in the form of property tax rebates can alleviate some of this financial burden. This guide aims to provide a comprehensive breakdown of the types of property tax rebates available in New Jersey, eligibility requirements, application processes, and tips to maximize your benefits.

Understanding Property Tax Rebates

Property tax rebates are designed to provide financial relief to homeowners by reducing the amount owed on property taxes. In New Jersey, several rebate programs exist, primarily aimed at senior citizens, disabled residents, and low-income families. These rebates are critical in helping residents maintain their homes without facing undue financial strain.

Types of Property Tax Rebates in New Jersey

New Jersey offers various property tax rebate programs, each serving different demographics. The most notable programs include:

- Senior Freeze (Property Tax Reimbursement): This program is designed for senior citizens and disabled persons who meet specific income eligibility criteria. It “freezes” property taxes at their current level, ensuring that homeowners aren’t burdened by rising tax rates.

- Homestead Benefit Program: This program provides property tax relief to eligible homeowners based on their income and property taxes paid. The benefit amount varies based on the specific qualifications and overall funding for the program.

- Veterans Property Tax Deductions: Veterans and their surviving spouses may be eligible for property tax deductions that reduce their taxable income. New Jersey provides a $250 annual deduction for veterans and a potential $500 deduction for disabled veterans.

- Disabled Persons Property Tax Deduction: Enacted to help disabled persons, this deduction allows for relief from property taxes, reducing the financial burden for those who need it most.

Eligibility Requirements

Eligibility for property tax rebates varies by program. Here are some key requirements for the most common programs:

Senior Freeze

- Applicant must be 65 years or older, or a disabled resident.

- The applicant must have lived in New Jersey continuously for at least the last ten years.

- Income limits are set annually, and applicants must meet these requirements.

Homestead Benefit

- Homeowners must occupy their property as the principal residence.

- The homeowner must meet income limits set by the state, which may change each year.

- Applicants should have paid property taxes during the tax year in question.

Veterans and Disabled Persons Tax Deductions

- Must provide proof of military service and disability status, if applicable.

- Residency in New Jersey and proof of property ownership are required.

Application Process

The application process for property tax rebates may seem daunting at first, but it is manageable with the right resources. Here are steps to guide you through:

Gather Required Documentation

Please ensure you have all relevant documents, including proof of income, residency, and property ownership. Keeping tax records organized will streamline the process.

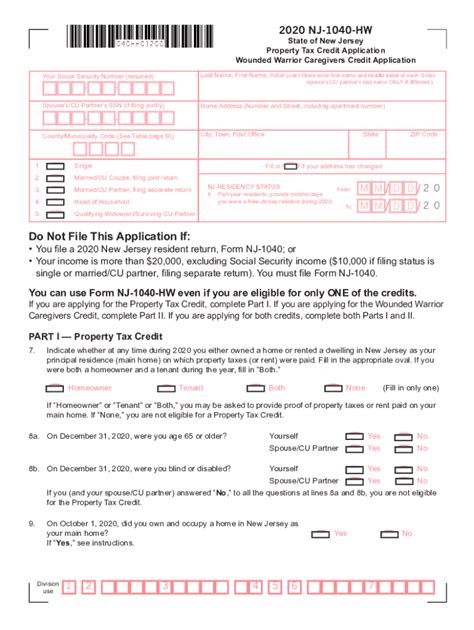

Complete the Application Form

New Jersey provides specific forms for each rebate program. You can find these forms on the New Jersey Division of Taxation website. Make sure to fill them out thoroughly to avoid delays.

Submit Your Application

Submit your application form and supporting documents before the deadline. Applications can often be submitted online, by mail, or in person, depending on the program.

Follow-Up

After submission, you may want to follow up with the local tax office to confirm the status of your application. Keeping track of communications can ensure any queries or issues are addressed promptly.

Maximizing Your Property Tax Rebates

To make the most out of available rebates, consider the following tips:

- Stay Informed: Regularly check for updates or changes in rebate programs to ensure you’re aware of your eligibility and any new opportunities.

- Keep Records: Maintain comprehensive records of all your property tax payments, income statements, and any correspondence related to your rebates.

- Consult a Tax Professional: If you’re uncertain about your eligibility or the application process, consulting a tax professional can provide personalized guidance and assistance.

Conclusion

Property tax rebates can significantly ease the financial burden faced by homeowners in New Jersey. By understanding the available programs, their eligibility requirements, and the application process, you can unlock savings that may otherwise go unclaimed. With potential refunds and manageable deductions, taking the time to apply can lead to meaningful financial relief. Remember to stay informed and proactive to maximize your benefits!

FAQs

1. How often can I apply for property tax rebates in New Jersey?

You can apply for property tax rebates annually as long as you meet the eligibility requirements each year.

2. What happens if I miss the application deadline?

If you miss the deadline, you may need to wait until the next year to apply. Some programs allow exceptions, so it is best to contact your local tax office for guidance.

3. Can I apply for multiple rebates at the same time?

Yes, you can apply for multiple rebates, as long as you meet the eligibility requirements for each program.

4. Is there any help available for filling out the application forms?

Yes, local tax offices, community organizations, and some advocacy groups may provide assistance with completing application forms.

By exploring the options available and taking advantage of property tax rebates, New Jersey residents can find some financial relief in today’s economic landscape.

Download Property Tax Rebate In Nj