In recent years, electric vehicles (EVs) have gained popularity not just for their ecological benefits but also for the many financial incentives available to consumers. One of the most compelling reasons to consider purchasing an electric car is the federal rebate. This guide will walk you through the various federal rebates for electric cars, how to qualify for them, and the potential savings you can unlock.

Understanding Federal Rebates for Electric Cars

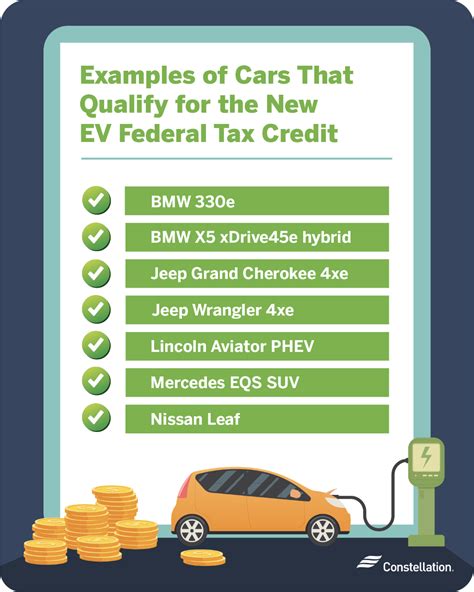

The federal government offers a tax credit for qualifying electric vehicles, designed to encourage the adoption of cleaner technologies. This credit can significantly offset the initial purchase price of an EV, making it a more attractive option for budget-conscious consumers.

The federal rebate can be up to $7,500, but the exact amount depends on several factors, including the make and model of the vehicle, the manufacturer’s sales volume, and whether the vehicle is purchased or leased.

Eligibility Criteria for Federal Rebates

To be eligible for the federal tax credit, EVs must meet specific criteria:

- Vehicle Type: The vehicle must be an all-electric or plug-in hybrid vehicle. The IRS provides a list of eligible vehicles that you can find on their official website.

- Purchase Dates: The vehicle must be purchased after a specific date to qualify for the rebate. Keep an eye on legislation changes that may affect eligibility.

- Manufacturer Limits: Some manufacturers have reached the total limit of tax credits available for their models. When an automaker sells 200,000 eligible vehicles, the tax credit may be phased out for that manufacturer.

How to Apply for the Federal Electric Car Rebate

Applying for the federal rebate is straightforward, but it requires some paperwork:

- Purchase Your Vehicle: First, you need to purchase a qualifying electric vehicle. Ensure that you get the correct documentation, including the Vehicle Identification Number (VIN).

- Complete IRS Form 8834: When filing your taxes, you’ll need to complete IRS Form 8834, which is specifically for the qualified plug-in electric and certain hybrid vehicles.

- Submit with Your Tax Return: Attach Form 8834 to your tax return and submit it. The credit will be subtracted from the tax you owe, potentially resulting in a significant refund or reduced tax liability.

State Incentives and Additional Savings

In addition to federal rebates, many states offer their own incentives for electric vehicle purchases. These can include tax credits, rebates, or even exemptions from sales tax. The combination of federal and state incentives can greatly enhance your total savings.

It’s essential to research your specific state’s programs, as these can vary widely. Some states even offer benefits such as access to carpool lanes, waivers on registration fees, or help with charging infrastructure installation.

Conclusion

Investing in an electric vehicle is not just an environmentally responsible choice; it’s also a financially savvy one. By taking advantage of federal rebates and state incentives, you can significantly reduce the overall cost of owning an electric car. The landscape for electric vehicles is changing rapidly, with new models and incentives constantly emerging. Staying informed will help you make the most of the savings available to you. As you consider this choice, evaluate both the initial purchase and long-term benefits such as lower fuel and maintenance costs.

FAQs

1. How much is the federal rebate for electric cars?

The federal rebate can be up to $7,500, depending on the make and model of the vehicle and the manufacturer’s sales volume.

2. How do I know if my vehicle qualifies for the rebate?

You can check the IRS website or consult the dealer to see if the exact model you’re considering is eligible for the federal tax credit.

3. Can I claim the rebate if I lease an electric vehicle?

Yes, you can still qualify for the federal tax credit if you lease an eligible vehicle, but the credit typically goes to the leasing company, which may pass some of the savings to you.

4. Are federal rebates the only incentives available for electric vehicles?

No, state and local governments may offer additional incentives like tax credits, rebates, or even grants for installing home charging stations.

5. Is the federal rebate a one-time offer, or can I claim it every year?

The federal tax credit is a one-time offer per vehicle. However, you can claim it for new vehicles only; used electric vehicles may have different rules.

Feel free to modify or expand upon this as needed!

Download Federal Rebate For Electric Cars