Unlock Savings: Discover the My Path Property Tax Rebate Program

Every homeowner dreams of finding ways to reduce their expenses, especially when it comes to property taxes. The burden of high property taxes can add significant financial strain to households, making homeownership less affordable. Fortunately, programs like the My Path Property Tax Rebate Program are designed to alleviate some of this burden and help homeowners reclaim their finances.

What is the My Path Property Tax Rebate Program?

The My Path Property Tax Rebate Program is an initiative aimed at assisting homeowners in receiving a rebate on property taxes paid. This program provides financial relief, especially to those who may find it challenging to keep up with rising property tax rates. By applying for this rebate, homeowners can unlock essential savings that can be redirected toward other pressing financial needs.

Who is Eligible?

The My Path Property Tax Rebate Program has specific eligibility requirements that must be met to qualify for benefits. Generally, the program is designed for:

- Homeowners who reside in their primary residence.

- Individuals who meet certain income criteria.

- Residents who have paid their property taxes in full and on time.

- Homeowners within specified age limits, often focusing on seniors or disabled individuals.

How to Apply

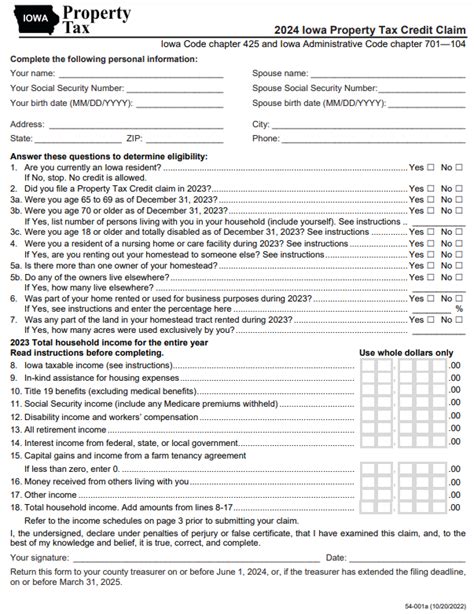

Applying for the My Path Property Tax Rebate Program is straightforward, but it does require some documentation. Follow these steps to apply:

- Gather Required Documentation: You’ll need proof of residency, income statements, and any other relevant financial documents.

- Visit the Official Website: Start your application by visiting your local government’s website dedicated to property tax rebates.

- Fill Out the Application Form: Complete the application form with accurate information. Be sure to double-check your entries to avoid potential delays.

- Submit Your Application: After completing the form, submit it along with your required documentation. Be mindful of application deadlines to ensure you’re considered.

- Await Confirmation: Once submitted, you will receive confirmation of your application status. If approved, expect details regarding your rebate amount and disbursement date.

Benefits of the My Path Property Tax Rebate Program

Participating in the My Path Property Tax Rebate Program offers numerous benefits:

- Financial Relief: The most significant advantage is the monetary savings that can substantially lower your property tax burden.

- Affordability: With lowered property taxes, homeowners can better manage their finances, making homeownership more sustainable.

- Encouragement for Community Residents: Programs like this promote community growth, attracting new residents and helping individuals remain in their homes.

- Increased Awareness: By participating in such programs, homeowners become more aware of available financial assistance, ensuring they don’t overlook other beneficial resources.

Common Misconceptions

Despite the clear benefits, several misconceptions surround the My Path Property Tax Rebate Program. Let’s address a few:

- It’s Only for Seniors: While the program may prioritize seniors, many other homeowners can qualify. Always check the eligibility criteria.

- It’s Complicated to Apply: While it requires documentation, the application process is designed to be user-friendly.

- Rebates Are Small: Many homeowners are pleasantly surprised by the amount they can receive, which might far exceed initial expectations.

Conclusion

The My Path Property Tax Rebate Program serves as a vital resource for homeowners looking to mitigate the financial pressures associated with property taxes. By understanding the program’s eligibility, application process, and potential benefits, homeowners can unlock substantial savings that contribute to their long-term financial stability. As real estate prices and taxes continue to rise, programs like this are essential to ensure affordable homeownership remains a reality for many.

FAQs

1. How long does it take to receive the rebate after application?

The time frame can vary based on the local government’s processing times, but most homeowners receive their rebate within a few weeks to a few months after approval.

2. Can I still apply if I’ve missed the deadline?

Application deadlines are strict; however, some jurisdictions may allow late applications under special circumstances. Check with your local office for details.

3. What happens if my application is denied?

If your application is denied, you will receive a notice explaining the reasons. You often have the opportunity to appeal the decision or rectify any issues.

4. Is there an income limit to qualify for the rebate?

Yes, the program often has income limits that vary by state or municipality. Always check the specific thresholds to determine your eligibility.

5. Can I apply for multiple years’ rebates?

Typically, rebates are issued on an annual basis. However, some programs may allow for retroactive claims in certain situations, so it’s advisable to verify with your local authority.

This HTML format provides a structured article with headings and sections, ensuring it can be easily read and navigated when published on WordPress.

Download My Path Property Tax Rebate