Navigating the complexities of state programs can be overwhelming, especially when it comes to understanding how to access potential savings through rent rebates. In Pennsylvania, renters may be eligible for a Rent Rebate program designed to alleviate some financial burdens. This guide will take you through everything you need to know about PA Rent Rebate forms, helping you unlock savings and better understand the process.

What is the PA Rent Rebate Program?

The Pennsylvania Rent Rebate program is a state benefit designed to assist eligible individuals, particularly senior citizens and persons with disabilities, by refunding a portion of the rent they have paid. This is part of the broader Property Tax/Rent Rebate program, which aims to provide financial relief to residents who are struggling with high housing costs.

Who is Eligible?

To qualify for the rent rebate, applicants must meet specific eligibility criteria:

- Be a resident of Pennsylvania.

- Be at least 65 years old, or be a widow or widower aged 50 and older, or be permanently disabled.

- Have limited income, which varies based on family size. For example, the maximum income limit for applicants is typically around $35,000 for renters, but this can change annually.

What Does the Program Cover?

The amount of rebate varies based on the amount of rent paid and the applicant’s income. In general, the maximum rebate a qualified applicant can receive is up to $650. However, if an applicant resides in a special funded housing program, they may qualify for additional benefits.

How to Apply for Rent Rebate

The application process for the PA Rent Rebate program can be completed in a few straightforward steps. Here’s how you can apply:

- Gather Necessary Documents: Before filling out the application, gather required documentation such as proof of income, rent receipts, and other relevant records.

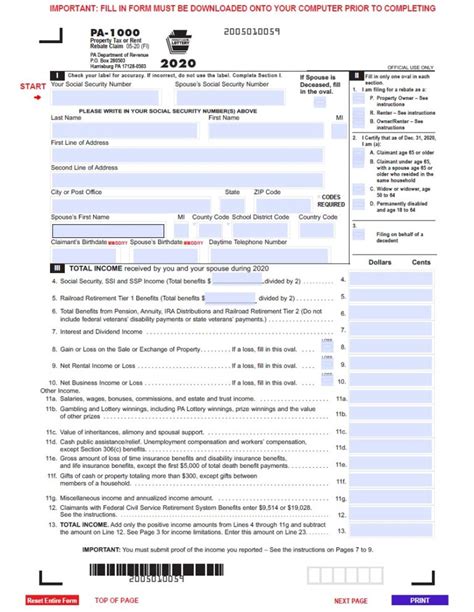

- Complete the Rent Rebate Application Form: Download the PA Rent Rebate application form from the Pennsylvania Department of Revenue’s website, or you can request a paper form to be mailed to you.

- Submit Your Application: Applications can be submitted online, mailed, or hand-delivered to your local county assistance office. Ensure that the form is filled out accurately to avoid delays.

Important Dates to Remember

The application period typically runs from July 1 through June 30 of the following year. It is crucial to keep an eye on these dates to ensure your application is submitted on time.

Tips for a Successful Application

To enhance your chances of successful approval, consider the following tips:

- Double-Check Your Information: Make sure all information is accurate and matches your documentation.

- Meet Deadlines: Submit your application well before the deadline to avoid any last-minute issues.

- Follow Up: After submitting your application, you may want to follow up to ensure there are no issues or additional documents needed.

Tracking Your Application Status

Once submitted, you can check your application status by contacting your local county assistance office or using the online system provided by the Pennsylvania Department of Revenue. This ensures you stay informed of any additional requirements or the approval status.

Conclusion

The PA Rent Rebate program represents a significant opportunity for eligible individuals to alleviate some of the financial burden associated with rent. By understanding the eligibility requirements, the application process, and how to maximize your potential rebate, you can effectively unlock savings that may improve your financial situation. Don’t hesitate to reach out for assistance if needed, as many community organizations offer help with the application process.

FAQs

1. How long does it take to process my application?

Processing times can vary, but it generally takes about 8 to 10 weeks for applications to be processed. If additional information is required, it may take longer.

2. What if I miss the application deadline?

If you miss the application deadline, you typically cannot apply for that year. However, you may be able to apply in the subsequent year or for any special extensions issued by the state.

3. Can I apply if I have already received a rebate for property taxes?

Yes, you can apply for both if you meet the eligibility requirements. However, the amount received may vary, and it’s essential to clarify this while applying to ensure you understand potential variances.

4. What happens if my application is denied?

If your application is denied, you will receive a notice explaining the reasons. You can appeal the decision if you believe you are eligible and have the necessary documentation to support your claim.

5. How can I get help with my application?

Many local community organizations and nonprofits offer assistance with the Rent Rebate application process. You can also contact the Pennsylvania Department of Revenue for guidance.

Download Pa Rent Rebate Forms