The New York State School Tax Relief (STAR) program is an essential initiative designed to provide property tax relief to homeowners. In 2025, the program continues to be a crucial source of assistance, especially in an era of rising property values and education funding needs. This article delves into the specifics of the STAR program, highlighting its benefits, eligibility criteria, and application process, while also offering insights into how it can positively impact your financial situation.

What is the NYS STAR Rebate?

The STAR program provides New York State homeowners with favorable tax exemptions on their school property taxes. It comes in two forms: Basic STAR and Enhanced STAR. Basic STAR is available to most homeowners, while Enhanced STAR is reserved for senior citizens who meet specific income requirements. These rebates can significantly reduce the financial burden of property taxes, allowing homeowners to allocate their resources more effectively.

Benefits of the NYS STAR Rebate

The primary benefit of the STAR rebate lies in the reduction of school tax burden. By lowering the taxable value of properties, homeowners can enjoy substantial annual savings. Furthermore, the STAR rebate is adaptable; as property values increase, the program aims to maintain a level of financial relief that keeps pace with economic changes.

Annual Savings

The exact savings can vary, but on average, homeowners can expect to save several hundred to over a thousand dollars each year. For example, in 2025, Basic STAR provides a property tax exemption of up to $30,000, while Enhanced STAR expands that relief to seniors, granting an exemption of up to $65,000, contingent upon their income levels.

Community Impact

The STAR program also contributes positively to local economies. By providing homeowners with tax relief, particularly in areas with high property taxes, the program helps stimulate spending in local businesses and improves community investment. In this way, STAR aids not only individual homeowners but also supports broader local economic development.

Eligibility Criteria

Understanding eligibility is crucial to ensure that you can take full advantage of the STAR program. Here are the primary criteria:

Basic STAR Eligibility

- You must own your home and use it as your primary residence.

- Your total annual income must be less than $500,000.

- New applicants must apply by March 1 to receive the exemption in the current tax year.

Enhanced STAR Eligibility

- You must be at least 65 years old by December 31 of the tax year.

- You must own your home and use it as your primary residence.

- Your income must be less than the threshold set by the state (in 2025, the income limit is $58,399).

- As with Basic STAR, applications must be submitted by March 1.

Application Process

Applying for the STAR rebate is a straightforward process. Here’s a step-by-step guide:

1. Gather Necessary Documentation

Before you begin the application, collect relevant documents, including proof of income, property deed, and any other pertinent information that substantiates your eligibility.

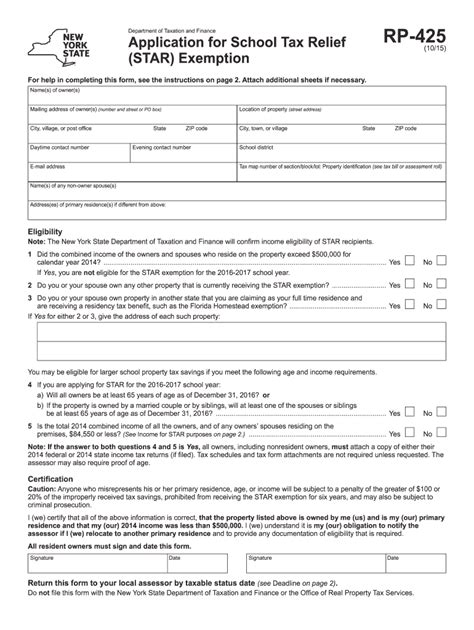

2. Complete the Application Form

Applicants must fill out the STAR application form available on the New York State Department of Taxation and Finance website. Specifically, ensure that you select the correct form based on whether you’re applying for Basic or Enhanced STAR.

3. Submit the Application

Once completed, submit your application by the designated deadline (March 1). You can do this online or by mailing a hard copy.

4. Confirmation

You will receive confirmation from your local assessors regarding your application’s acceptance or further requirements.

Key Points to Remember in 2025

As the STAR program evolves in 2025, keep these points in mind:

- Stay informed about income limits and potential changes in policies or exemptions.

- Check with your local tax assessor for any updates or additional programs available in your area.

- Be aware of application deadlines to ensure you can access your benefits without delay.

Conclusion

The NYS STAR rebate program remains a vital resource for homeowners looking to alleviate the burden of property taxes in 2025. By understanding the eligibility requirements, application process, and benefits, you can make informed decisions that will help you save money and enhance your financial situation. Whether you qualify for Basic or Enhanced STAR, the potential for significant savings is a valuable advantage for every eligible homeowner. Make sure to apply early and keep an eye on any updates regarding the program to maximize your benefits.

FAQs

1. How long does it take to receive my STAR rebate?

Once your application is approved, the rebate will typically be applied to your property taxes. However, the specific timing may vary based on local processing times.

2. Can I apply for STAR if I recently purchased my home?

Yes, new homeowners can apply for the STAR exemption, provided they meet the eligibility criteria and ensure their application is submitted by the March 1 deadline.

3. What should I do if my application is denied?

If your application is denied, you will receive a notice explaining the reasons. You can either appeal the decision or address the issues raised and reapply in the next assessment period.

4. Is the STAR program available for rental properties?

No, the STAR program is only available for primary residences owned by homeowners. Rental properties do not qualify for the rebate.

5. How often must I reapply for the STAR exemption?

Homeowners generally do not need to reapply annually, as long as they continue to meet eligibility criteria. However, if you encounter a change in ownership or your income status changes significantly, you may need to reapply.

This HTML format provides structured headings and paragraphs suited for a WordPress article. Each section is clearly defined, making it easy for readers to navigate through the content. Ensure you adjust the styling as needed depending on your WordPress theme!

Download Nys Star Rebate 2025