Maximize Your Savings: A Comprehensive Guide to NJ’s Property Tax Rebate Program

New Jersey homeowners often feel the financial burden of property taxes, which can significantly affect their budgets. Thankfully, the state has implemented a Property Tax Rebate Program that aims to alleviate some of this stress. This program offers eligible homeowners the chance to receive rebates on their property taxes, ultimately maximizing savings and providing some financial relief. This article will guide you through the details of the program, eligibility criteria, application processes, and tips for maximizing rebates.

Understanding the Property Tax Rebate Program

The Property Tax Rebate Program in New Jersey was designed to provide a refundable property tax credit for homeowners and renters. Under certain conditions, the program can help reduce the amount you actually pay in property taxes, offering a significant financial reprieve.

Eligibility Criteria

To qualify for New Jersey’s Property Tax Rebate, applicants must meet several specific criteria:

- Residency: Homeowners must be legal residents of New Jersey.

- Property Ownership: The property must be your primary residence. Investment properties and second homes are not eligible.

- Income Limits: There are income limits that vary based on the age of the applicant. For instance, households with senior citizens or disabled individuals may have different thresholds.

- Tax Paid: Property owners must have paid their property taxes in full for the year in which they are applying.

These criteria ensure that the program benefits those who need help the most, while fostering overall community growth and stability.

Application Process

Applying for the Property Tax Rebate Program in New Jersey is a straightforward process, though it is essential to follow the necessary steps carefully. Here’s how to go about it:

- Gather necessary documents, including proof of residency, property tax bills, and income statements.

- Complete the application form, which can be accessed on the New Jersey Division of Taxation website.

- Submit your application during the designated filing period, which usually runs from February to June of the year following the tax year you wish to claim.

- Keep a copy of your application and any supporting documents for your records.

Understanding the Rebate Amount

The amount of rebate received may vary significantly depending on several factors:

- Property Taxes Paid: Higher tax amounts typically lead to larger rebates.

- Income Level: Lower-income households may receive larger rebates to help combat their financial burdens.

- Age or Disability Status: Seniors and disabled individuals may qualify for enhanced rebate amounts.

Checking previous years’ averages can give applicants a good idea of what they might expect from their rebates.

Tips for Maximizing Your Rebate

Several strategies can help homeowners make the most of their Property Tax Rebate. Here are some suggestions:

- Keep Accurate Records: Maintain detailed records of property taxes paid, as this supports your application and ensures you are receiving your due rebate.

- Stay Informed: Changes in laws and regulations can impact the program. Keep up with any updates on the New Jersey Division of Taxation website or consult a tax professional.

- Seek Professional Assistance: If you find the application process overwhelming, consider hiring a tax advisor to help navigate it effectively.

- Utilize Additional Programs: Explore any additional financial aid or rebate programs that might be available from local government sources.

Common Misconceptions

Many homeowners have misconceptions about the New Jersey Property Tax Rebate Program. Here are a few clarifications:

- Rebate vs. Credit: A rebate is returned to you after filing, while a credit reduces your tax bill upfront.

- Annual Application: Many homeowners mistakenly believe they must apply every year; however, once approved, you may not need to reapply unless your circumstances change.

- Impact on Future Property Taxes: Receiving a rebate should not directly impact how your property taxes are assessed in the future.

Conclusion

New Jersey’s Property Tax Rebate Program offers significant opportunities for homeowners to reduce their financial burden and maximize savings. Understanding the eligibility requirements, application process, and tips for maximizing rebates can lead to substantial savings. The program is designed to assist those in financial need, notably seniors and disabled individuals. By remaining informed and proactive, homeowners can leverage these resources effectively.

FAQs

- 1. How often can I receive a rebate?

- Homeowners can apply for a rebate each year, provided they meet the eligibility requirements.

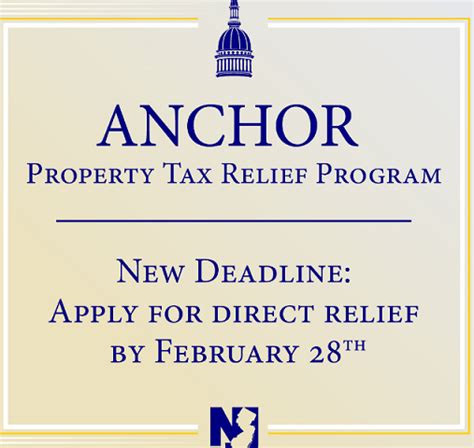

- 2. Are there any deadlines?

- Yes, applications are generally accepted from February to June for the prior year’s taxes.

- 3. Can renters apply for rebates?

- Renters may not qualify for property tax rebates, but they can check for rental rebate programs available to them.

- 4. What should I do if I miss the application deadline?

- If you miss the deadline, unfortunately, you will need to wait until the next year to apply. Always check for extensions or special circumstances on the NJ Division of Taxation website.

- 5. How will I receive my rebate?

- If approved, rebates are typically issued via a check mailed to your registered address.

This HTML format is ready for pasting into a WordPress post or page to ensure proper formatting for online reading.

Download Property Tax Rebate Nj