IRS Rebate Check 2025: What You Need to Know to Maximize Your Refund

The IRS Rebate Check is a topic of considerable interest for many taxpayers, especially as we approach the 2025 tax season. With potential changes in tax laws and eligibility requirements, it’s crucial to stay informed about the rebate check process. This article aims to provide you with the necessary information to maximize your refund in 2025, ensuring a smoother tax filing experience.

Understanding the IRS Rebate Check

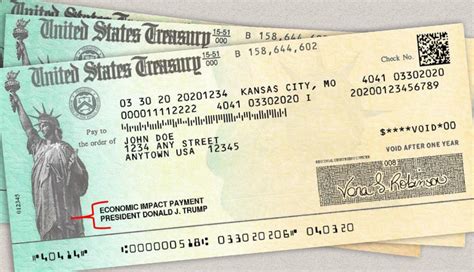

IRS rebate checks, often referred to as stimulus checks or economic impact payments, were initially introduced in response to economic challenges. These payments are designed to provide financial relief to eligible taxpayers. In 2025, the mechanism for distributing these rebates may again change, influenced by economic conditions and legislative decisions.

Eligibility Criteria for the 2025 Rebate Check

To qualify for the IRS Rebate Check in 2025, individuals and families need to meet specific eligibility criteria. While details may vary, here are some general factors to consider:

- Filing Status: Your filing status (single, married filing jointly, etc.) will affect your eligibility and rebate amount.

- Income Limitations: Typically, higher-income earners may not qualify for these rebates. The IRS often sets income thresholds that determine eligibility.

- Dependents: Families with dependents may receive additional rebates, increasing the total amount available to them.

- Residency Status: Only U.S. citizens and certain resident aliens usually qualify for rebates.

How to Maximize Your Refund

Maximizing your IRS rebate check involves understanding the nuances of tax law and taking proactive steps. Consider the following tips:

1. File Your Taxes Early

One of the best strategies to maximize your rebate is to file your taxes early. Filing as soon as the IRS begins accepting returns ensures you are among the first to receive your rebate, minimizing delays.

2. Utilize Available Deductions and Credits

Take advantage of all eligible tax deductions and credits. This may include credits for education, childcare, and energy-efficient home improvements. Each of these can reduce your taxable income, which in turn can impact your eligibility for a rebate.

3. Update Your Information

Ensure that the IRS has your updated information, including your current address and banking details. This is crucial for receiving your rebate promptly, whether via direct deposit or mail.

4. Consider the Impact of Side Income

If you have side income from freelancing, investments, or other sources, keep careful records. Make sure to report all income accurately, as underreporting may lead to delayed or reduced rebate checks.

5. Monitor Legislative Changes

Stay informed about any legislative changes that may affect the IRS rebate process. New laws can change eligibility requirements and rebate amounts. Checking the IRS website or following trusted news sources will help you stay updated.

Expected Amount for the 2025 Rebate Check

The amount of the IRS rebate check can vary based on several factors, including filing status and number of dependents. While specific amounts for 2025 may not be finalized, it’s reasonable to expect rebates to be in a similar range to previous years, adjusted for inflation and economic conditions.

Conclusion

Understanding the IRS Rebate Check for 2025 is essential for taxpayers looking to maximize their refunds. By staying informed about eligibility criteria, filing taxes early, utilizing deductions and credits, and keeping your information up-to-date, you can significantly improve your chances of receiving a more substantial rebate. As we move closer to the tax season, it’s important to keep an eye on changing guidelines and prepare accordingly. Planning ahead can help you navigate any complexities and ensure you take full advantage of available benefits.

FAQs

1. When will the IRS Rebate Check be distributed in 2025?

The specific distribution dates for the IRS Rebate Check in 2025 have not been announced. Generally, payments occur after tax returns are processed, typically beginning in late spring.

2. How do I check the status of my Rebate Check?

You can check the status of your Rebate Check through the IRS website, using their online tool designed for this purpose.

3. What if I don’t receive my Rebate Check?

If you do not receive your Rebate Check, you should first verify that you were eligible and that the IRS has your correct information. If everything appears correct, you may need to contact the IRS directly for further assistance.

4. Will the Rebate Check affect my tax liability?

The IRS Rebate Check is generally considered a tax credit and is not subject to federal income tax, so it should not affect your tax liability for the given year.

5. Can I adjust my withholding to maximize my Rebate Check?

While adjusting your withholding may impact the amount of income tax you owe throughout the year, it does not directly affect your eligibility for the Rebate Check. For those interested in maximizing their tax refund, it’s wise to consult with a tax professional for personalized advice.

This HTML format is appropriate for a WordPress post, complete with headings, paragraphs, and lists for clarity and readability.

Download Irs Rebate Check 2025