In 2025, South Carolina taxpayers can look forward to a significant opportunity to enhance their financial stability through the state’s tax rebate program. Designed to ease the financial burden on individuals and families, this rebate initiative aims to return a portion of the taxes paid to residents. This article will delve into the specifics of the South Carolina tax rebate for 2025, including eligibility criteria, how to apply, and tips for maximizing your savings.

Understanding the 2025 South Carolina Tax Rebate

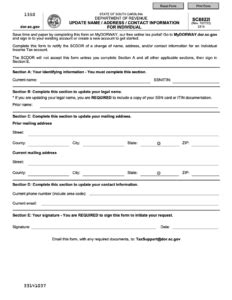

The South Carolina Department of Revenue (SCDOR) administers the tax rebate program. In essence, the rebate functions as a type of tax break that allows residents to receive a refund based on their income tax contributions. The program is particularly beneficial for low to middle-income taxpayers who may struggle to meet living expenses during challenging economic times.

Eligibility Criteria

To qualify for the 2025 tax rebate, residents must meet several criteria. Below are the key requirements:

- Residency: You must be a resident of South Carolina for the entire tax year.

- Filing Requirements: Taxpayers must complete their state tax return to be eligible. This includes submitting Form 1040 or any other applicable state forms.

- Income Limits: While specifics may change, generally, there are income thresholds that dictate full or partial rebate eligibility. It’s crucial to check the latest guidelines from the SCDOR.

- Non-Dependents: Filers can’t be claimed as a dependent on someone else’s tax return.

How the Rebate Amount is Determined

The amount a taxpayer can expect to receive as a rebate largely depends on the amount of state income tax they’ve paid and their filing status. In recent years, rebates have typically varied based on adjusted gross income (AGI), and taxpayer household makes a difference in the final calculation. For 2025, residents can anticipate more straightforward calculations aimed at maximizing rebate distribution.

Application Process for the Tax Rebate

Applying for the 2025 South Carolina tax rebate can be a straightforward process, but it requires necessary diligence to ensure accuracy. Here are the essential steps you need to take:

1. Gather Your Documentation

Before completing your tax return, gather all relevant financial documents, including W-2 forms, 1099s, and records of any deductions you intend to claim. This ensures you have a comprehensive view of your tax obligations.

2. Complete Your Tax Return

Ensure you fill out your South Carolina tax return accurately. Pay special attention to the income section, as this will influence your rebate eligibility. Consider using tax software or a professional tax preparer if the complexities of tax return preparation feel overwhelming.

3. Submit Your Tax Return

File your completed tax return electronically or by mail. Electronic filing often speeds up the processing time for rebates, so it is the preferred choice for many taxpayers.

4. Check Your Status

After submitting your tax return, monitor the status of your rebate. The SCDOR typically provides updates on its website, allowing taxpayers to stay informed and anticipate their rebate arrival.

Maximizing Your Savings with the Tax Rebate

As taxpayers prepare for the 2025 tax rebate, here are some strategies to help maximize savings:

1. Stay Informed About Changes

Tax laws are subject to frequent changes. Keep abreast of any updates to the tax code that may affect rebate eligibility or amounts.

2. Deductions and Credits

Utilize available deductions and credits to decrease your taxable income. This can increase your eligibility for the rebate as well as lower the overall tax burden.

3. Use Tax Software

Investing in reliable tax software can simplify the process while ensuring you capture all potential savings. Many platforms also allow for easy e-filing, expediting the rebate process.

4. Consult a Tax Professional

If your financial situation is complex or if you have specific questions regarding your eligibility, consider consulting with a tax professional. Expert advice can often highlight objectives that the average taxpayer may overlook.

Conclusion

Maximizing your savings through the 2025 South Carolina tax rebate can significantly impact your financial landscape. Understanding eligibility, following the proper application process, and utilizing strategies to increase your rebate will aid in achieving the best possible financial outcome. Remember, your tax return serves not only as a means to fulfill a legal obligation but also as a potential source of savings that you can put towards your future.

FAQs

Q1: When will I receive my South Carolina tax rebate?

A1: Typically, rebates are processed after the state tax return deadline. Expect to receive your rebate a few weeks after your return is processed, especially if filed electronically.

Q2: How much can I expect to receive as a rebate?

A2: The rebate amount varies based on the taxes you’ve paid and your filing status. For the most accurate estimate, refer to the latest guidelines from the SCDOR or consult with a tax professional.

Q3: Do I need to apply separately for the rebate?

A3: No, if you correctly complete and file your state tax return, the rebate will be automatically calculated based on your tax situation.

Q4: What happens if I owe state taxes?

A4: If you owe state taxes, your rebate may be applied to your outstanding balance. It is crucial to pay off any owed amounts to maximize potential future rebates.

Q5: Can I appeal my rebate amount if I believe it’s incorrect?

A5: Yes, taxpayers can appeal their rebate amounts. However, it typically requires thorough documentation and possibly a review process with the SCDOR.

Feel free to adjust any specific details, such as rebate amounts or specific legislation updates, as necessary based on your audience or the latest information.

Download S.c. Tax Rebate 2025