As the world increasingly focuses on renewable energy, solar power has emerged as a top choice for homeowners seeking to reduce their energy bills and carbon footprints. Harnessing the sun’s power not only contributes to environmental sustainability but can also lead to significant financial savings. One of the most compelling incentives for going solar is the federal tax rebate available to eligible homeowners. This article explores how this rebate can dramatically reduce your solar installation costs.

The Federal Tax Credit Explained

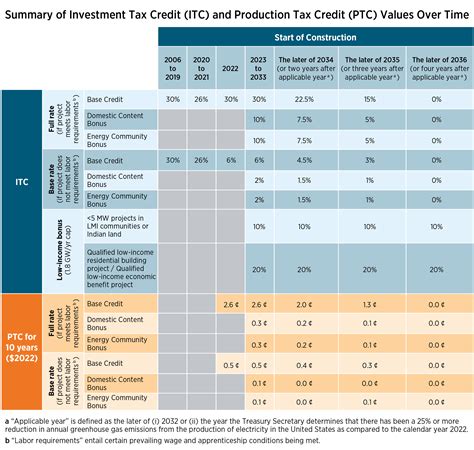

The federal tax credit for solar energy systems, formally known as the Investment Tax Credit (ITC), allows homeowners to deduct a percentage of the cost of their solar photovoltaic (PV) system from their federal taxes. Initially established in 2006, the ITC has significantly propelled the adoption of solar energy in the U.S.

Current ITC Rate

As of recent updates, the ITC allows homeowners to claim up to 30% of the installation costs of their solar energy systems on their taxes. This rate is set to gradually decrease, so now is an excellent time to invest in solar. As of 2023, the ITC rate will remain at 30% until the end of 2032, when it will drop to 26% in 2033, then 22% in 2034, before potentially facing expiration.

Understanding Solar Installation Costs

The cost of installing a solar system varies based on several factors, including system size, equipment quality, and installation complexity. On average, homeowners can expect to pay between $15,000 and $30,000 for a residential solar PV system before any incentives are applied. This upfront investment can be a barrier for many, but the ITC significantly reduces the effective cost, making solar more accessible.

Calculating Your Savings

Here’s a simplified example to illustrate how the ITC can reduce your solar costs:

- Total cost of solar installation: $20,000

- ITC deduction (30% of $20,000): $6,000

- Net cost after rebate: $14,000

In this example, the federal tax rebate saves you $6,000 right off the bat, making the investment in solar much more approachable.

Additional Financial Benefits

In addition to the federal tax rebate, homeowners can enjoy other financial benefits from solar energy:

- State and Local Incentives: Many states and local governments offer additional credits, rebates, and incentives that can complement the ITC, further reducing your overall cost.

- Net Metering: Homeowners can sell excess energy generated back to the grid, creating an opportunity for additional income or credits on your electricity bill.

- Increased Home Value: Installing solar systems can increase your property value, making it a solid long-term investment.

Choosing the Right Solar System

Before diving into a solar installation, it’s crucial to select a system that meets your needs. Consider the following factors:

- Energy Needs: Assess your energy consumption to determine the appropriate system size.

- Quality of Equipment: Invest in high-quality solar panels and inverters to maximize efficiency and lifespan.

- Reputation of Installer: Research potential installers, focusing on their experience, certifications, and customer reviews.

The Installation Process

Once you’ve decided on the right system, the installation process typically involves the following steps:

- Site Assessment: A professional will evaluate your home’s roof and energy consumption.

- System Design: A custom solar system is designed based on your specific needs.

- Permitting: The installer will handle the necessary permits and inspections required by local authorities.

- Installation: The solar equipment is installed on your roof or property.

- Connection to the Grid: Your solar system is connected to the grid, often requiring an inspection.

Conclusion

Investing in solar energy is not only a step towards a greener future but also a financially sound decision. With the federal tax rebate and additional incentives available, homeowners can significantly reduce the cost of solar installation, making it an actionable and achievable goal. Whether you’re looking to lower your energy bills, increase your property value, or contribute to environmental sustainability, solar energy offers a practical solution. Take advantage of the ITC before it phases out, and join the growing community of solar-powered homes.

FAQs

1. How do I qualify for the federal tax rebate?

To qualify, you must own your solar energy system and it must be installed in your primary or secondary residence in the U.S. Properties must also meet local and state regulations for solar installations.

2. When can I claim the tax credit?

You can claim the tax credit on your federal income tax return for the year the solar system was installed and made operational.

3. Are there any limits to the tax credit?

No, there is no limit on the amount of credit you can claim; however, you can only claim the credit on your taxable income, and any amount exceeding your tax liability can be carried over to the next year.

4. What if I finance my solar system?

Even if you finance your solar system through a solar loan or lease, you may still be eligible for the full tax credit as long as you own the system. Consult your tax advisor for personalized advice.

5. Can I install solar panels on any type of roof?

Most roof types can accommodate solar panels, but the installation may be more challenging for certain roofs, such as flat or very steep roofs. A professional installer can provide guidance based on your specific situation.

Download Federal Tax Rebate For Solar