Long Island Tax Rebate Checks 2025: What You Need to Know

As we approach 2025, many residents of Long Island are eager to understand the tax rebate checks that are anticipated to be issued by the state. These checks have become a pivotal source of financial relief for many households, especially in the wake of rising living expenses. This article provides a detailed overview of what you need to know about the Long Island tax rebate checks in 2025.

Understanding Tax Rebate Checks

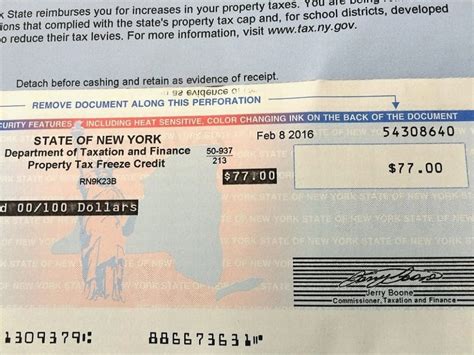

Tax rebate checks are payments issued by the government to taxpayers aimed at providing financial relief. These checks can stem from various sources such as excess revenue collection, state budget surpluses, or specific tax initiatives aimed at aiding residents. Specifically on Long Island, these checks are designed to alleviate the financial burden on residents through direct monetary support.

Eligibility Criteria

To be eligible for the Long Island tax rebate checks in 2025, certain criteria must be met:

- Residency: You must be a legal resident of Long Island.

- Income Limitations: There may be income thresholds that determine eligibility. Typically, lower to middle-income households may qualify for a larger rebate.

- Filing Requirements: Residents must file their state tax returns to be considered for the rebate checks.

Expected Amounts and Distribution Dates

While the exact amounts for the 2025 tax rebate checks have not yet been finalized, past distributions provide a useful benchmark. In previous years, checks have ranged from a few hundred to over a thousand dollars depending on income levels and family size. Residents can expect greater transparency from the state as the distribution date approaches.

How to Apply

Application processes may vary, but typically involve:

- Filing Tax Returns: Ensure that you file your state tax returns by the designated deadline.

- Checking Eligibility: Utilize the resources provided by the state tax department to confirm your eligibility for the rebate.

- Awaiting Notification: Residents should expect to receive notifications regarding the rebate checks, including amounts and distribution methods.

Distribution Methods

For residents concerned about how they will receive their tax rebate checks, there are typically two primary distribution methods:

- Direct Deposit: Eligible participants can receive their checks via direct deposit into their bank accounts, which is generally faster and more secure.

- Mail Checks: For those who prefer or do not have direct deposit options, checks will be mailed to the address listed on the tax returns.

Impact on Local Economy

The issuance of tax rebate checks can have a significant positive impact on the local economy. With residents receiving additional funds, spending in the community often increases, benefiting local businesses. Furthermore, it can alleviate some of the financial strain that many families experience, thereby enhancing their quality of life.

Tax Implications

One common question residents may have relates to the tax implications of receiving a tax rebate check. Generally, these rebate checks are not considered taxable income in New York State. However, it’s always recommended to consult with a tax professional to understand how it may affect your financial situation.

Conclusion

As the anticipation builds for the 2025 Long Island tax rebate checks, it is essential for residents to stay informed about eligibility, application processes, and potential benefits. These rebate checks have the potential to provide significant financial relief to many families, ultimately contributing to the overall economic health of Long Island. Keep an eye on official announcements and prepare your financial documentation to ensure a smooth application process.

FAQs

1. When will the Long Island tax rebate checks be issued?

While specific dates have yet to be announced, residents are typically notified in the spring, with checks often distributed by mid-year.

2. How do I know if I’m eligible for a rebate check?

Eligibility typically hinges on residency status, income limits, and tax filing status. Check with the New York State Department of Taxation and Finance for specific information.

3. Will I have to pay taxes on the rebate check?

No, tax rebate checks are typically not considered taxable income in New York State, but always consult a tax advisor for personal circumstances.

4. Can I track the status of my rebate check?

Yes, once checks are issued, the state often provides resources for residents to track the status of their rebate checks.

5. What should I do if I don’t receive my check?

If you do not receive your rebate check by the expected date, contact the state tax department for assistance and clarification on your status.

Download Long Island Tax Rebate Checks 2025