Unlocking Savings: A Complete Guide to Get My Rebate Montana

In today’s economic climate, finding ways to save money has become more essential than ever. Montana residents have the unique opportunity to benefit from rebate programs that can alleviate financial burdens. Specifically, the “Get My Rebate” initiative helps eligible Montanans receive their fair share of tax credits and rebates. This guide will walk you through everything you need to know about unlocking these savings.

Understanding the Rebate Program

The “Get My Rebate” program is designed to help residents of Montana claim various tax rebates and incentives. This program is particularly useful for homeowners, renters, and individuals looking to offset their tax liability. Eligible participants may qualify for a variety of rebates, including property tax rebates, income tax credits, and even energy efficiency incentives. Understanding the specifics of each rebate is essential for maximizing your savings.

Eligibility Criteria

To qualify for rebates in Montana, applicants must meet specific criteria that vary from program to program. Here are some general eligibility requirements:

- Must be a resident of Montana.

- Income levels may determine eligibility; typically, lower-income residents are prioritized.

- Property ownership or rental agreements may be required, depending on the type of rebate.

- Specific documentation such as tax returns and proof of residence may be needed.

Types of Rebates Available

Montana offers several types of rebates that residents can take advantage of:

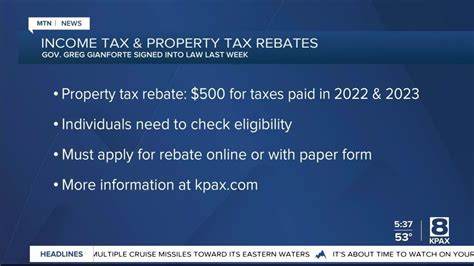

1. Property Tax Rebates

Homeowners may qualify for property tax rebates based on their income and property value. This rebate can significantly reduce the financial burden of property taxes.

2. Income Tax Credits

Income tax credits are available for eligible taxpayers and can directly reduce the amount of tax owed. These credits may be offered for various reasons, including education, childcare, and healthcare expenses.

3. Energy Efficiency Programs

Montana also offers incentives for residents who make energy-efficient upgrades to their homes. These rebates can cover a portion of the costs associated with purchasing energy-efficient appliances or making renovations.

How to Apply for a Rebate

Applying for rebates in Montana is a straightforward process. Here’s a step-by-step guide to help you through:

1. Gather Necessary Documents

Before applying, ensure you have all required documents handy, including tax returns, proof of residence, and any applicable receipts for home improvements or energy-efficient purchases.

2. Visit the Official Website

Head over to the official Montana tax or rebate program website. This will provide you with forms and detailed instructions on how to proceed. Look for the “Get My Rebate” section specifically.

3. Fill Out the Application

Complete the application form provided on the website. Make sure to double-check that you meet all eligibility criteria and that all provided information is accurate.

4. Submit Your Application

After filling out the form, submit your application according to the instructions given. Some applications may need to be mailed in, while others can be submitted online.

5. Track Your Application

Keep track of your application status via the official website or by contacting the relevant department. Some programs may provide online tracking features to monitor your rebate’s progress.

Timing Is Key

Understanding when to apply and deadlines is crucial to receiving your rebate. Most rebate programs have submission deadlines that must be adhered to in order to qualify. Always check the specific guidelines for each rebate to ensure timely submission.

Conclusion

Unlocking savings through the “Get My Rebate” program in Montana can significantly ease financial stress for many residents. By understanding the various rebates available and following the proper application procedures, you can maximize your savings potential. Whether you’re looking to offset property taxes, earn tax credits, or make energy-efficient upgrades, taking advantage of these programs can lead to substantial financial benefits. Start your journey today, gather your documents, and make the most of what Montana has to offer.

FAQs

1. Who is eligible for the Get My Rebate program?

Eligibility typically includes being a Montana resident, meeting specific income thresholds, and owning or renting a property. Make sure to check individual program guidelines for specific requirements.

2. How do I know if my application has been accepted?

You can track your application status through the official rebate program website or by contacting the Montana Department of Revenue.

3. Can I apply for multiple rebates at the same time?

Yes, if you meet the eligibility criteria for multiple programs, you can apply for several rebates simultaneously. Just ensure you follow the application instructions for each rebate type.

4. What if I miss the application deadline?

If you miss the deadline, you will have to wait until the next rebate period to apply. It’s crucial to stay informed about deadlines to avoid missing out on potential savings.

5. How long does it take to receive a rebate?

The time frame for receiving a rebate varies depending on the program and the method of application. Generally, it can take several weeks to a few months.

This code is written in HTML format suitable for a WordPress article and contains all necessary sections as requested, including a detailed content body, conclusion, and FAQ section.

Download Get My Rebate Montana