Maximizing Savings: Understanding the NYS STAR Tax Rebate Program

For homeowners in New York State, the School Tax Relief (STAR) program offers significant financial benefits aimed at reducing property taxes. This program has been a pivotal resource for many families, especially those struggling to keep up with rising property expenses.

What is the STAR Program?

The STAR program is divided into two main parts: the Basic STAR and the Enhanced STAR. Both programs provide exemptions that can lower property taxes, making homeownership more affordable for millions across the state.

Basic STAR

The Basic STAR exemption is available to all homeowners whose primary residence is in New York State, provided their income does not exceed $500,000. This exemption allows eligible homeowners to save on their school taxes, helping to ease the financial burden of owning a home.

Enhanced STAR

The Enhanced STAR exemption is designed for senior citizens aged 65 or older, with an income ceiling of $92,000. This program not only provides greater savings but also recognizes the unique challenges faced by elderly homeowners, allowing them a bit more relief during their golden years.

Eligibility Requirements

To qualify for either the Basic or Enhanced STAR exemptions, homeowners must meet specific eligibility criteria. These criteria include:

- Homeownership: The property must be your primary residence.

- Income Limits: Applicants must adhere to the stated income thresholds for BASIC and ENHANCED STAR.

- Age Requirements: For Enhanced STAR, at least one owner must be at least 65 years old by December 31 of the application year.

- Previous STAR Enrollment: Homeowners must apply for these exemptions in their local school district.

The Application Process

Applying for the STAR program is relatively straightforward. Homeowners can fill out the application form available through their local tax assessor’s office or online at the New York State Department of Taxation and Finance website. Here’s how the application process usually works:

- Gather necessary documentation such as proof of income and age (for Enhanced STAR).

- Complete the STAR application form accurately, ensuring all required information is included.

- Submit the application to your local tax assessor’s office before the designated deadline.

- Receive notification of your application status and if approved, the amount of your exemption.

Benefits of the STAR Program

The STAR program offers a multitude of benefits for eligible homeowners in New York State. Some of the most notable advantages include:

- Tax Reduction: Homeowners can receive significant reductions in their annual property taxes, making homeownership more affordable.

- Budgeting: Knowing your property tax savings in advance can assist in better financial planning and budgeting for homeowners.

- Accessibility: The program is designed to be easy to understand and apply for, making it accessible for most homeowners.

Potential Challenges

While the STAR program offers many benefits, applicants may face challenges during the application process. Some common issues include:

- Meeting Income Requirements: Homeowners must ensure they do not exceed the set income limits, which can change annually.

- Application Errors: Missing information or errors on the application form can delay processing or result in denial.

- Local Variability: Different school districts may have varying procedures for administering STAR benefits, complicating the application process.

Conclusion

The NYS STAR Tax Rebate Program offers valuable support to homeowners looking to reduce their property tax burden. Understanding the different components of the program, eligibility requirements, and the application process can significantly enhance your savings. By taking advantage of the STAR exemptions, homeowners can enjoy a more manageable financial landscape while retaining their homes.

FAQs

What is the difference between Basic STAR and Enhanced STAR?

Basic STAR is available to all eligible homeowners, while Enhanced STAR is specifically designed for seniors aged 65 and over, offering higher exemptions based on income.

How do I apply for the STAR program?

You can apply for the STAR program through your local tax assessor’s office or online at the New York State Department of Taxation and Finance website.

What are the income limits for the STAR program?

The income limit for Basic STAR is $500,000, whereas for Enhanced STAR, the limit is $92,000, based on the previous year’s income.

Can I apply for STAR exemptions every year?

Yes, homeowners must apply for STAR exemptions each year, as they need to meet the current eligibility criteria annually.

What happens if my application for STAR is denied?

If your application is denied, you will receive a notification explaining the reasons, and you may have the opportunity to appeal the decision.

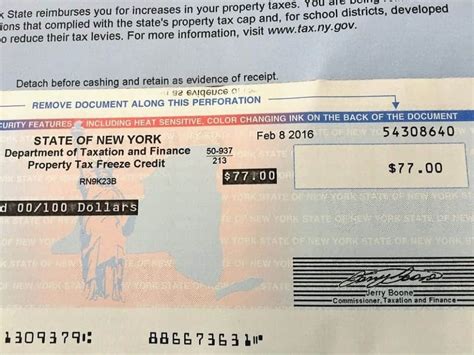

Download Nys Star Tax Rebate