Unlock Savings: Understanding Federal Rebates for Solar Panel Installation

As the world increasingly shifts towards sustainable energy solutions, solar power has emerged as a popular choice for homeowners and businesses alike. One of the most attractive aspects of solar energy is the potential for significant savings, especially when considering federal rebates and incentives. Understanding these benefits can help you make an informed decision about installing solar panels and ultimately lowering your energy costs.

What Are Federal Rebates for Solar Panel Installation?

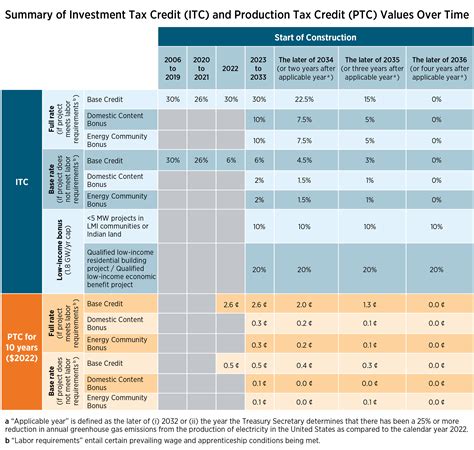

Federal rebates for solar panel installation are financial incentives provided by the government to encourage the adoption of renewable energy technologies. These rebates can significantly reduce the upfront costs of purchasing and installing solar panels, making it more feasible for many to switch to this clean energy source. The primary federal incentive currently available is the Investment Tax Credit (ITC).

Understanding the Investment Tax Credit (ITC)

The Investment Tax Credit allows homeowners to deduct a percentage of their solar installation costs from their federal taxes. As of 2023, the ITC is set at 30% for solar panel installations. This means that if you install a solar system that costs $20,000, you could potentially receive a tax credit of $6,000.

Eligibility Criteria for the ITC

To qualify for the ITC, a few criteria must be met:

- The solar panel system must be installed on a residential or commercial property in the United States.

- Ownership of the solar system is required; leased systems typically do not qualify.

- The installation must be completed before the credit is claimed on your tax return.

- Systems installed in the future may be eligible depending on program changes and extensions.

Other Federal Incentives and Programs

Beyond the ITC, there are several other federal initiatives designed to promote solar energy. These can vary based on state and local regulations but often include:

- Grants and rebates: Some federal agencies offer grants to assist with installation costs or rebates for energy efficiency improvements.

- Low-interest loans: Programs may assist homeowners in financing solar projects with favorable loan terms.

- Net metering: While not a federal program, many states have policies that allow you to sell excess energy back to the grid, further offsetting costs.

The Process of Claiming Federal Rebates

To take advantage of federal rebates like the ITC, follow these steps:

- Research and select a reliable solar provider: Make sure the company you choose is reputable and experienced in the solar industry.

- Get an installation estimate: The provider will assess your property and give you an estimate, including the potential financial savings through rebates and tax credits.

- Finalize your installation: Once you decide to proceed, the provider will handle the installation of your solar system.

- File your taxes: When filing your federal taxes, make sure to include IRS Form 5695 to claim the ITC. Your solar provider can provide documentation needed for this.

The Cost-Benefit Analysis of Solar Energy

Many potential solar adopters are concerned about the high initial costs. However, solar energy often pays off in the long run. After factoring in federal rebates, state incentives, and ongoing savings on electricity bills, the average return on investment (ROI) can be quite favorable. A comprehensive cost-benefit analysis should include:

- Upfront costs: Estimate how much you’ll pay for the solar system and installation.

- Rebates and credits: Calculate all applicable federal and state rebates.

- Long-term savings: Consider electricity bill savings over the lifespan of the solar panels, typically around 25 to 30 years.

- Increased property value: Solar installations can enhance your home’s market value.

Conclusion

Understanding federal rebates for solar panel installation is crucial for homeowners looking to reduce energy costs and take advantage of renewable energy. The Investment Tax Credit (ITC) in particular can provide substantial financial benefits, lowering the overall costs and improving accessibility. By carefully researching options and filing the necessary paperwork for credits, individuals can “unlock” savings and contribute to a sustainable future.

FAQs

1. How long do the federal solar rebates last?

The ITC is currently available until 2032, subject to changes in legislation. Keep an eye on the policy updates that may affect the future availability of these rebates.

2. Can I claim the ITC if I finance my solar panel system?

Yes, you can claim the ITC regardless of whether you pay for your solar installation upfront or through financing, as long as you own the system.

3. Are there state-specific rebates for solar installations?

Yes, many states offer additional rebates and incentives for solar installation, which can further reduce your costs. Check your state’s energy office for details.

4. What happens if I sell my house before fully benefiting from the ITC?

If you sell your home, the new owner can benefit from any rebates associated with the solar system that you installed. However, tax credits need to be claimed in the year they are earned.

5. How can I find a reputable solar installer?

Research online reviews, ask for referrals from friends or family, and consult databases like the Solar Energy Industries Association (SEIA) for qualified installers in your area.

This article provides a comprehensive overview of federal rebates for solar panel installation, including key benefits, eligibility, and important FAQs, formatted in HTML for use in WordPress.

Download Federal Rebates For Solar Panels