New Jersey is known for its high property taxes, making it crucial for homeowners to take advantage of every available saving opportunity. One such opportunity is the New Jersey Property Tax Rebate Program, designed to alleviate some of the financial burden on homeowners. This guide aims to provide a comprehensive overview of the program, its eligibility requirements, application process, and how you can maximize your savings.

Understanding the Property Tax Rebate Program

The New Jersey Property Tax Rebate Program is a state-funded initiative aimed at providing financial relief to eligible homeowners by refunding part of the property taxes they pay. This program is part of the state’s efforts to reward property ownership and enhance the affordability of living in New Jersey.

Eligibility Criteria

To qualify for the New Jersey Property Tax Rebate Program, homeowners must meet specific criteria:

- Homeowners must reside in the property for which they are applying.

- The property must be their primary residence.

- Applicants must have paid property taxes in the previous year.

- Applicants must meet certain income limits, which may vary based on the year.

It’s essential to review the official guidelines as the income limits and other criteria may change annually.

Types of Rebates Available

New Jersey offers various types of property tax rebates, including but not limited to the following:

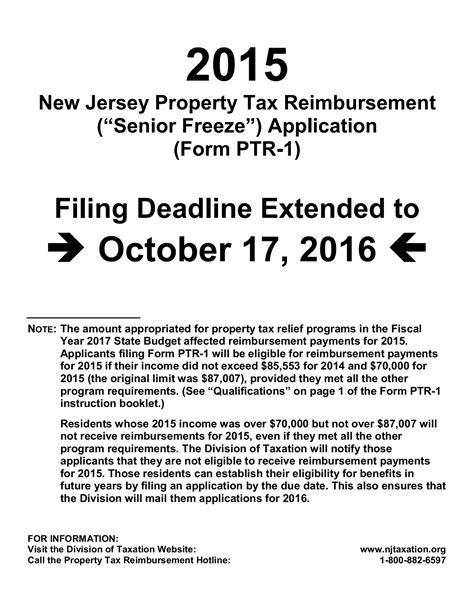

- Senior Freeze Program: This program is intended for senior citizens and disabled individuals, allowing them to benefit from a freeze on their property taxes.

- Homestead Benefit Program: This program provides annual property tax relief to eligible homeowners based on their income and property tax payments.

The Application Process

Applying for the New Jersey Property Tax Rebate Program is straightforward but requires careful attention to detail. The following steps outline the application process:

- Gather Necessary Documents: Ensure you have all relevant documents, including proof of income, property tax bills, and identification.

- Complete the Application Form: You can find the application on the New Jersey Division of Taxation’s website or at your local municipal office.

- Submit the Application: Follow the specified submission guidelines; applications can usually be submitted online or via mail.

- Await Confirmation: After submitting your application, be on the lookout for any communications from the state regarding your status.

Important Deadlines

It’s vital to keep track of deadlines to avoid missing out on the benefits. The official application period typically runs from early spring to early summer. Check the New Jersey Division of Taxation’s official site for the specific dates each year.

Maximizing Your Savings

To maximize your savings under the property tax rebate program, consider the following strategies:

- Stay Updated on Changes: Property tax rebate programs can change, so stay informed about any updates that may affect your eligibility or potential savings.

- Consult a Tax Professional: A tax expert can provide valuable insights into how to structure your finances to qualify for maximum rebates.

- Review Your Property Taxes: Regularly review your property taxes and assess whether you qualify for different types of rebates.

Conclusion

The New Jersey Property Tax Rebate Program can significantly lighten the financial load for homeowners struggling with high property tax rates. Understanding the program’s requirements and application process is crucial for maximizing benefits and ultimately achieving financial relief. By staying informed and proactive, you can unlock potential savings that may contribute positively to your household budget.

Frequently Asked Questions (FAQs)

- 1. What is the maximum rebate I can receive?

- The maximum rebate amount can vary based on several factors, including your property taxes, income, and the specific program under which you are applying. Check the New Jersey Division of Taxation website for the most up-to-date information.

- 2. Can I apply online?

- Yes, applications can typically be submitted online through the New Jersey Division of Taxation’s portal, as well as by mail.

- 3. How long does it take to receive my rebate?

- The processing time for rebates can vary, but it usually takes several weeks to a few months. You’ll receive a confirmation once your application has been reviewed.

- 4. What should I do if my application is denied?

- If your application is denied, you can appeal the decision. The notification you receive will provide information on how to proceed with an appeal.

This HTML structure can be directly used in a WordPress editor that supports HTML format. Adjust the content and styling as needed based on the theme you are using.

Download Property Tax Rebate New Jersey