In today’s increasingly cashless society, access to cash is often taken for granted. However, when you need to withdraw cash, the fees associated with using ATMs can quickly add up. This is where Charles Schwab’s ATM fee rebate advantage comes into play. For those seeking to maximize their withdrawals and minimize banking costs, leveraging this benefit can be a game-changer.

Understanding ATM Fees

ATM fees can vary dramatically depending on the machine you use. When you withdraw money from an ATM that doesn’t belong to your financial institution, you might be charged a fee for the transaction. This fee can range from a few dollars to as much as $5 or more. On top of that, if you’re using an ATM outside of your bank’s network, your bank may also charge you a separate fee, making withdrawing cash a costly affair.

The Schwab Banking Experience

Charles Schwab provides an unparalleled banking experience that aligns with the needs of modern consumers. One of the standout features of their High Yield Investor Checking Account is the lack of monthly fees and the reimbursing of ATM fees worldwide. Yes, you read that right. Schwab clients can withdraw cash from any ATM and have the fees reimbursed at the end of the month, allowing for a hassle-free banking experience.

How the Fee Rebate Works

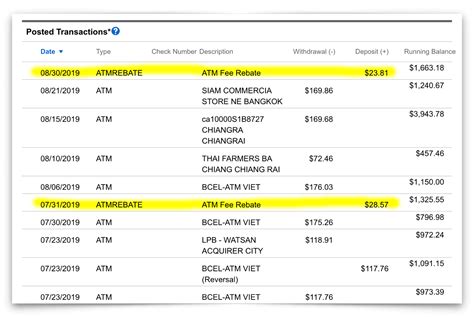

When you use an ATM outside of Schwab’s network, the ATM operator may charge a usage fee. Schwab will reimburse you for these fees, regardless of the amount or the number of transactions. This is a significant advantage, especially for those who travel frequently or live in areas where ATM options from Schwab are limited.

Step-by-Step Guide to Using Schwab’s ATM Rebate

- Open a Schwab Account: First, you need to set up a Schwab High Yield Investor Checking Account, which is easily done online.

- Find an ATM: While you can use any ATM, try to find ones that are well-lit and in safe locations.

- Withdraw Cash: Proceed with your withdrawal, keeping in mind the fees that may apply.

- Monitor Your Statements: At the end of each month, Schwab will automatically credit any ATM fees charged to your account.

Additional Benefits of Schwab’s Account

Beyond the ATM fee rebate, Schwab offers a plethora of features that enhance your banking experience:

- No Monthly Fees: Enjoy a bank account without any maintenance fees, whether you maintain a minimum balance or not.

- Worldwide Access: Access your funds easily no matter where you are in the world without the worry of constant fees.

- Interest Earnings: Earn interest on your checking account balance, which is uncommon in traditional checking accounts.

- Integration with Trading Accounts: If you are a Schwab investing client, you can easily transfer funds between your investment and checking accounts.

Maximizing Your Withdrawals

To maximize your withdrawals while minimizing costs, consider these tips:

- Plan Your Withdrawals: When you know you’ll need cash, consider withdrawing a larger amount to limit the number of transactions.

- Use Schwab’s Online Tools: Utilize Schwab’s online tools and app to monitor fees and transaction history. This will help you keep track of reimbursements.

- Look for Partner ATMs: They may have partnerships with certain ATM networks. Finding these ATMs may reduce your fees.

Conclusion

In summary, maximizing your withdrawals can be made significantly easier with the Schwab ATM fee rebate advantage. With the ability to withdraw cash from virtually any ATM without worrying about fees, Charles Schwab sets itself apart as a consumer-friendly banking option. The simplicity of getting reimbursed and the additional bank features make Schwab a compelling choice for anyone looking to control their banking costs.

FAQs

1. How does Schwab reimburse ATM fees?

Schwab automatically reimburses any ATM fees charged to your account at the end of each month, regardless of whether they are charged by another bank or an independent ATM operator.

2. Are there any limits on the total amount of ATM fees Schwab will reimburse?

No, there are no limits on the amount of ATM fees Schwab will reimburse you.

3. Do I need to apply for the ATM fee rebate separately?

No, the ATM fee rebate feature is automatically applied to your Schwab High Yield Investor Checking Account once you open it.

4. What if I am traveling internationally? Can I still get the fee rebates?

Yes! Schwab will reimburse ATM fees incurred while traveling internationally as well, making it an excellent option for travelers.

5. What are the eligibility requirements for opening a Schwab account?

You must be at least 18 years old, a U.S. citizen or resident, and provide valid identification and social security information.

This HTML format can be directly pasted into a WordPress post or page editor. Ensure that your site’s theme and styling support the display of headings, lists, and paragraphs for optimal viewing.

Download Schwab Atm Fee Rebate