In recent years, the push for environmentally friendly vehicles has led to a remarkable surge in the popularity of hybrid cars. They offer a happy compromise between traditional gasoline-powered vehicles and fully electric alternatives, providing increased fuel efficiency and reduced emissions. But beyond their environmental benefits, one of the most intriguing aspects of hybrid cars is the potential financial savings they can unlock through federal rebates. This article delves into how these rebates work, their impact on your budget, and why you should consider making the switch to a hybrid vehicle.

The Allure of Hybrid Cars

Hybrid cars combine a conventional internal combustion engine with an electric propulsion system. This technology allows for better fuel economy, reduced greenhouse gas emissions, and a decreased reliance on fossil fuels. As consumers become increasingly aware of the environmental impact of their vehicle choices, hybrid cars have emerged as a practical solution that aligns with sustainability goals without sacrificing convenience.

Understanding Federal Rebates

In an effort to promote the adoption of fuel-efficient vehicles, the U.S. government offers various federal rebate programs for hybrid car buyers. These incentives are designed to offset the higher upfront costs typically associated with hybrid vehicles, making them more accessible to budget-conscious consumers.

Types of Federal Rebates

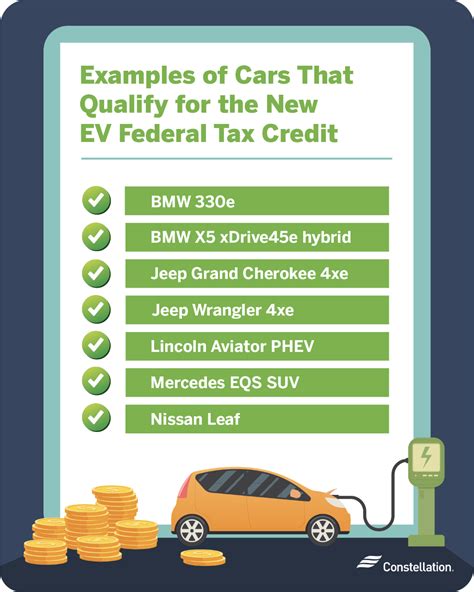

The most well-known federal rebate for hybrid cars is the Electric Vehicle (EV) Tax Credit. As part of the energy policy set forth in the 2005 Energy Policy Act, buyers of qualified hybrid vehicles can receive a tax credit that reduces their tax liability. The amount of the credit can vary based on the make and model of the car, but it can be as much as $7,500. It’s crucial to verify whether the hybrid vehicle you’re considering qualifies for this incentive.

Budget-Friendly Benefits

The financial savings from federal rebates can significantly alleviate the initial cost of purchasing a hybrid vehicle. Let’s break down how these savings can enhance your budget:

Lower Initial Investment

The most obvious benefit of federal rebates is the immediate reduction in the purchase price of your new hybrid car. Taking advantage of the EV tax credit can make a hybrid model more competitive with traditional gasoline vehicles, ensuring you don’t have to stretch your budget too far.

Fuel Savings

Apart from the upfront savings, hybrid cars typically offer lower fuel costs over time. With better fuel economy ratings than their gas-only counterparts, hybrid vehicles can save drivers hundreds of dollars each year on gas. The combination of lighter fuel consumption and the electric assistance means you spend less time—and money—at the pump.

Reduced Maintenance Costs

Hybrid cars generally require less maintenance than conventional vehicles. They have fewer moving parts, and their regenerative braking system reduces wear on the brake components. This longevity can result in significant savings over the lifespan of the vehicle, freeing up funds for other budget needs.

Environmental Impact and Other Perks

Beyond the financial advantages, switching to a hybrid vehicle contributes to the reduction of your carbon footprint. With lower emissions, you can feel good about making a choice that is less harmful to the environment.

Additionally, many states offer further incentives for hybrid vehicle owners, such as rebates, tax credits, or even exemptions from emissions testing. Taking advantage of these local incentives, when combined with federal rebates, can create even more significant savings.

Making the Switch

As market options expand, more automakers are including hybrid versions of popular models. This increases competition and can lead to lower prices as manufacturers try to entice buyers. This abundance of choices means that potential hybrid car buyers can find a vehicle that suits their specific needs and budget.

Conclusion

In conclusion, federal rebates for hybrid cars are an excellent opportunity for consumers looking to maximize their budget while making eco-friendly choices. The combination of tax credits, fuel savings, and reduced maintenance costs creates a compelling case for switching to a hybrid vehicle. As more options become available in the market, it is worth considering how adopting a hybrid car could benefit both your wallet and the environment.

FAQs

- 1. What exactly is the federal tax credit for hybrid vehicles?

- The federal tax credit for hybrid vehicles varies depending on the make and model of the car. Generally, it can provide a tax reduction of up to $7,500 for qualified vehicles.

- 2. How can I find out if a specific hybrid vehicle qualifies for the rebate?

- You can check the IRS website or consult with your tax advisor to confirm eligibility for the rebate based on the vehicle’s VIN (Vehicle Identification Number).

- 3. Are there state-level incentives available for hybrid car buyers?

- Yes, many states offer additional rebates, tax credits, or benefits such as reduced registration fees for hybrid vehicles. Always check with your local Department of Motor Vehicles or environmental agency for details.

- 4. Are hybrid cars more fuel-efficient than traditional vehicles?

- Yes, hybrid cars typically have better fuel economy than traditional gasoline-powered vehicles, helping you save money over time on fuel expenses.

- 5. What should I consider when purchasing a hybrid car?

- When purchasing a hybrid car, consider factors like total cost of ownership, eligibility for federal and state incentives, available charging infrastructure, and your driving habits.

Download Federal Rebate For Hybrid Cars