Unlocking Savings: A Comprehensive Guide to New Jersey’s Homestead Rebate

The New Jersey Homestead Rebate is a financial assistance program designed to help homeowners in the state alleviate their property tax burden. For many residents, navigating the complexities of property tax can be a daunting task. This comprehensive guide will help you understand what the Homestead Rebate is, who qualifies, how to apply, and tips to ensure you maximize your savings.

What is the Homestead Rebate?

The Homestead Rebate is a program offered by the State of New Jersey that provides financial relief to homeowners by directly offsetting their property taxes. This rebate is designed specifically for primary residences and can significantly reduce the amount homeowners have to pay each year.

Eligibility Criteria

To qualify for the Homestead Rebate in New Jersey, you need to meet certain criteria:

- Homeowner Status: You must be the owner of the property and use it as your primary residence.

- Income Limits: Depending on the year and the specific program guidelines, there may be income limits. Generally, lower-income households qualify for more significant rebates.

- Property Tax Paid: You must have paid property taxes in the prior year to be eligible.

- Age and Disability: Seniors (age 65 or older) and disabled individuals may have additional benefits, including enhanced rebates.

How to Apply for the Homestead Rebate

Applying for the Homestead Rebate can be completed in just a few steps:

- Gather Required Documents: Make sure you have all necessary documentation, including proof of income, property tax statements, and identification.

- Complete the Application: You can obtain the application form online through the New Jersey Division of Taxation website or at your local tax office.

- Submit Your Application: Be mindful of the deadlines, typically set for June 30th each year for the preceding tax year. Submitting early ensures you don’t miss out on potential savings.

Understanding the Rebate Amount

The amount of the rebate generally depends on your property’s value, the amount of taxes you paid, and your income level. Rebates are calculated based on a percentage of what you paid in property taxes; thus, those who pay higher taxes generally receive a larger rebate. For low to moderate-income households, rebates can significantly offset their overall tax burden.

When to Expect Your Rebate

After your application is submitted, you may wonder when you will receive your rebate. Typically, recipients can expect to receive their rebates within a few months after the application deadline. It’s always wise to maintain a record of your application and any correspondence with the Division of Taxation.

Tips to Maximize Your Savings

Here are some tips to ensure you maximize your Homestead Rebate savings:

- Stay Informed: Keep abreast of changes to the Homestead Rebate program by regularly checking the New Jersey Division of Taxation website.

- Consult a Tax Professional: If you have a complex financial situation, consulting a tax professional can help you ensure you’re getting all available benefits.

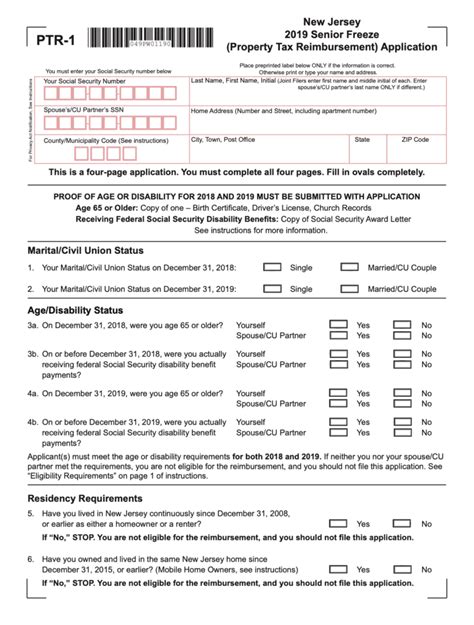

- Consider Additional Programs: In addition to the Homestead Rebate, explore other property tax relief programs that may be available in New Jersey, such as the Senior Freeze Program.

Conclusion

The New Jersey Homestead Rebate program offers significant savings opportunities for homeowners facing high property taxes. By understanding the eligibility criteria, application process, and how to maximize your rebate, you can alleviate some of the financial burdens associated with homeownership. It’s essential for homeowners to stay informed and proactive to ensure they benefit fully from this program.

FAQs

1. Can renters apply for the Homestead Rebate?

No, the Homestead Rebate is only available for homeowners who use their property as a principal residence.

2. What if I missed the application deadline?

If you miss the June 30th deadline, you will need to wait until the next application period to apply.

3. Is the Homestead Rebate income capped?

Yes, the rebate amount may vary based on your income level, and there are often income caps for eligibility.

4. Can I apply for the Homestead Rebate if I just purchased my home?

Yes, new homeowners can apply, provided they can demonstrate that they paid property taxes during the relevant year.

5. Where can I get more information about the Homestead Rebate?

For more details, visit the New Jersey Division of Taxation website or contact your local tax office.

This article provides a thorough overview of New Jersey’s Homestead Rebate program, featuring key information for homeowners looking to benefit from potential savings. The conclusion summarises the importance of the program, and the FAQs section addresses common inquiries effectively.

Download Homestead Rebate New Jersey