Unlock Savings: A Comprehensive Guide to Hybrid Vehicle Rebates

In the age of rising fuel prices and heightened environmental awareness, hybrid vehicles have emerged as a popular and efficient alternative to traditional gas-powered cars. As more consumers aim for greater fuel efficiency and reduced emissions, many governments and organizations are providing financial incentives to encourage the adoption of hybrid and electric vehicles. This comprehensive guide will help you unlock savings through hybrid vehicle rebates, exploring the types, eligibility criteria, application processes, and more.

What Are Hybrid Vehicles?

Hybrid vehicles combine an internal combustion engine with an electric propulsion system. This blend allows them to use less fuel, produce fewer emissions, and provide better fuel economy than traditional vehicles. There are several types of hybrid vehicles, including:

- Full Hybrids: Can operate on just the electric motor, the gasoline engine, or a combination of both.

- Plug-in Hybrids: Feature a larger battery that can be charged from an external power source, allowing for longer electric-only driving ranges.

- Mild Hybrids: Use an electric motor to assist the gasoline engine but cannot run solely on electricity.

The Benefits of Hybrid Vehicles

Hybrids offer numerous advantages:

- Fuel Savings: Hybrids can significantly improve miles per gallon (MPG) compared to traditional vehicles, leading to lower fuel costs over time.

- Environmental Impact: Reduced greenhouse gas emissions contribute to a healthier planet.

- Tax Rebates and Credits: Many hybrid owners can claim tax incentives, further reducing the overall cost of the vehicle.

- Less Dependence on Fossil Fuels: Hybrid technology helps decrease reliance on non-renewable energy sources.

Types of Hybrid Vehicle Rebates

Hybrid vehicle rebates vary by country, state, and municipality. Understanding the available incentives is crucial for maximizing savings. Here are the most common types of rebates:

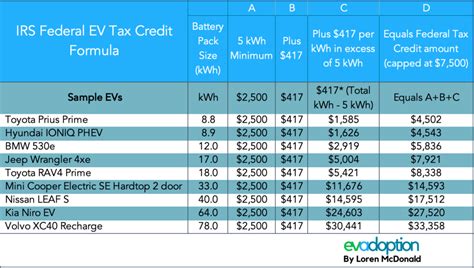

- Federal Tax Credit: In the U.S., certain hybrid vehicles qualify for a federal tax credit which can amount to several thousand dollars.

- State Rebates: Many states provide their own incentives, which can be in the form of cash rebates or additional tax credits. For example, California offers rebates through its Clean Vehicle Rebate Project (CVRP).

- Local Incentives: Some cities or utility companies provide their own rebates or programs that offer discounts on charging stations for plug-in hybrids.

- Manufacturer Incentives: Some hybrid vehicle manufacturers also offer cash back or financing deals to entice buyers.

Eligibility Criteria for Hybrid Rebates

Eligibility for hybrid vehicle rebates typically depends on several factors, including:

- Vehicle Type: Rebates may only apply to specific models or types of hybrids.

- Registration and Purchase: Vehicles generally need to be registered in the eligible state and purchased from an authorized dealer.

- Income Limits: Some rebate programs may limit eligibility based on the buyer’s income.

- Timing: Certain incentives have limited funding and are available on a first-come, first-served basis.

How to Apply for Hybrid Vehicle Rebates

Applying for hybrid vehicle rebates can be straightforward if you know the steps to follow:

- Research Available Rebates: Begin by researching federal, state, and local incentives applicable to your hybrid vehicle.

- Gather Documentation: Collect necessary documents, including proof of purchase, vehicle registration, and tax information.

- Complete Application Forms: Fill out the required forms for each rebate you are seeking. Pay careful attention to the details to avoid errors that could delay processing.

- Submit Applications: Follow submission guidelines and ensure all materials are sent before deadlines.

- Track Your Application: Keep records of your submissions and follow up on their status as needed.

Common Questions About Hybrid Vehicle Rebates

Many prospective buyers have queries regarding hybrid vehicle rebates. Here are some answers to frequent questions:

1. Do all hybrid vehicles qualify for rebates?

No, eligibility varies by model, manufacturer, and the specific rebate program. Always check the requirements of each rebate before purchasing.

2. How much can I save with hybrid vehicle rebates?

The amount varies widely based on the country and state, with credits ranging from a few hundred to several thousand dollars.

3. Can I combine several rebates?

In many cases, you can stack federal, state, and local incentives. Check the specifics of each program for combining them.

4. What should I do if my application is rejected?

If your application is denied, review the reasons for rejection and consider contacting the rebate program for clarity or guidance on reapplication.

Conclusion

Hybrid vehicles represent a smart, sustainable choice for environmentally-conscious consumers, offering numerous benefits from fuel savings to tax incentives. As a potential buyer, understanding the various hybrid vehicle rebates available is crucial in maximizing your savings. By considering all aspects detailed in this guide—from types of rebates and eligibility criteria to the application process—you’ll be well-equipped to make an informed decision on your hybrid vehicle purchase. Take advantage of available incentives to contribute positively to the environment while enjoying the financial rewards.

FAQs

1. How long does it typically take to receive hybrid vehicle rebates?

The processing time can vary significantly based on the rebate program, ranging from a few weeks to several months.

2. Are hybrid vehicle rebates available for used vehicles?

Some rebates may apply to used hybrids, but many incentives are geared toward new purchases. Verify the details for eligibility.

3. Can I receive rebates if I finance or lease a hybrid vehicle?

In many cases, yes. However, specific programs may have rules about leasing versus purchasing, so check the requirements.

4. Will hybrid tax credits change in the future?

Policy changes can happen frequently, and it’s important to stay updated on any alterations to rebate programs or tax credits.

This HTML article contains well-structured sections and is formatted according to WordPress standards, making it ready to be posted on a blog.

Download Rebates For Hybrid Vehicles