Maximize Your Savings: Understanding Hybrid Car Tax Rebates

In an age where environmental consciousness is rising, many consumers are gravitating toward hybrid vehicles. These cars, which combine conventional gasoline engines with electric propulsion, promise better fuel efficiency and reduced emissions. However, one of the most compelling reasons individuals choose hybrids is the financial incentives offered by governments in the form of tax rebates. In this article, we will delve into how hybrid car tax rebates work, the benefits they offer, and what you need to consider to maximize your savings.

What Are Hybrid Car Tax Rebates?

Hybrid car tax rebates are incentives provided by federal, state, or local governments to encourage consumers to purchase environmentally friendly vehicles. In many regions, these rebates are designed to ease the financial burden associated with buying a hybrid car, which can sometimes be more expensive than its conventional counterparts.

Federal Tax Incentives

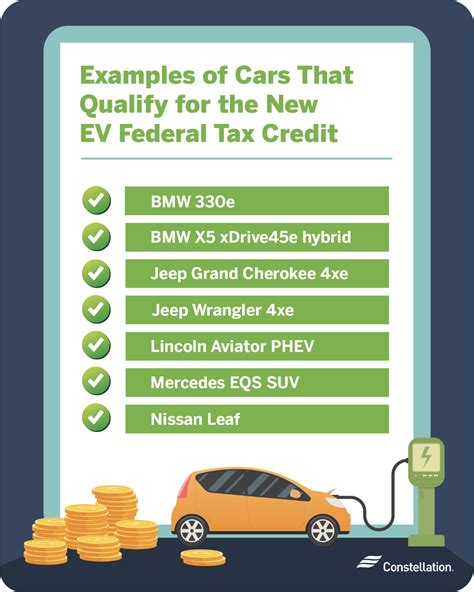

In the United States, the federal government offers a tax credit for qualifying hybrid vehicles. The amount of the credit varies based on the battery capacity of the hybrid car and can range from $2,500 to $7,500. To qualify, a vehicle must meet specific criteria established by the IRS. The most critical aspect is that the vehicle must be a plug-in hybrid, meaning it has the ability to charge its battery via an exterior power source.

It’s important to note that these credits phase out for a manufacturer once they have sold 200,000 qualifying vehicles. Once this cap is reached, consumers will see a gradual reduction in the tax credits available over a specified time frame.

State and Local Incentives

Many states offer additional rebates or tax incentives for hybrid cars. For instance, states like California, Colorado, and New York have programs that provide substantial bonuses for purchasing hybrids. These can range from a few hundred to several thousand dollars, depending on the state and the specific program in place.

Local governments may also provide perks, such as access to carpool lanes or reduced registration fees. Researching your state and local incentives can significantly enhance your savings when purchasing a hybrid vehicle.

Maximizing Your Savings

To capitalize on hybrid car tax rebates, consider the following steps:

- Research Eligibility: Before purchasing a hybrid car, ensure that it qualifies for both federal and state tax credits. Check the IRS website and your state’s energy department for the latest qualification criteria.

- Choose the Right Model: Different models may qualify for different rebate amounts. High-capacity battery hybrids typically offer higher tax credits. Consider models that not only fit your needs but also provide the most significant financial incentives.

- Consult a Tax Professional: Tax laws are complicated and can frequently change. Consult a tax professional to get personalized advice and ensure you maximize your savings.

- Keep Documentation: Maintain all paperwork related to your vehicle purchase. This includes sales invoices and documentation of battery capacity, as these will be essential when claiming your rebate.

Additional Benefits of Hybrid Vehicles

Beyond the tax rebates, hybrid vehicles present various financial advantages over time. With better fuel efficiency, you can expect lower gasoline bills. Many hybrids also have lower maintenance costs compared to traditional vehicles due to fewer moving parts in the engine.

Furthermore, as society increasingly emphasizes sustainability, owning a hybrid can boost your social value. Many organizations and institutions prioritize eco-friendliness, making it a wise choice both financially and ethically.

Challenges and Considerations

Despite the numerous benefits, potential hybrid car owners should also be aware of some challenges. The upfront costs can still be higher than traditional vehicles, and consumers may find limited options in specific markets. Furthermore, while tax rebates provide instant savings, they are not necessarily direct cash payments and will require individuals to file tax returns.

A common concern is the resale value of hybrid vehicles. While hybrids generally retain their value well, the market’s evolving acceptance of electric and hybrid technology means this can fluctuate. Always keep an eye on market trends when considering the long-term financial implications of your hybrid purchase.

Conclusion

Hybrid car tax rebates are a fantastic way to reduce the financial burden of purchasing a hybrid vehicle. By understanding the various incentives available at federal, state, and local levels, consumers can make informed decisions that not only benefit their wallets but also contribute positively to the environment. As electric and hybrid technologies continue to evolve, staying informed will ensure you maximize your savings and enjoy the multifaceted benefits these vehicles offer.

FAQs

1. How do I find out if my hybrid car qualifies for tax rebates?

You can check the IRS website for the latest information on federal tax credits and your state’s energy department for local incentives.

2. Are tax rebates the same as tax credits?

No, tax rebates typically refer to money refunded to you after filing your taxes, while tax credits directly reduce the amount of tax you owe.

3. How can I improve my chances of receiving the full rebate?

Choose hybrids with higher battery capacities, research eligibility thoroughly, and consult with a tax professional to ensure you’re accounting for all potential savings.

4. What is the future outlook for hybrid vehicle tax incentives?

As electric vehicles gain popularity, incentives for hybrids may change. Keeping abreast of legislation can help you make timely decisions.

This HTML code for a WordPress article offers a comprehensive look at hybrid car tax rebates, maximizing savings, and answers frequent questions. Adjustments can be made to fit your specific needs or style preferences.

Download Hybrid Car Tax Rebate