Maximize Your Savings: Understanding Rebates for Home Electric Vehicle Chargers

As electric vehicles (EVs) become increasingly popular, many homeowners are considering the installation of electric vehicle chargers. However, the initial investment can be significant. Fortunately, various rebates and incentives are available that can help ease the financial burden. Understanding these rebates is crucial for maximizing your savings. This article explores the types of rebates available for installing home electric vehicle chargers, how to apply for them, and tips for maximizing your savings.

Types of Rebates Available

Government agencies, utilities, and private organizations offer a variety of rebates aimed at promoting the adoption of electric vehicles and charging infrastructure. Here are the main types:

Federal Rebates

The federal government offers a tax credit for the purchase and installation of electric vehicle charging stations. As of now, homeowners can receive a tax credit for 30% of the installation costs, up to a maximum of $1,000. This credit can also apply to equipment costs, so it’s essential to keep all receipts and documentation for tax purposes.

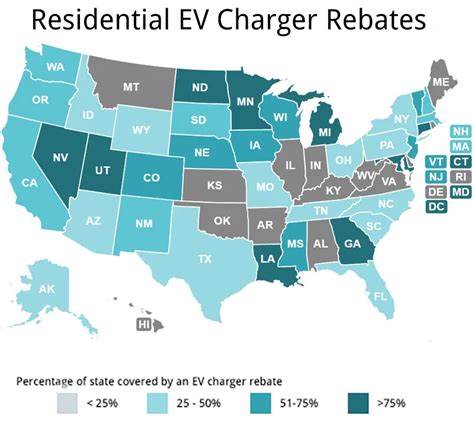

State Incentives

Many states have implemented their own rebate programs to encourage electric vehicle adoption. These can vary considerably in terms of value and eligibility. For example, some states may offer rebates based on your income level or the specific make and model of your electric vehicle. You can typically find the details of your state’s programs on your state’s Department of Energy or transportation website.

Utility Company Rebates

Local utility companies often have their own rebate initiatives that can significantly ease the financial burden. These utility rebates usually depend on your energy provider and may offer rebates based on the size of the charger and its demand on the electric grid. Some utilities even offer special rates for EV charging during off-peak hours.

Local and Nonprofit Programs

In addition to government and utility offerings, local nonprofit organizations may provide grants or rebates for charger installation. These programs can be especially valuable in communities focused on sustainability. Checking with local environmental groups or community organizations can yield additional savings opportunities.

How to Apply for Rebates

Applying for rebates can feel overwhelming, but breaking down the process can make it manageable. Here’s a helpful guide:

Research Available Rebates

Start by researching what rebates you might be eligible for at the federal, state, and local levels. Websites like Fueleconomy.gov can be particularly useful. Check your utility company’s website for any specific programs they offer.

Gather Documentation

Keep track of all necessary documentation, including receipts, installation invoices, and any supporting documents required by the rebate program. Some programs may require you to submit photos of the installed charger or proof of your electric vehicle ownership.

Complete Application Forms

Each rebate program will have specific application forms. Ensure you fill these out completely and accurately, as incomplete applications can lead to delays or denials. Don’t hesitate to reach out to the program’s customer service if you have any questions.

Track Your Application

After submitting your application, keep track of your application’s status. Some programs may allow you to check the status online, while others may require you to call customer service. Being proactive can help you resolve any issues quickly.

Tips for Maximizing Your Savings

To maximize your savings on home electric vehicle chargers, consider the following strategies:

Choose the Right Charger

Opt for a charger that fits your needs without unnecessary features. While higher-capacity chargers can charge faster, they may not be necessary for all households. Make sure to align your choice with how often you charge your vehicle, as well as any utility program you might join that incentivizes certain charger types.

Time Your Installation

Some utility companies offer incentives for installing chargers at certain times of the year. Doing some research to determine if there is an optimal time to install can save you money. Additionally, seasonal promotions by manufacturers or local installation companies might provide discounted rates during specific months.

Combine Rebates

If you qualify for multiple rebates, you can often stack them for greater savings. For example, you may receive a federal tax credit while also securing a local utility rebate. Always read the terms and conditions to ensure you can combine these incentives without violating any rules.

Get Professional Installation

While DIY installations can be tempting, hiring a professional can sometimes qualify you for additional rebates. Professional installations are often vetted by various programs, leading to a better chance of passing any inspections that may be required.

Conclusion

Installing a home electric vehicle charger is an excellent investment for environmentally conscious homeowners and electric vehicle owners. However, the initial costs can seem daunting. By understanding the variety of federal, state, and local rebates available, you can significantly reduce your out-of-pocket expenses. Make sure to do your research, gather the necessary documentation, and explore all available incentives for maximum savings. Investing in a home EV charger not only makes your life more convenient but also contributes to a more sustainable future.

FAQs

What is the federal tax credit for EV chargers?

The federal government offers a tax credit of up to 30% for the purchase and installation of EV charging stations, with a maximum credit cap of $1,000 for residential installations.

How can I find local EV charger rebates?

Visit your state’s Department of Energy website or your local utility company’s website to find information about available rebates in your area.

Can I combine multiple rebates for the same installation?

Yes, you can often combine state, local, and utility rebates, as long as you meet the eligibility requirements for each program.

Is professional installation necessary for rebates?

While DIY installation may be possible, some rebate programs require professional installation to qualify for rebates, and it often ensures compliance with local codes and standards.

This HTML format can be directly used in a WordPress post. It includes structured headings, paragraphs, and links to maintain user engagement and readability.

Download Rebate For Home Charger