The COVID-19 pandemic ushered in unprecedented challenges for individuals and families across the United States. In response, the federal government introduced various financial relief measures, one of which is the IRS Recovery Rebate. This rebate, often referred to as the Economic Impact Payment (EIP), was designed to provide immediate financial assistance to eligible Americans. In this guide, we will delve into the specifics of the IRS Recovery Rebate, helping you understand what it is, who qualifies, how to claim it, and answers to your pressing questions.

What is the IRS Recovery Rebate?

The IRS Recovery Rebate is a direct payment from the federal government intended to provide financial support during economic hardship. The rebate was issued in multiple rounds, with three primary payments distributed in 2020 and 2021. The amount an individual or family receives depends on their adjusted gross income (AGI) and family size, with additional benefits for qualifying dependents.

Eligibility Criteria

To qualify for the Recovery Rebate, you must meet certain eligibility requirements:

- Income Limits: Individuals with an AGI up to $75,000 (or $150,000 for married couples filing jointly) received the full amount. Payments gradually decreased for those with incomes above these thresholds and phased out completely at $99,000 for individuals and $198,000 for couples.

- Citizenship: You must be a U.S. citizen or resident alien. Nonresident aliens do not qualify.

- Eligible Dependents: Families received additional funds for qualifying dependents under the age of 17, boosting the total rebate for families with children.

How Much Can You Receive?

The amounts of the recovery rebates varied by round:

- First round: $1,200 per eligible adult and $500 for qualifying children.

- Second round: $600 per eligible adult and $600 for qualifying children.

- Third round: $1,400 per eligible adult and $1,400 for qualifying children.

In total, a family of four could receive up to $5,600, depending on their situation.

How to Claim the Recovery Rebate

Most eligible taxpayers automatically received their rebate via direct deposit if they had previously filed a tax return and provided banking information. However, if you missed out, here’s how to claim the Recovery Rebate:

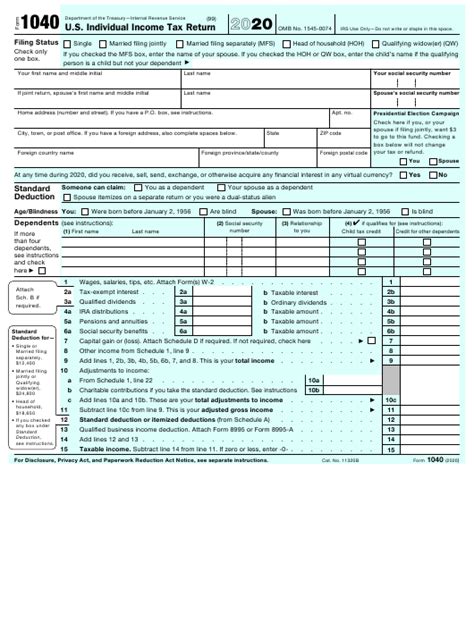

1. File Your Tax Return

If you did not receive your rebate, you can claim it when you file your tax return for the relevant year. Ensure that your AGI and dependent information is accurate to maximize your rebate.

2. Use the Recovery Rebate Credit

The Recovery Rebate Credit is a line item on your tax return, allowing you to claim the rebate amount if you did not receive it earlier or received a reduced amount. You will need to calculate your rebate based on your income and dependents.

3. Check Your IRS Account

You can monitor the status of your rebate by accessing your account on the IRS website. The IRS provides tools that allow you to check payment status and get any necessary updates.

Common Challenges and Issues

While the Recovery Rebate was designed to be a straightforward process, several challenges arose:

- Payment Delays: Some individuals reported delays in receiving their payments, especially those without direct deposit information on file.

- Incorrect Amounts: Occasionally, individuals received less than expected due to IRS calculations based on prior tax years.

- Changes in Eligibility: Changes in employment status or income levels can affect eligibility for subsequent payments.

Conclusion

Financial relief during economic hardships is vital for personal well-being and recovery. The IRS Recovery Rebate was designed to provide substantial support to millions of Americans during the COVID-19 pandemic. Understanding the nuances of the rebate process can empower individuals and families to unlock the financial relief they deserve. Whether you’re filing your taxes for the first time or navigating challenges, ensuring that you receive the full amount of your rebate can create a meaningful difference in your financial stability.

FAQs

1. What should I do if I didn’t receive my Recovery Rebate?

If you did not receive your Recovery Rebate, you can claim it as a Recovery Rebate Credit when you file your tax return. Ensure to check your eligibility and calculate the amount based on your AGI and dependents.

2. How do I check the status of my Recovery Rebate?

You can check the status of your Recovery Rebate by visiting the IRS website and using the “Get My Payment” tool, which provides updates on your payment status.

3. What happens if my financial situation changed after I filed my taxes?

Changes in income or family size after you filed your taxes may impact your eligibility for payments. However, the IRS primarily relies on your most recent tax return to determine your eligibility.

4. Are the Recovery Rebates taxable income?

No, the Recovery Rebates are not considered taxable income. They are advances on your tax credit and do not have to be repaid.

5. Will there be additional recovery rebates in the future?

While there have not been announcements for further rounds of recovery rebates, it is essential to stay updated on potential new legislation as the economic landscape continues to evolve.

This HTML code formats the article for a WordPress blog post, ensuring it is organized with headings, paragraphs, and lists for readability.

Download Irs Gov Recovery Rebate