Introduction

Saving money is a priority for many, especially when it comes to taxes. In Pennsylvania, residents have the opportunity to take advantage of tax rebates that can significantly lighten the financial load. This comprehensive guide aims to provide you with all the information you need to maximize your savings through Pennsylvania’s State Tax Rebate program.

What is the Pennsylvania State Tax Rebate Program?

The Pennsylvania State Tax Rebate program, often referred to as the Property Tax/Rent Rebate Program, is designed to assist eligible residents, particularly seniors and individuals with disabilities, who face high property taxes or rent. This program helps alleviate some of the financial burdens associated with homeownership or renting by providing a rebate based on income and property taxes paid.

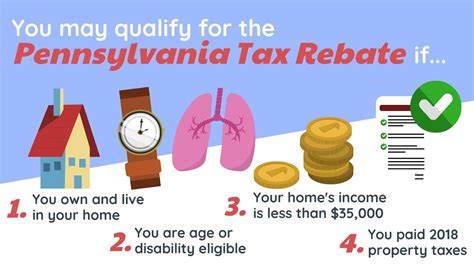

Eligibility Criteria

To qualify for the Pennsylvania State Tax Rebate, applicants must meet specific criteria:

- Be a resident of Pennsylvania.

- Be at least 65 years old, or 50 years old if a widow or widower.

- Individuals with disabilities can qualify if they are 18 years or older.

- Meet the income limits set by the state. For most applicants, this limit is $35,000 for homeowners and $15,000 for renters.

How to Apply for the Rebate

Applying for the Pennsylvania State Tax Rebate is a straightforward process. Here are the steps to follow:

- Obtain the Application: The application form (PA-1000) is available online through the Pennsylvania Department of Revenue website or can be requested at local government offices.

- Gather Necessary Documents: You will need documents that provide proof of income and property taxes or rent paid during the calendar year.

- Complete the Application: Fill out the application form accurately. Ensure all information is correct to avoid delays.

- Submit the Application: Submit your completed application to the Pennsylvania Department of Revenue by the deadline, usually June 30 of the year following the tax year for which you are claiming a rebate.

Rebate Calculation

The rebate amount you may receive varies based on your income, property taxes, or rent paid. Here’s how it generally works:

- Homeowners may receive a rebate of up to $975 based on the amount of property taxes paid and their income level.

- Renters may receive rebates based on the rent they have paid, capped at $650.

- Special circumstances, such as disabilities, can also affect the amount of rebate available.

Generally, the lower your income, the higher your rebate. It is crucial to understand these calculations to maximize your benefits.

Tips to Maximize Your Savings

To get the most out of Pennsylvania’s State Tax Rebate program, consider the following tips:

- Stay Informed: Regularly check the official Pennsylvania Department of Revenue website for updates on income limits and rebate amounts.

- File On Time: Ensure that you submit your application by the deadline to avoid missing out on your rebate.

- Review Your Taxes: If you believe you have overpaid on property taxes, consider appealing your property assessment.

- Seek Assistance: If you’re unsure about the application process, consider seeking help from local community organizations or tax professionals who can offer guidance.

Potential Challenges

While the Pennsylvania State Tax Rebate program is beneficial, applicants may face challenges, such as:

- Income Documentation: Gathering all necessary documents can be time-consuming and stressful.

- Understanding Eligibility: Many residents are unaware of their eligibility due to the specific criteria involved.

- Application Errors: Mistakes on the application can result in delays or denial of the rebate, underscoring the importance of accuracy.

Conclusion

The Pennsylvania State Tax Rebate program can be a valuable financial resource for eligible residents, particularly seniors and individuals with disabilities. By understanding the eligibility criteria, application process, and rebate calculations, you can maximize your savings effectively. Being informed and proactive is key to taking full advantage of the tax rebates available to you.

FAQs

1. Who is eligible for the Pennsylvania State Tax Rebate Program?

Residents who are at least 65 years old, or 50 years old if a widow or widower, and meet specified income limits can qualify for the program.

2. How do I calculate my rebate amount?

Your rebate amount is calculated based on your income and the amount of property taxes or rent that you have paid during the year. Maximum rebates are $975 for homeowners and $650 for renters.

3. When is the application deadline?

The application deadline for the rebate is typically June 30 of the year following the year for which you are claiming a rebate.

4. Where can I find the application form?

The application form (PA-1000) can be found on the Pennsylvania Department of Revenue’s website or obtained from local government offices.

5. What should I do if I make an error on my application?

If you make an error, it is essential to contact the Pennsylvania Department of Revenue to correct it as soon as possible to avoid delays or denial of your rebate.

Download Pa State Tax Rebate