Navigating the complexities of property taxes can be a daunting task for homeowners, especially in a state like New Jersey, where property tax rates are among the highest in the nation. Fortunately, the state offers various programs and rebates designed to alleviate some of the financial burden on homeowners. One such program is the New Jersey Property Tax Rebate. This article will explore what the rebate entails, who is eligible, how to apply, and key deadlines you should keep in mind. Let’s dive in!

Understanding the Property Tax Rebate

The New Jersey Property Tax Rebate is a financial incentive aimed atreducing the amount of property tax homeowners pay. This program is designed primarily for senior citizens, disabled persons, and low- to moderate-income homeowners. The rebate can significantly impact your financial situation, allowing you to invest more in your home or save for future expenses.

Who Is Eligible?

To determine your eligibility for the Property Tax Rebate, several factors come into play:

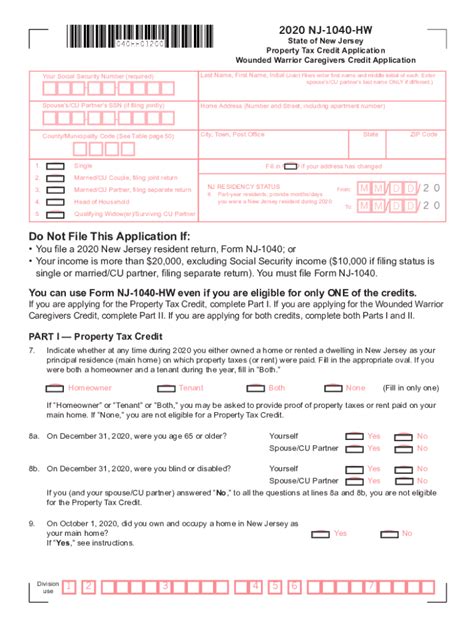

- Age and Disability Status: Typically, homeowners aged 65 or older and disabled persons are eligible.

- Income Level: The rebate is generally aimed at low- to moderate-income households. For the latest income limits, refer to the New Jersey Division of Taxation website.

- Primary Residence: The property must be your primary residence as of October 1st of the tax year.

Application Process

Applying for the New Jersey Property Tax Rebate is a straightforward process, but it requires attention to detail. Here’s a step-by-step guide to help you through:

- Gather Necessary Documents: You will need a copy of your property tax bill, income documents, and any relevant banking information.

- Complete the Application: You can find the application forms on the New Jersey Division of Taxation website. It’s crucial to fill out the form accurately, as any discrepancies could delay your rebate.

- Submit the Application: Once completed, you can submit your application online, by mail, or in person at your local tax office.

- Wait for the Processing: After submitting your application, be prepared to wait a few weeks to a few months for processing. The New Jersey Division of Taxation will notify you of your rebate status.

Important Deadlines

Staying on top of deadlines is crucial for a smooth application process. Here are some key dates to remember:

- Application Period: Generally, applications for the Property Tax Rebate open in the spring and close in late summer. Check the New Jersey Division of Taxation website for specific dates each year.

- Filing Taxes: Make sure to have your tax returns filed, as your income will be verified during the rebate process.

- Notification of Rebate: Most homeowners can expect notifications by the end of the calendar year.

Types of Rebates Available

Understanding the different types of rebates can help you make informed decisions. Here are the most common forms of property tax relief available:

- Senior Freeze Program: This program allows eligible senior citizens and disabled individuals to “freeze” their property taxes at a certain rate, preventing future increases.

- Homestead Benefit: This program provides property tax relief to eligible homeowners based on their income and property taxes paid.

- Veterans’ Deduction: Eligible veterans may receive a deduction on their property taxes, providing additional financial relief.

Conclusion

Navigating New Jersey’s property tax system can be overwhelming, but programs like the Property Tax Rebate offer critical relief to those who qualify. By understanding the eligibility requirements, application process, and available rebates, you can effectively reduce your property tax burden. Finally, staying informed about important deadlines will ensure you maximize the benefits available to you as a homeowner.

FAQs

1. How much can I expect to receive from the Property Tax Rebate?

The amount of the rebate varies and is determined based on your income, the amount of property taxes paid, and eligibility criteria. It is advisable to consult the New Jersey Division of Taxation for detailed information.

2. When will I receive my Property Tax Rebate?

After submitting your application, the processing time can vary. Generally, notifications are sent out by the end of the calendar year.

3. Can I apply for the rebate online?

Yes, homeowners can submit their applications online through the New Jersey Division of Taxation website.

4. Do I need to reapply every year?

It depends on your circumstances. Generally, if your financial situation or property status remains unchanged, you may not need to reapply annually. It’s best to check the latest guidelines on the Division of Taxation website.

5. What happens if my application is denied?

If your application is denied, you will receive a notice explaining the reason. You may be able to appeal the decision or correct any mistakes in your application to reapply.

Download State Of Nj Property Tax Rebate