The New Jersey Homestead Rebate program provides financial relief to homeowners by reducing property taxes. This initiative is particularly crucial for those struggling with rising housing costs. As of 2023, several updates to the program will impact how homeowners apply for rebates and what they can expect in terms of financial benefits. Below, we delve into key aspects every homeowner should consider.

Understanding the Homestead Rebate Program

The Homestead Rebate provides property tax relief to eligible New Jersey homeowners based on their income and property tax amounts. The program aims to assist homeowners in maintaining their homes and mitigating the burden of property taxes, which can be particularly high in New Jersey.

Eligibility Criteria

To qualify for the NJ Homestead Rebate in 2023, homeowners must meet specific criteria:

- Residency: Applicants must be legal residents of New Jersey for at least the tax year in question.

- Property Ownership: The property must be an owner-occupied residence.

- Income Limitations: Homeowners must meet a designated income threshold that can vary by year.

- Property Taxes: Applicants must have paid property taxes on their home.

Rebate Calculations

The amount of the rebate can vary significantly based on several factors:

- Property Taxes Paid: Homeowners will receive a rebate amount proportional to the property taxes they have paid.

- Income Level: Those with lower incomes tend to receive higher rebates while higher-income households may receive reduced amounts.

- Adjustment Factors: Additional adjustments may apply for senior citizens and disabled persons.

For 2023, it’s crucial for homeowners to refer to the latest guidelines from the New Jersey Division of Taxation to understand the exact amounts that they may be eligible to receive.

Application Process

The application process for the Homestead Rebate can seem daunting, but it is manageable with the right information:

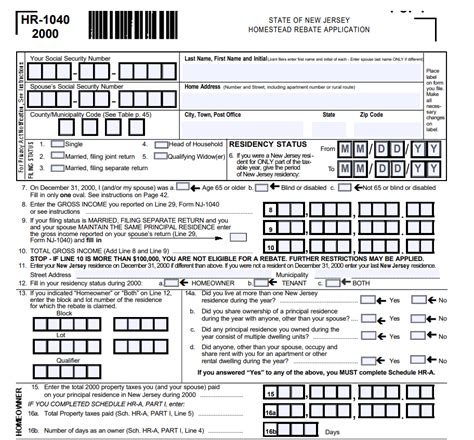

- Gather Necessary Documents: Homeowners will need documents including proof of income, property tax bill, and Social Security numbers.

- File the Application: Applications can be filed online through the NJ Division of Taxation’s website or through traditional mail. Be sure to check the deadlines for submissions.

- Check Your Status: After submitting, homeowners can check the status of their application via the Division of Taxation’s online portal.

Important Deadlines for 2023

Staying aware of deadlines is critical for ensuring that you do not miss out on your rebate:

- Filing Period: Applications for the Homestead Rebate are typically accepted from late February to late May. Check the NJ Division of Taxation website for exact dates for 2023.

- Notification of Rebates: Notifications regarding the approval or denial of rebates are usually sent out by the end of the year.

Tax Benefits of the Homestead Rebate

Beyond the immediate financial relief, understanding the tax implications of receiving a Homestead Rebate is essential:

- Non-Taxable Income: The rebate received is not considered taxable income, which means homeowners don’t need to report it on their state or federal returns.

- Long-Term Financial Planning: Regularly receiving this rebate can help homeowners budget better, providing predictability in their financial planning.

Conclusion

The NJ Homestead Rebate is more than just a program to alleviate property taxes; it represents a crucial support system for homeowners managing the challenges of living in New Jersey. Understanding eligibility, application processes, and staying up to date on deadlines are essential for maximizing the benefits available. Homeowners should take proactive steps to apply for the rebate, ensuring they reap the financial rewards they are entitled to.

FAQs

1. Can I apply for the Homestead Rebate if I am a renter?

No, the Homestead Rebate is exclusively for homeowners who occupy their properties. Renters do not qualify for this program.

2. What if I am denied my Homestead Rebate application?

If your application is denied, you will receive a notification detailing the reasons. You may appeal the decision by following the provided instructions.

3. How often do I need to apply for the rebate?

Homeowners must apply for the rebate each year; however, once you are granted eligibility, some years may allow you automatic enrollment based on previous applications.

4. Is there assistance available for filling out the application?

Yes, various local organizations and municipal offices often offer assistance for homeowners needing help with the application process.

5. Where can I find more detailed information about the program?

The best resource is the New Jersey Division of Taxation’s official website, where all the most current information about eligibility, calculations, and deadlines can be found.

Download Status Of Nj Homestead Rebate