Introduction

As energy costs continue to rise, many homeowners are seeking alternative ways to reduce their utility bills while contributing to a cleaner environment. One of the most effective ways to achieve this is through solar energy. Not only is solar power a sustainable option, but it can also save you money, especially with the assistance of the Solar Federal Tax Rebate. In this comprehensive guide, we will explore how you can maximize your savings through this federal rebate program, understand eligibility requirements, and navigate the application process.

What is the Solar Federal Tax Rebate?

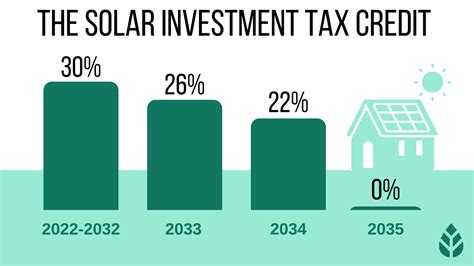

The Solar Federal Tax Rebate, also known as the Investment Tax Credit (ITC), allows homeowners and businesses to deduct a significant percentage of the cost of installing a solar energy system from their federal taxes. As of 2023, the rebate allows for a deduction of 30% of the installation cost. This percentage is slated to decrease in the coming years, making it essential for prospective solar energy users to act quickly.

Understanding the Benefits of the Solar Federal Tax Rebate

The Solar Federal Tax Rebate serves several purposes beyond the obvious financial incentive. Here are some key benefits:

- Financial Savings: The most immediate benefit is the reduction in your tax liability, which can make the installation of a solar system more affordable.

- Increased Home Value: Solar power systems can enhance the market value of your home, often recouping the costs of installation when you sell.

- Environmental Impact: By switching to solar, you are contributing to a reduction in greenhouse gas emissions and reliance on fossil fuels.

- Energy Independence: Solar energy allows homeowners to produce their own power, shielding them from fluctuating energy prices.

Eligibility Requirements for the Tax Rebate

To qualify for the Solar Federal Tax Rebate, you must meet the following criteria:

- Ownership: You must own the solar energy system; leasing or Power Purchase Agreements (PPAs) typically do not qualify.

- Installation Date: Your system must be installed and operational before the end of the tax year for which you are claiming the credit.

- Installation Type: The system must be for residential or commercial use and meet certain performance standards set by the federal government.

How to Apply for the Solar Federal Tax Rebate

Applying for the Solar Federal Tax Rebate is straightforward, although it does require some documentation. Follow these steps to ensure a smooth application process:

1. Gather Documentation

Collect necessary documents including:

- Proof of ownership of the solar system

- Purchase receipts or invoices

- Installation contracts

- Any applicable permits or approvals

2. Complete IRS Form 5695

Fill out IRS Form 5695, which is used to calculate the residential energy credits. This form guides you through the process and ensures that you correctly calculate your rebate amount.

3. Include it with Your Tax Return

Submit Form 5695 along with your annual federal tax return. Ensure that you keep copies of all documentation for your records.

Maximizing Your Savings

To further maximize your savings, consider the following tips:

- Combine State Incentives: Research state-level grants, rebates, and credits that may be available in addition to the federal rebate.

- Choose the Right Installer: Select a reputable solar installer who can provide quality work and optimal system performance.

- Monitor Your System: After installation, regularly check your system’s performance to ensure it operates efficiently and generates maximum savings.

- Consider Financing Options: Look into low-interest loans or financing options that can further reduce upfront costs while allowing you to still benefit from the rebate.

Common Questions

1. Can I claim the tax rebate if I financed my solar system?

Yes, as long as you own the solar system, you can claim the tax rebate even if you financed it with a loan.

2. Are there any limitations on the size of the system installed?

No, there are no size limitations on the system to qualify for the rebate, but the credit amount is based only on your actual costs and not on any excess capacity.

3. What happens if I don’t owe taxes this year?

If your tax liability is lower than the credit, you can carry over the unused portion to the following tax year.

Conclusion

The Solar Federal Tax Rebate is a significant opportunity for homeowners to invest in renewable energy while maximizing their savings. With careful planning, you can not only reduce your installation costs through tax benefits but also enhance your home’s value and contribute positively to the environment. Be sure to stay informed about changes to the rebate program, and consult with tax professionals or financial advisors to take full advantage of available incentives. Investing in solar energy is not just a smart financial decision; it’s an investment in a sustainable future.

FAQs

1. What is the current percentage for the Solar Federal Tax Rebate?

As of 2023, the rebate is 30% of the installation costs, but this rate will decrease in subsequent years, so it’s advisable to act quickly.

2. Can I receive this rebate if my solar system is installed on a rental property?

Generally, the property owner can claim the rebate if they own the system, irrespective of whether it’s a primary or rental property.

3. Is the rebate available for businesses as well?

Yes, the Solar Federal Tax Rebate applies to both residential and commercial solar installations, providing similar benefits for businesses looking to invest in solar energy.

Download Solar Federal Tax Rebate