Understanding the Current Status of Pennsylvania’s Property Tax Rebate: What Homeowners Need to Know

Pennsylvania’s property tax rebate program has long been a subject of discussion among homeowners, particularly

those on fixed incomes or low income. The program is designed to provide financial relief to seniors,

individuals with disabilities, and certain other homeowners. With ongoing discussions in the legislature about

adjustments and reforms to the program, understanding its current status is crucial for residents. In this

article, we’ll delve deep into the Pennsylvania property tax rebate program, outlining who qualifies, the

application process, the current benefits, and legislative changes.

What is the Property Tax Rebate Program?

Established to assist older adults and certain individuals with disabilities, the Pennsylvania Property Tax

Rebate Program aims to reduce the financial burden created by property taxes. Eligibility is primarily based on

income levels, and the resultant rebates can significantly aid those struggling with housing costs.

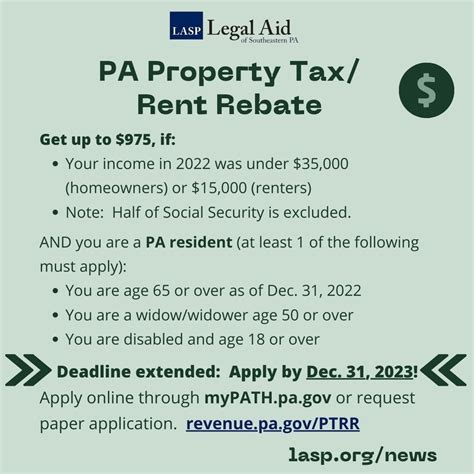

Eligibility Criteria

To qualify for the property tax rebate program, homeowners must meet the following criteria:

- Age: Homeowners must be 65 years of age or older.

- Disability: Individuals who are permanently disabled and are at least 18 years old are also eligible.

- Income Limits: The household income must not exceed $35,000 for homeowners, with certain exclusions.

- Property Type: The program applies to primary residences. Rental properties do not qualify.

Current Benefits of the Program

Once eligible, qualified homeowners can expect to receive a rebate on their property taxes. The amount awarded

as a rebate is contingent upon income and the amount of property tax paid. Here’s a breakdown of what

homeowners can anticipate:

- Maximum Rebate: The maximum rebate is $650, though it can go higher based on specific conditions.

- Income Adjustments: Homeowners with lower incomes may receive the full amount, while those approaching

the income cap will see it decrease. - Supplemental Funds: Certain local programs may offer additional financial aid for homeowners struggling with

taxes.

Application Process

Navigating the application process can appear overwhelming, but it is relatively straightforward.

Homeowners can apply for the property tax rebate online or by mailing in a paper application. Here’s what you

need to do:

- Gather the necessary documentation, including income statements, property tax records, and any other required paperwork.

- Visit the Pennsylvania Department of Revenue website to start your application online or download a paper form.

- Submit your application and documentation by the deadline, which typically is set for June 30 of the following year.

- Monitor your status through the Department of Revenue’s online portal or contact them for updates.

Legislative Trends and Changes

The property tax rebate program has seen various proposals for reforms aimed at broadening eligibility,

increasing the rebate amount, and more. Legislative updates have sparked hope for many homeowners. As of the

latest discussions, key focal points include:

- Potential Income Adjustments: Legislators are actively discussing increasing the income

threshold to accommodate more applicants. - Boosting Rebate Amounts: Some proposals focus on increasing the maximum rebate from

$650 to potentially higher amounts for qualifying homeowners. - Budget Considerations: Funding for these programs remains a topic of debate,

influencing possible expansions and enhancements.

Importance of Staying Informed

As a homeowner, it is vital to stay informed about potential changes to the property tax rebate program.

Regularly check state government websites, and consider joining local advocacy groups that focus on property tax issues.

Prepare for annual deadlines so timely applications can be submitted.

Conclusion

Pennsylvania’s property tax rebate program provides vital support to many homeowners struggling with property

taxes. Understanding the qualifications, benefits, and application process can make a significant difference.

As legislative discussions continue, staying informed about potential changes is equally important. Homeowners

should take proactive measures to apply for rebates and better understand their rights and benefits. This

knowledge can translate into valuable financial support, significantly easing the burden of property taxes.

FAQs

1. How do I know if I qualify for the property tax rebate?

To be eligible, you must be 65 years or older, or a permanently disabled individual aged 18 or older, and your

household income must be below the specified limits. Check with the Pennsylvania Department of Revenue for

the most accurate information.

2. What documents do I need to apply?

You will need proof of income, property tax records, and other identifying information. It’s best to consult

the application guidelines for a full list.

3. Can I apply online?

Yes, Pennsylvania offers an online application process for convenience. You can also send in a paper

application if preferred.

4. When should I apply for the rebate?

Applications usually need to be submitted by June 30 for the prior tax year. Ensure you check the specific deadline

each year.

5. Are there any changes coming to the rebate program?

Yes, legislative discussions are ongoing, with potential changes aimed at increasing eligibility and rebate amounts.

Stay updated through state government channels for the latest news.

This HTML formatted content gives a comprehensive overview of Pennsylvania’s property tax rebate program while addressing essential topics like eligibility, application process, legislative changes, and FAQs.

Download Status Of Pa Property Tax Rebate