Minnesota offers a valuable resource for renters facing financial challenges—the Rent Rebate program. Designed to assist low- and moderate-income renters, it aims to alleviate some of the burdens associated with housing costs. As we enter the current fiscal year, it’s essential to understand the nuances of the program, including eligibility requirements, application procedures, and crucial deadlines. This article will guide you through everything you need to know about Minnesota’s Rent Rebate program this year.

What is the Rent Rebate Program?

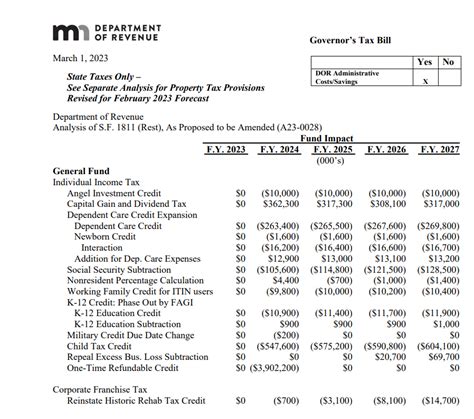

The Rent Rebate program is a state-funded initiative that provides financial assistance to eligible renters based on their income and the amount of rent they pay. This rebate aims to ease the financial burden of housing and make it manageable for those experiencing hardships. The program is administered by the Minnesota Department of Revenue, and qualifying participants can receive a refund of a portion of their rent paid during the previous year.

Eligibility Criteria

To qualify for the Rent Rebate program in Minnesota, applicants must meet specific criteria:

- Residency: You must be a resident of Minnesota for at least half of the year.

- Age and Income: You must be at least 18 years old, and your income must fall below the established limits. The income guidelines may vary from year to year.

- Rent Payment: You must have paid rent for at least 10% of your total income, with the minimum rent threshold set for the year.

How Much Can You Receive?

The amount you can receive from the Rent Rebate program depends on several factors, including your total income and the amount of rent you paid. Generally, the rebate amounts can range from a few hundred to several thousand dollars. The state adjusts these rates annually, so be sure to check the current year’s guidelines to understand what you might expect.

Application Process

Applying for the Rent Rebate program involves several steps:

- Gather Necessary Documents: Collect all documents related to your income (W-2s, tax returns) and your rent payments (lease agreements or rent receipts).

- Complete the Application: You can apply online or obtain a paper application from the Minnesota Department of Revenue’s website. Make sure to fill out all sections thoroughly, as incomplete applications may be delayed or denied.

- Submit Your Application: If applying online, follow the prompts to submit your application electronically. If using paper, ensure it reaches the Department of Revenue by the deadline.

Important Deadlines

The deadline for submitting your Rent Rebate application is typically August 15 of the year following the year for which you are applying. However, it’s crucial to stay updated with the Minnesota Department of Revenue’s announcements regarding any changes or extensions to deadlines.

Where to Get Help

If you encounter issues or have questions during the application process, there are several resources available:

- Minnesota Department of Revenue: The department provides detailed information on its website and offers assistance via phone.

- Local Community Organizations: Many local nonprofits assist with the application process, especially for those who may face language or technology barriers.

- Tax Professionals: Consulting a tax professional can be beneficial, especially for those with complicated income situations.

Conclusion

Navigating Minnesota’s Rent Rebate program can initially seem overwhelming, but understanding the eligibility criteria, application process, and available resources will empower you to take the necessary steps. Taking advantage of this program can significantly ease your financial burdens, allowing you to allocate more resources towards other essential living expenses. As we move through the year, stay informed about any updates to the program that could impact your eligibility or reimbursement amounts. Remember that help is available—don’t hesitate to reach out and ensure you make the most of the support offered by Minnesota’s Rent Rebate program.

FAQs

1. What is the minimum income required to apply for the Rent Rebate program?

There is no minimum income required; however, you must demonstrate that you’ve paid rent accounting for at least 10% of your total income. The rebate eligibility is more contingent upon the maximum income thresholds set by the state.

2. Can I apply for the Rent Rebate if I have roommates?

Yes, you can apply even if you have roommates. Just ensure to indicate how much rent you paid and provide the necessary documentation.

3. Is the Rent Rebate considered taxable income?

No, the Rent Rebate you receive is not considered taxable income at the state or federal level.

4. What should I do if my application is denied?

If your application is denied, you have the right to appeal the decision. The denial notice will provide instructions on how to proceed with an appeal.

5. Are there resources available for those who need assistance with the application process?

Yes, numerous resources are available, including the Minnesota Department of Revenue, community organizations, and tax professionals who can assist with the application process.

Download Minnesota Rent Rebate Status