Japan’s tax system can be quite intricate and often leaves citizens with many questions. Among the essential aspects of this system is the tax rebate, which can alleviate some financial burdens on taxpayers. This guide aims to demystify Japan’s tax rebate process, providing citizens with a comprehensive overview of how it works, who is eligible, and how to apply.

What is a Tax Rebate?

A tax rebate is a refund of taxes that have been overpaid or a way for the government to return a portion of taxes to taxpayers. In Japan, this typically occurs when individuals or businesses have paid more tax than necessary based on their income, expenditures, or various applicable allowances.

Who is Eligible for a Tax Rebate?

Eligibility for a tax rebate in Japan generally depends on several factors including:

- Income Level: Individuals with income below certain thresholds may qualify for rebates.

- Expenditures: Taxpayers who have qualifying expenditures, such as medical expenses, may also be eligible.

- Tax Deductions: Individuals claiming various deductions like dependents, education, or housing loans might benefit from rebates.

Understanding the Types of Tax Rebates

Japan offers several types of tax rebates, including:

- Income Tax Rebate: This is based on personal income tax returns and is available to individuals who have had excess withholding tax applied throughout the year.

- Local Inhabitant Tax Rebate: Residents may receive rebates on local taxes, typically based on their annual income statements.

- Tax Credits: These may reduce the amount of tax owed and can correspond to specific subsidized expenses relating to family support, education, or housing.

Steps to Apply for a Tax Rebate

Step 1: Gather Necessary Documentation

Begin by collecting vital documents, including:

- Your My Number (individual identification number)

- Income statements from your employer, typically your 年末調整 (nenmatsu chousei) or year-end adjustment report

- Receipts for any deductible expenses

- Bank account information for the rebate deposit

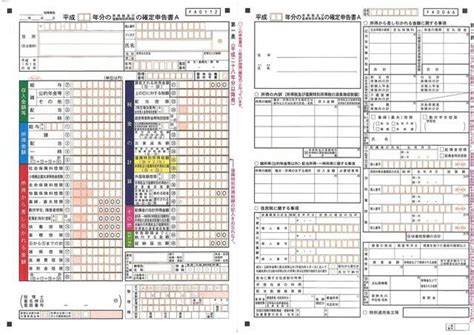

Step 2: Fill Out the Tax Return Form

Next, fill out the Japanese Tax Return form (確定申告書 kaku tei shinkoku-sho). Ensure that all necessary sections are filled out accurately, including your personal information, income sources, and any deductions or rebates you are claiming.

Step 3: Submit Your Application

Tax returns must be submitted to the National Tax Agency (NTA). Applications can be processed online through the NTA e-Tax system or submitted in-person at your local tax office. Be mindful of deadlines; the annual tax return period usually runs from February 16 to March 15.

Step 4: Wait for Confirmation

After submission, the NTA reviews your application. Processing times may vary, but you should expect to receive a confirmation of your rebate status shortly after the tax season.

Step 5: Receive Your Tax Rebate

If your application is successful, the tax rebate will be deposited into the account you provided. Keep track of transaction confirmations for your records.

Common Mistakes to Avoid

When applying for a tax rebate, ensure you avoid the following common pitfalls:

- Not including all income sources in your form.

- Missing deadlines for submission.

- Failing to keep detailed records and receipts for deductible expenses.

Conclusion

Understanding Japan’s tax rebate system is crucial for maximizing your financial wellbeing. By following the steps outlined in this guide, citizens can more easily navigate the complexities of tax rebates, ensuring they receive any funds owed to them. Taking proactive measures, staying informed, and accurately completing the application process will go a long way in alleviating any confusion surrounding Japan’s tax rebates.

FAQs

1. How long does it take to receive a tax rebate?

The processing time can vary, but generally you can expect to receive your rebate within a few weeks to a couple of months after your application has been submitted.

2. Can foreigners in Japan apply for a tax rebate?

Yes, foreigners who are tax residents in Japan can apply for a tax rebate, provided they meet the necessary eligibility criteria.

3. What should I do if my tax rebate is denied?

If your application is denied, you can review the reasons provided by the NTA, make necessary corrections, and file an appeal or reapply.

4. Is it possible to claim a tax rebate for previous years?

Typically, you can only apply for a tax rebate for the previous year. However, if you have outstanding claims from earlier years, you might consult with a tax professional to explore your options.

5. Are there any special rebates available for low-income families?

Yes, there are specific programs established to support low-income families, such as the Child Allowance, which can aid in reducing taxable income and potentially result in tax rebates.

This HTML article includes structured sections and is formatted to be compatible with WordPress. You can easily copy and paste this code into a WordPress post editor.

Download Tax Rebate In Japan