Maximize Your Savings: A Guide to Tax Rebates for Electric Vehicles

As the global focus shifts towards sustainable energy and reducing carbon footprints, electric vehicles (EVs) have surged in popularity. Not only do they offer an environmentally friendly alternative to gas-powered cars, but they also come with financial incentives that can significantly alleviate the initial purchase costs. One of the most attractive aspects of buying an electric vehicle is the tax rebates that many governments provide to encourage this transition. This article explores the various tax rebates available, how to qualify for them, and tips to maximize your savings.

Understanding Tax Rebates for Electric Vehicles

Tax rebates for electric vehicles vary depending on the country and sometimes even the state or region. These incentives are designed to make electric vehicles more affordable, increase their adoption, and support the reduction of greenhouse gas emissions. Their structure can include direct rebates, tax credits, or various state-specific incentives.

Types of Incentives Available

Federal Tax Credit

In the United States, the federal government offers a tax credit for the purchase of electric vehicles. As of 2021, the credit can be as much as $7,500, depending on the battery capacity of the vehicle. However, this credit may phase out once a manufacturer sells 200,000 qualifying vehicles. Always check the current status of the credits, as they can change.

State Incentives

In addition to federal tax credits, many states offer their own rebates and incentives for electric vehicle buyers. These can range from additional tax credits to rebates that can be applied at the time of purchase. States like California, Colorado, and New York have robust programs that can help buyers save even more.

Local Incentives

Some municipalities offer incentives such as vouchers, grants, or rebates for purchasing electric vehicles. Check with your local government or energy authority to see what is available in your area. These local incentives can stack on top of federal and state benefits, amplifying your total savings.

Eligibility Requirements

Before you can claim rebates, it’s essential to verify your eligibility. While specific requirements vary by program, some common criteria include:

- Vehicle Type: Many incentives are available only for new, qualifying electric vehicles.

- Purchase Timing: Check the program to ensure that your purchase falls within the eligible dates for incentives.

- Income Limits: Some incentives may have income restrictions, making them targeted towards low- to moderate-income buyers.

Steps to Maximize Your Savings

Research Available Programs

Before purchasing, take the time to research all available incentives in your area. Websites like the U.S. Department of Energy and local government sites can provide comprehensive information. Knowing what you may qualify for can directly influence your purchasing decision.

Consider Qualified Electric Vehicles

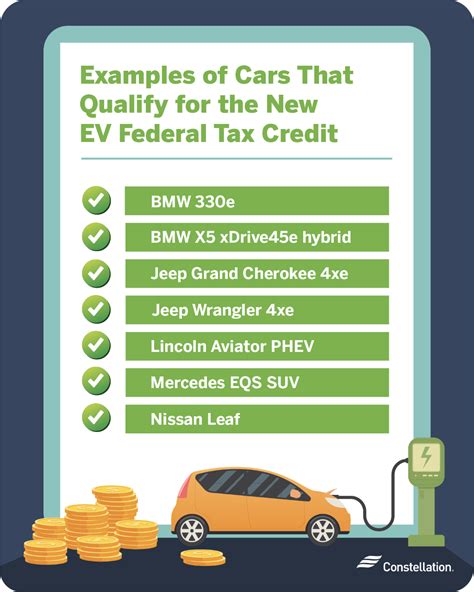

Not all electric vehicles qualify for tax rebates. Ensure that the car you’re interested in meets the specifications laid out by the incentive programs. Additionally, some newer models may have more significant rebates than older models, so keep this in mind while shopping.

Keep Track of Deadlines

Tax credits and rebates often have specific deadlines for both application submission and vehicle purchase. Staying informed about these deadlines can ensure you don’t miss out on potential savings.

Consult with a Tax Professional

While it may seem straightforward, tax laws can be complex. Consulting with a tax professional who is well-versed in electric vehicle tax rebates can help ensure you’re optimizing your savings. They can guide you through the eligibility criteria and assist in filing your tax returns properly.

Conclusion

Investing in an electric vehicle is not only a step towards a more sustainable future but can also be a financially savvy decision. By understanding the various tax rebates available and taking the necessary steps to maximize your savings, you can make your transition to electric driving more affordable. As the automotive landscape continues to evolve, so too will the incentives for electric vehicle ownership. Stay informed, and take full advantage of these opportunities to benefit both your wallet and the environment.

FAQs

1. How much can I save with federal tax credits for electric vehicles?

The federal tax credit can provide savings of up to $7,500, depending on the battery capacity of your electric vehicle. However, this amount may vary based on the manufacturer and your tax situation.

2. Do I have to apply for tax rebates after purchasing the vehicle?

In most cases, yes. You’ll typically need to file paperwork with your tax returns to claim any federal or state rebates. Always check the specific requirements for the program you are interested in.

3. Are there any local incentives available for electric vehicles?

Yes, many cities and regions offer local incentives, including rebates, grants, and reduced fees for electric vehicle owners. It’s best to check with your local government or energy authority to find out what’s available.

4. Can I still receive a tax rebate if I buy a used electric vehicle?

Most tax incentives are available only for new electric vehicles. However, some locations have introduced incentives for used electric vehicle purchases, so check local programs to find out.

5. What happens if I don’t owe enough taxes to use the full credit?

If you don’t have enough tax liability to use the entire credit in one year, you may be able to carry it over to the following years, depending on the specific rules governing the federal or state credit.

This HTML code provides a comprehensive article that covers tax rebates for electric vehicles, organized with clear sections, including a conclusion and a FAQs section. You can copy and paste this code into a WordPress HTML editor to publish it directly.

Download Tax Rebates For Electric Cars