Understanding the New Jersey Anchor Rebate: What Homeowners Need to Know

The New Jersey Anchor Rebate Program is designed to provide financial relief to homeowners across the Garden State. As property taxes continue to rise, many residents find themselves searching for ways to alleviate the burden. This article will delve into everything homeowners need to know about the Anchor Rebate, covering eligibility, application procedures, and more.

What is the Anchor Rebate Program?

The Anchor Rebate Program was introduced as part of Governor Phil Murphy’s broader initiative to reform property tax and rental assistance. The program aims to provide direct financial assistance to New Jersey homeowners and renters who meet specific income criteria. It serves as a financial cushion, effectively lowering the costs of living in a state often ranked among the highest for property taxes.

Eligibility Criteria

Understanding the eligibility criteria for the Anchor Rebate is essential for homeowners looking to benefit from this program. Here are the primary factors:

- Residency: Applicants must be legal residents of New Jersey.

- Property Ownership: Only homeowners may apply for the rebate. Renters are not eligible, but they may be covered under different assistance programs.

- Income Limits: There are specific income thresholds that applicants must meet to qualify, ensuring that assistance is directed toward those who need it most.

- Property Type: The property must be your primary residence, and it must be a residential property; vacation homes and investment properties do not qualify.

Rebate Amounts

The amount of rebate a homeowner may receive varies based on several factors, including income level and the corresponding property tax amount paid. For instance, lower-income households may receive a higher percentage of their property taxes back, while higher-income households may see a different calculation.

The program aims to ensure that all eligible homeowners receive adequate compensation that helps cover the rising costs of property taxes. The New Jersey Division of Taxation provides details on varying rebate amounts based on the individual homeowner’s situation and locality.

How to Apply for the Anchor Rebate

Applying for the Anchor Rebate is a straightforward process, designed to be user-friendly to enable as many homeowners as possible to access the program. Here’s a step-by-step guide:

- Gather Necessary Documents: Collect your property tax bill, proof of income, and any other documentation required by the State.

- Complete the Application: Applications can often be completed online through the New Jersey Division of Taxation website. Alternatively, homeowners may also choose to submit paper applications by mail.

- Submit Your Application: Make sure to submit the application before the provided deadline to ensure you qualify for the rebate.

- Track Your Application: Homeowners can track the status of their application through the same online portal.

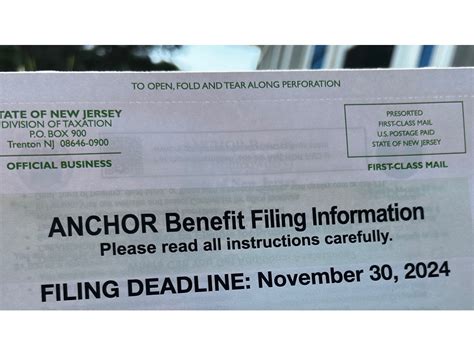

Important Deadlines

To ensure eligibility and avoid missing out on the rebate, it is vital to be aware of all relevant deadlines. Generally, applications for the Anchor Rebate are accepted during specific periods each year, often starting in the early spring and concluding in late summer. Homeowners are encouraged to stay informed about the exact dates and any changes in the application timeline.

Impact on Property Taxes

The Anchor Rebate significantly impacts New Jersey homeowners by offering a financial buffer that can help offset their property taxes. Since New Jersey has some of the highest property taxes in the nation, this relief program is crucial for many families who are struggling to balance their home expenses with other financial obligations.

The state government utilizes funds from various sources, including budgets allocated for property tax relief, to ensure that the program remains viable. It’s important to understand that while the Anchor Rebate will not eliminate property tax liabilities, it provides much-needed assistance to alleviate the pressure associated with these costs.

Key Takeaways

In summary, the New Jersey Anchor Rebate Program is an essential financial resource for homeowners looking to manage the rising costs associated with property taxes. Understanding eligibility, application procedures, and available rebate amounts can empower homeowners to take full advantage of this initiative.

Conclusion

As New Jersey continues to grapple with high property taxes, the Anchor Rebate Program stands out as a significant effort aimed at easing the financial burden for homeowners. Taking the time to understand eligibility and application processes can lead to meaningful financial relief. Homeowners are encouraged to remain proactive, stay informed on deadlines, and utilize the program to its full potential. When in doubt, reaching out to the New Jersey Division of Taxation can provide the assistance needed for a successful application.

FAQs

1. Who is eligible to apply for the Anchor Rebate?

Eligibility is typically limited to homeowners who meet certain income criteria and residency requirements. Renters are not eligible for this specific rebate.

2. How much can I expect to receive from the Anchor Rebate?

The rebate amount varies based on your property tax payments, income level, and current tax laws. The state provides a calculation formula to determine the specific amount for each applicant.

3. When can I apply for the Anchor Rebate?

Application periods generally open in the spring and close in late summer. It’s essential to check the official New Jersey Division of Taxation website for specific dates.

4. How do I apply for the Anchor Rebate?

You can apply online via the New Jersey Division of Taxation website or submit a paper application by mail. Make sure to have all required documentation ready when applying.

5. Can the Anchor Rebate eliminate my property taxes?

No, the Anchor Rebate does not eliminate property taxes; it provides a rebate to help offset the costs, easing the overall financial burden.

Download New Jersey Anchor Rebate