Living in Minnesota can be a dream for many, thanks to its beautiful landscapes and vibrant communities. However, for renters, managing the cost of living can sometimes feel overwhelming. Fortunately, the state of Minnesota offers a financial lifeline to qualified renters through its Renters Rebate program. This comprehensive guide will walk you through everything you need to know about the program—its eligibility criteria, application process, and tips to maximize your savings.

What is the Renters Rebate?

The Renters Rebate is a state-funded program designed to provide financial assistance to low- and moderate-income renters. It is aimed at helping individuals and families offset their housing costs, making living in Minnesota more affordable. This rebate can be significant, depending on your income and rent expenses, thus serving as an essential support for many households.

Eligibility Criteria

To qualify for the Minnesota Renters Rebate, applicants must meet specific criteria, which typically include:

- Residency: You must be a resident of Minnesota for at least part of the year in which you are applying.

- Income Limits: Your total income must be below certain thresholds, which may vary depending on your household size.

- Age Requirement: Generally, applicants must be 18 years or older.

- Rental Expenses: You must have paid rent during the year you are applying for the rebate.

How to Apply

Applying for the Renters Rebate can seem daunting, but the process is relatively straightforward. Here are the key steps:

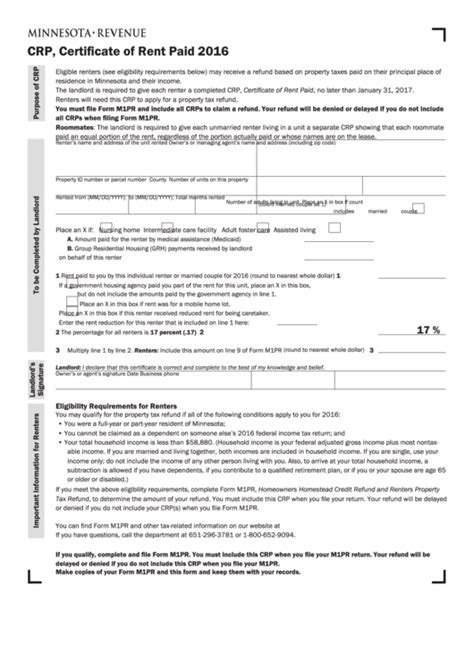

- Gather Documents: Collect necessary documents such as proof of income, rental agreements, and any other relevant paperwork.

- Complete the Application: You can find the Renters Rebate application on the Minnesota Department of Revenue website or obtain a paper form from their office.

- Submit Your Application: Applications can be submitted online or mailed to your local tax office. Ensure you pay attention to deadlines to avoid delays in processing your rebate.

What Information Do You Need?

When filling out the application, you will need to provide various details, including:

- Your personal information (name, address, Social Security number)

- Your landlord’s information and the rental amount paid

- Your total household income for the year

- Any additional information requested by the form

Maximizing Your Savings

Once you understand the eligibility criteria and application process, you can take steps to maximize potential savings:

- Keep Records: Maintain organized records of your rental payments and income to ensure you can substantiate your application easily.

- Explore Additional Programs: In addition to the Renters Rebate, consider looking into programs such as housing assistance or energy assistance programs that can further reduce your expenses.

- Consult Tax Professionals: If you have complicated tax situations or questions about your eligibility, don’t hesitate to seek professional advice.

Common Issues and Troubleshooting

During the application process, you may encounter a few common issues:

- Missing Information: Ensure that all relevant information is provided in your application to avoid delays.

- Income Calculation Confusion: Don’t hesitate to seek clarification if you’re unsure how to calculate your total household income.

- Application Deadlines: Always keep an eye on application deadlines and submit your forms as soon as possible.

Conclusion

The Minnesota Renters Rebate program offers significant financial assistance to eligible renters, making it easier for individuals and families to thrive in the North Star State. By understanding the criteria, application process, and ways to maximize your rebate, you can unlock important savings that may improve your overall quality of life. If you are a renter in Minnesota, be sure to take full advantage of this valuable resource!

FAQs

1. What is the maximum rebate amount I can receive?

The maximum rebate amount varies each year based on the state budget and is determined by your total income and rent expenses. You can check the Minnesota Department of Revenue website for the most current information.

2. Can I apply for the Renters Rebate if I receive subsidized housing?

No, typically, if you receive federal or state housing assistance, you may not be eligible for the Renters Rebate. Always consult the guidelines or a tax professional to clarify your specific situation.

3. When can I apply for the Renters Rebate?

The filing period usually opens on January 1 and closes on August 15 of the following year. It’s advisable to apply as early as possible to ensure your application is processed timely.

4. How long will it take to receive my rebate?

The processing time can vary, but typically, you can expect to receive your rebate within 8 to 12 weeks of your application being submitted. Monitor your application status on the Minnesota Department of Revenue website for updates.

Download File Renters Rebate Mn