Maximize Your Savings: Understanding NYS STAR Rebate Checks

The New York State (NYS) School Tax Relief (STAR) program is a valuable opportunity for homeowners to reduce their school property taxes. It offers financial relief to millions of New Yorkers, making it one of the most beneficial tax relief programs in the state. Understanding how STAR rebate checks work can help you maximize your savings and support your financial well-being.

What is the STAR Program?

The STAR program was established to provide property tax relief to eligible New York State homeowners. It consists of two main types: the Basic STAR and the Enhanced STAR. While Basic STAR is available to all eligible homeowners, Enhanced STAR is designated for senior citizens who meet specific income requirements.

Basic vs. Enhanced STAR

Basic STAR is available to homeowners with a primary residence in New York, and the income limit is generally set at $500,000 or less. Enhanced STAR, on the other hand, is aimed at seniors aged 65 and older with an income limit that may vary by locality. The Enhanced STAR often provides a more significant tax reduction, making it essential for seniors to explore this option.

How to Apply for STAR

To take advantage of the STAR program, you must apply through your local assessor’s office. The application process can vary slightly depending on your county, but it often requires proof of ownership and residency, along with any necessary income documentation if applying for Enhanced STAR. It’s crucial to stay informed about deadlines, as applications must typically be filed by a specific date each year.

The STAR Rebate Check Explained

Once your application is approved, you will receive STAR benefits in one of two ways: through a reduction in your property tax bill or via STAR rebate checks. The choice of method may depend on whether you opted for the STAR credit or the STAR exemption during the application process. Regardless of how you receive your benefits, it’s essential to understand what to expect in terms of amounts and timelines.

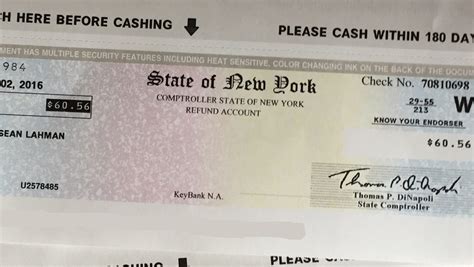

Receiving Your Rebate Check

STAR rebate checks are typically issued once a year, and the amount can vary based on several factors including, but not limited to, the type of STAR you qualify for, the assessed value of your property, and local school taxes. Checks are usually mailed directly to homeowners and can be a welcome financial relief during tougher months.

Strategies to Maximize Your Savings

To truly make the most out of your STAR benefits, consider the following strategies:

- Stay Informed: Keep up-to-date with changes in the STAR program and any new legislation that may affect your benefits.

- Review Your Assessment: Ensure that your property assessment is accurate. If you believe it is too high, you may contest the assessment, which can lead to greater savings.

- Consider Upgrades Carefully: While home improvements can increase the value of your home, they may also increase your tax bill. Weigh the long-term benefits against potential short-term costs.

- Plan for Future Finances: Use your STAR rebate check wisely. Consider saving it or applying it to debts to improve your overall financial situation.

Conclusion

The NYS STAR program is a powerful tool that can significantly ease the financial burden of property taxes for homeowners across the state. By understanding how to apply, manage, and maximize your STAR rebate checks, you can enhance your financial well-being. Don’t underestimate the importance of staying informed about your rights and opportunities within the STAR program, as this knowledge can lead to substantial savings now and in the future.

FAQs

1. Who is eligible for the STAR program?

Eligibility varies between Basic and Enhanced STAR. Basic STAR is available to all homeowners, while Enhanced STAR is for seniors aged 65 and older who meet specific income limitations.

2. How do I apply for the STAR program?

You can apply through your local assessor’s office with documentation proving ownership and residency. Specific guidelines may vary by location.

3. How is the amount of the STAR rebate check determined?

The rebate check amount depends on various factors, including the type of STAR, the assessed value of the home, and local school tax amounts.

4. When can I expect to receive my STAR rebate check?

Rebate checks are usually issued annually, depending on the local government’s processing schedule, and they are typically mailed directly to homeowners.

5. Can I receive both Basic and Enhanced STAR?

No, homeowners can choose either Basic or Enhanced STAR, but not both simultaneously. Enhanced STAR is specifically for qualified seniors.

This HTML structure contains headers, paragraphs, lists, and FAQs formatted for a WordPress article about NYS STAR Rebate Checks. Adjust the details or specific contents as necessary for your publication needs!

Download Nys Star Rebate Checks