Navigating the New EV Rebate Income Limits: What You Need to Know

The electric vehicle (EV) market is rapidly evolving, with incentives being a crucial factor in making this transition more accessible to everyday consumers. As part of efforts to promote eco-friendly transportation, new EV rebate income limits have been introduced. Understanding these changes is essential for potential EV buyers. This article will delve into the details of the new income limits, how they affect eligibility for rebates, and what you can do to make the most of these incentives.

What Are EV Rebates?

EV rebates are financial incentives, often provided by federal and state governments, aimed at encouraging the adoption of electric vehicles. These rebates can significantly lower the cost of purchasing an EV, making them more appealing to a broader range of consumers. However, eligibility for these rebates often has income limits, designed to target benefits to those who need them most.

Understanding the New Income Limits

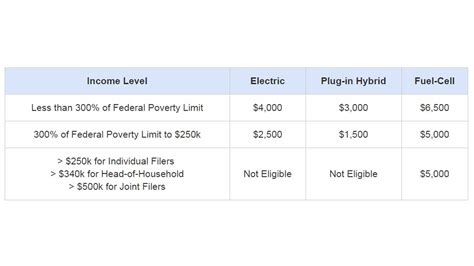

As part of the recent legislation aimed at promoting clean energy, new income limits have been introduced for EV rebates. These limits are adjusted based on household size and are designed to exclude high-income earners from receiving rebate benefits.

Income Thresholds

Under the new guidelines, the income thresholds can be broken down as follows:

- Individuals: $150,000

- Heads of household: $225,000

- Married couples filing jointly: $300,000

These thresholds apply to the modified adjusted gross income (MAGI), which is calculated based on your adjusted gross income with certain deductions and exclusions. If your household income exceeds these thresholds, you will likely be ineligible for federal rebates.

State-Level Rebates and Eligibility

While the federal government sets base income limits, many states also offer additional EV incentives, which may have their own eligibility criteria and income limits. It’s essential to research your local area’s incentives and regulations, as these can vary widely.

For instance, states like California offer significant rebates but also adhere to income caps. In contrast, some states provide rebates without income limits, making it easier for a larger population to benefit from EV incentives.

Impact of Income Limits on EV Adoption

The introduction of income limits may seem restrictive, but the goal is to ensure that subsidies are targeted effectively. By capping eligibility, the government aims to provide financial assistance primarily to those who may struggle to afford an EV.

It’s worth noting that studies show that lower-income households are generally more responsive to incentives. Thus, by implementing these income limits, policymakers hope to drive broader adoption of EVs in communities that would benefit most significantly from lower transportation costs and improved air quality.

How to Navigate the New Income Limits

To effectively navigate the new income limits and maximize your chances of qualifying for rebates, consider the following steps:

-

Evaluate Your Income:

Start by determining your MAGI, including any relevant deductions or exclusions. Be diligent in calculating your income accurately to understand where you stand.

-

Research State Incentives:

Look into state-specific EV incentives and income limits. Websites such as the U.S. Department of Energy and your state’s energy office can provide valuable resources and information on available rebates.

-

Consider Timing:

Keep an eye on changes to financial incentives and rebates, as these can shift with new legislation or government budgets. Purchasing an EV can sometimes be a matter of timing, so stay informed.

-

Consult with Professionals:

If you’re unsure about your eligibility or the best way to navigate the rebates, consider speaking with a financial advisor or a professional in the automotive industry. They can provide insights tailored to your specific situation.

-

Stay Updated:

Policies regarding EV rebates are evolving, and staying informed will ensure you don’t miss any opportunities that may arise in the future.

Conclusion

The new EV rebate income limits represent an important shift in the landscape of electric vehicle incentives. While these income thresholds may initially appear restrictive, they aim to maximize benefits for those who need them the most. By navigating the changes carefully and staying informed about both federal and state-level incentives, consumers can make the most of available rebates to help alleviate the costs associated with adopting electric vehicles. Transitioning to an EV is not only beneficial for individual finances but also contributes to a more sustainable and healthier planet.

FAQs

1. Who qualifies for the new EV rebates?

To qualify for federal EV rebates under the new income limits, individuals must have a modified adjusted gross income (MAGI) of $150,000 or less, heads of household must be at $225,000 or less, and married couples filing jointly must have an income of $300,000 or less.

2. Can I still receive state rebates if I exceed federal income limits?

Yes, some states do not impose income limits for their EV rebates. It’s important to check your specific state’s regulations to understand your options.

3. How do I calculate my modified adjusted gross income (MAGI)?

MAGI is your adjusted gross income with certain deductions and exclusions added back in. The IRS provides guidelines on what qualifies as MAGI, and it’s advisable to consult tax forms or a tax professional for accurate calculations.

4. Are the income limits permanent?

No, income limits can change based on new legislation, economic factors, and budget appropriations. Staying informed about policy changes is crucial.

5. What should I do if I believe I qualify but my income is close to the limit?

If your income is near the thresholds, it is prudent to double-check your calculations, explore potential deductions, and consult a tax professional who can assist with any adjustments that might qualify you for rebates.

Download Ev Rebate Income Limit