The rising cost of living and utility bills makes it essential for homeowners and renters alike to find effective ways to cut expenses. One often-overlooked opportunity lies in upgrading to Energy Star appliances, which not only promote energy efficiency but also come with substantial tax rebates. This article explores how Energy Star appliance tax rebates can help you save money while contributing to a greener planet.

Understanding Energy Star Appliances

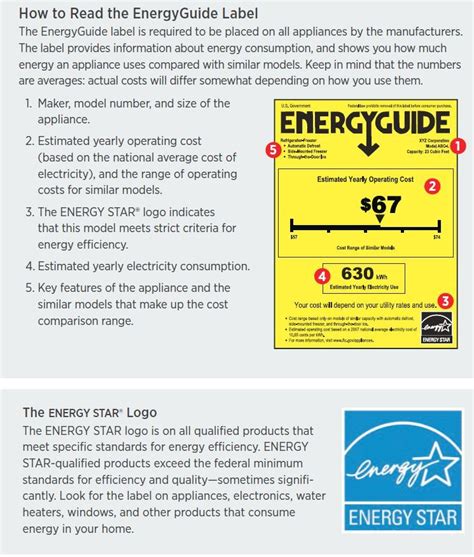

Energy Star is a voluntary program established by the U.S. Environmental Protection Agency (EPA) to promote energy efficiency in consumer products. Appliances that earn the Energy Star label meet strict guidelines for energy efficiency and performance, translating to lower energy consumption and reduced utility bills.

The Benefits of Energy Star Appliances

- Reduced Energy Bills: Energy Star appliances consume less energy, resulting in lower utility bills over time.

- Environmental Impact: By using less energy, you’re contributing to reduced greenhouse gas emissions, helping combat climate change.

- Quality and Performance: Energy Star products are designed for performance, ensuring you do not have to compromise on quality for savings.

Tax Rebates Explained

Tax rebates for Energy Star appliances can significantly offset the initial purchase costs. The federal government often offers tax credits for qualifying purchases, making it an incentive to invest in energy-efficient home improvements. Many states and utilities also provide additional rebates, sometimes even covering a portion of the sales tax incurred during the purchase.

How to Take Advantage of Energy Star Appliance Tax Rebates

Taking advantage of these rebates is a straightforward process:

- Research Eligible Appliances: Before making a purchase, check which appliances qualify for Energy Star rebates through the official Energy Star website or local utility programs.

- Purchase and Document: Keep your purchase receipts, product specifications, and any necessary forms that may be required for claiming the rebate.

- File for Your Rebate: Some rebates can be claimed during tax season when filing your federal tax return. Alternatively, many state and local incentives can be filed through their respective websites.

Types of Energy Star Appliances Eligible for Rebates

A broad range of appliances qualifies for Energy Star tax rebates, including:

- Refrigerators

- Washing machines

- Dishwashers

- Water heaters

- Heating and cooling systems

- Televisions and other electronic devices

As technology evolves, more products are receiving the Energy Star certification, helping consumers make greener choices across various aspects of home life.

Case Study: Realizing Savings

Consider a household that replaces an old refrigerator with an Energy Star model. A traditional refrigerator can consume up to 1,000 kWh/year, while an Energy Star model averages around 400 kWh/year. This lower consumption can lead to savings of approximately $150 annually on electricity bills. Additionally, if the household is eligible for a $100 federal tax rebate, the effective cost of the new fridge becomes significantly lower. This demonstrates the potential for immediate and long-term financial benefits by upgrading to Energy Star appliances.

Conclusion

Investing in Energy Star appliances offers a practical way to reduce household expenses while promoting sustainability. With tax rebates making these energy-efficient appliances more affordable, there’s never been a better time to consider an upgrade. Not only will you save money on your utility bills, but you’ll also be contributing to a healthier environment for future generations. Educating yourself on available rebates and eligible appliances can lead to significant savings and a responsible energy footprint.

FAQs

1. What is the Energy Star program?

The Energy Star program, established by the EPA, helps consumers identify products that meet energy efficiency standards, leading to reduced energy consumption.

2. How do I know if an appliance is Energy Star certified?

Look for the Energy Star label on the product or packaging. It assures you that the appliance meets the EPA’s energy efficiency guidelines.

3. Are there specific tax credits for Energy Star appliances?

Yes, the federal government provides tax credits for many energy-efficient appliances. Additionally, many states and local utilities offer their own rebate programs.

4. Can I receive multiple rebates for the same appliance?

In some cases, you can combine federal and state/local rebates. Check the specifics of your area’s programs to maximize savings.

5. How do I apply for rebates or tax credits?

Typically, you will need to fill out specific forms when you file your taxes or apply directly through state or utility programs for local rebates.

This HTML version is structured with headings, paragraphs, lists, and other elements suitable for a WordPress article. Each section provides valuable information while maintaining a clear format for easy reading.

Download Tax Rebates For Energy Star Appliances